Download Pintu App

3 Reasons Why Investors Haven’t Maximized Results When the Altseason Index Surges

Jakarta, Pintu News – The most active altcoin season since early 2025 is underway, with many altcoins outperforming Bitcoin (BTC). However, while the crypto market seems exciting, many retail investors still struggle to see significant gains in their portfolios. This article will explain the main reasons behind this phenomenon.

Altcoin Market Capitalization Rises, but Dominance Declines

Data from TradingView shows that the market capitalization of TOTAL3 (excluding Bitcoin (BTC) and Ethereum (ETH)) has reached a new record of over $1.1 trillion in September. However, the market share of OTHERS (excluding the top 10) has been declining since 2022, now standing at just 8%.

In previous cycles such as 2017 and 2021, TOTAL3 and OTHERS.D increased together, signaling capital flows not only to large altcoins, but also to mid- and small-cap altcoins. Currently, the divergence suggests that capital is concentrated on stablecoins and some top altcoins such as Solana (SOL), Ripple (XRP), Binance Coin (BNB), Dogecoin (DOGE), HYPE, and Chainlink (LINK).

Smaller altcoins get much less liquidity, making it difficult for their prices to return to the levels where investors previously bought. This creates a situation where only a few win while most lose.

Read also: Aave Transforms: L2 Closure and $100 Million Push for GHO Spark Controversy

Altcoin Index surges, but investor sentiment remains cautious

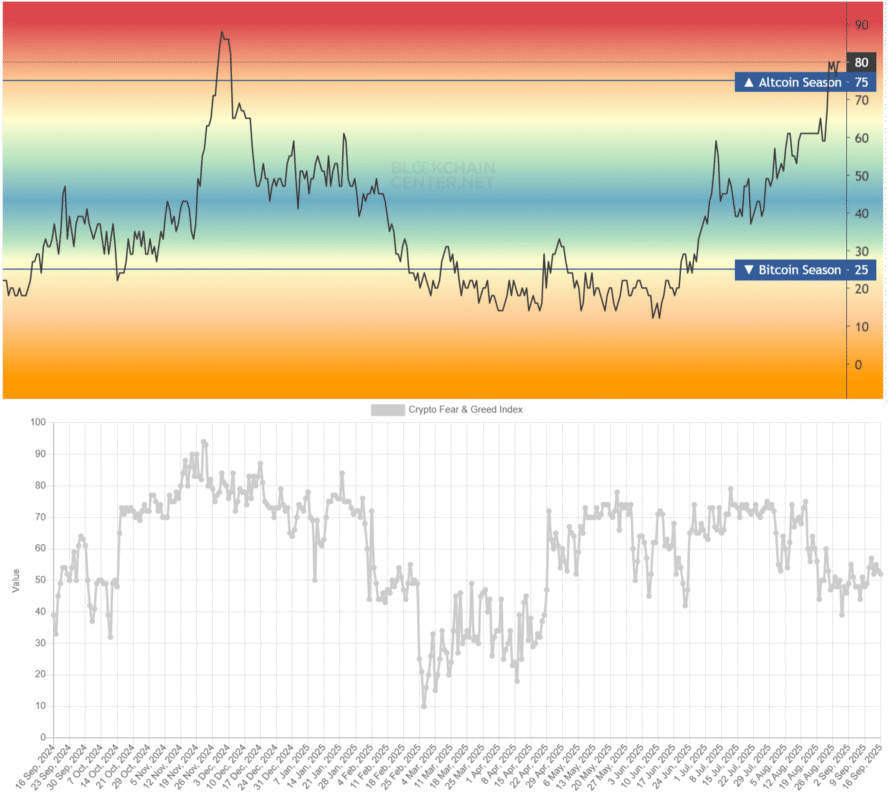

Blockchain Center’s Altcoin Seasonality Index now stands at 80 points. This shows that more than 80% of the top 50 altcoins have outperformed Bitcoin (BTC) in the past 90 days-a clear indication of altcoin seasonality.

However, the Fear & Greed Index is at 52, a neutral level that reflects caution and the absence of a clear directional bias.

Historical data shows that the 2024 rally pushed both indicators higher. At that time, the Altcoin Season Index rose above 75, while the Fear & Greed Index surged past 80, indicating extreme greed.

The parallel rise reflects investor confidence as capital rotates strongly into altcoins. However, this is not the case at the moment.

Also read: Forward Industries Launches $4 Billion Program, Analysts Predict SOL to Reach $500!

The Number of Altcoins Has Increased Tenfold Since 2021

While TOTAL3’s market capitalization almost peaked in 2021, the context has changed dramatically. CoinMarketCap reports that by 2025, more than 21 million altcoins will be tracked-100 times more than the approximately 20,000 coins in 2021.

Dune’s data highlights a token boom from 2017 to 2025, with unique tokens surging, especially on Ethereum, Solana, and Base. This creates a more selective environment.

In 2021, investors can benefit more easily with fewer coins due to lower competition. With tens of millions of tokens that include DeFi, meme coins, and AI tokens, choosing the right one is as difficult as looking for a needle in a haystack.

Conclusion

These factors explain why the September 2025 altcoin season feels incomplete. To overcome this, investors may need to conduct more in-depth research, focus on projects with strong fundamentals, and reconsider over-diversification.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Why Many Portfolios Still Show No Profit Amid Altcoin Season. Accessed on September 18, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.