Download Pintu App

Michael Saylor and MicroStrategy Transformation: World’s Largest BTC Holder!

Jakarta, Pintu News – Michael Saylor, CEO of MicroStrategy, turned his software technology company’s journey into one of the most striking stories in the cryptocurrency world.

In 2020, he decided to allocate $250 million from the company’s cash to buy Bitcoin (BTC), making MicroStrategy the first publicly traded company to hold large amounts of Bitcoin.

This bold move sparked a new wave in Bitcoin adoption by large institutions and companies, which previously only considered Bitcoin as a speculative asset. Today, MicroStrategy holds more than 2% of the total fixed supply of Bitcoin in the world, making it the largest Bitcoin holder in the world.

Saylor Turns MicroStrategy into a “Bitcoin Treasury Company”

In August 2020, Saylor, previously known as a tech executive, made the bold decision to buy Bitcoin (BTC) for MicroStrategy. He made the move as a hedge against inflation and the declining value of the weakening dollar.

Since then, MicroStrategy has continued to add to its Bitcoin holdings, and in 2021, the company spent more than $2 billion to buy more Bitcoin. This decision made Saylor and MicroStrategy a symbol of crypto adoption by large corporations, although many considered this move risky.

Also read: Arthur Hayes’ Prediction: “Bitcoin (BTC) Could Reach $1 Million!”

Saylor considers Bitcoin a “capital preservation” or wealth hedge, likening it to a “virtual Manhattan”, a rare and indestructible asset. While many are skeptical of this decision, Saylor remains firm in his belief that Bitcoin is the future of long-term financial strategies.

In fact, Saylor predicted in 2013 that Bitcoin would “end up like online gambling”, a tweet that is now considered the “most expensive tweet in history” after he changed course and led the company in Bitcoin adoption.

Long-term Strategy and Structured Purchasing

Saylor’s strategy didn’t just stop at the first purchase. Saylor continued his Bitcoin purchases by using structured finance techniques, such as convertible debt issuance, to increase his Bitcoin (BTC) holdings.

In 2021, MicroStrategy started buying Bitcoin regularly using the dollar-cost averaging method, a strategy where the company buys Bitcoin at a different price each time, reducing the impact of price volatility.

Amidst the Bitcoin price spike that reached $64,000 in 2021, Saylor continued with this strategy even though the Bitcoin price eventually fell back to around $16,000 by the end of 2022.

Saylor believes that Bitcoin is not only an investment tool, but also a new standard in value storage. Even as the price of Bitcoin drops, MicroStrategy continues to add to their holdings, with the goal of storing their Bitcoin for over 100 years.

Read also: BNB Breaks ATH Beyond $1,000, CZ’s Return a Factor Behind Its Price Increase?

This long-term approach worked in MicroStrategy’s favor, with the company’s stock soaring and even outpacing the rise in the price of Bitcoin itself. By the end of 2024, MicroStrategy’s stock had risen far beyond the S&P 500 index, making the company more than just a software company.

MicroStrategy Becomes the Largest Bitcoin Holder

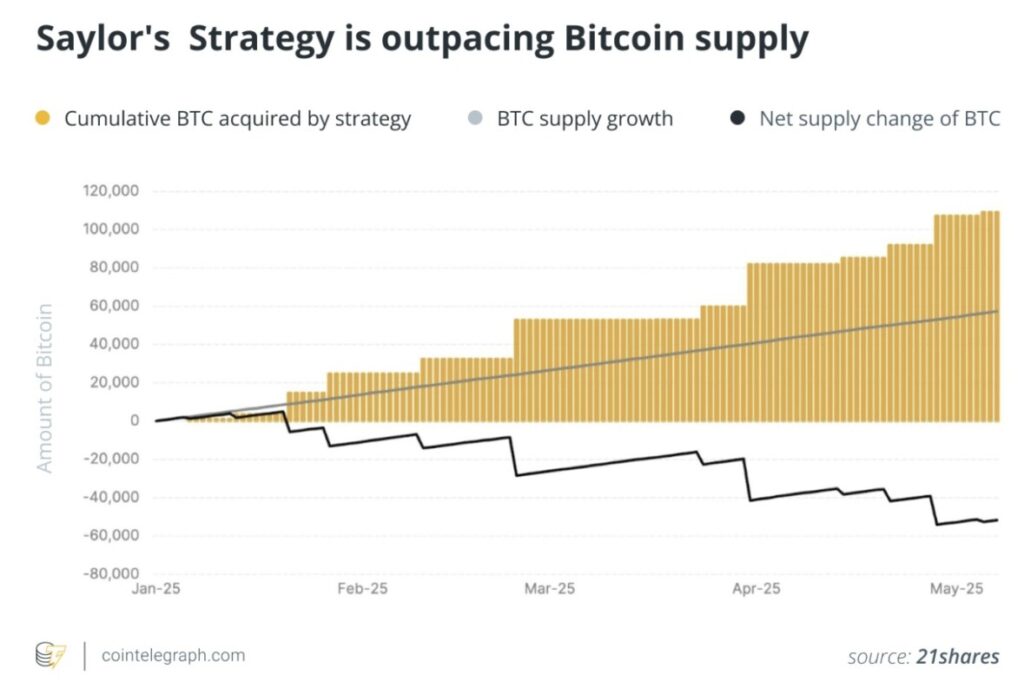

With more than 500,000 Bitcoins owned by MicroStrategy as of early 2025, the company now controls more than 2% of the total fixed supply of Bitcoin. Saylor’s huge influence in the Bitcoin market triggered a huge wave of other companies buying into Bitcoin.

In the first five months of 2025 alone, institutional and corporate purchases of Bitcoin were recorded at more than $25 billion. However, with such a large number of holdings, there are concerns about the pressure this puts on the limited supply of Bitcoin.

Saylor’s financing strategy of issuing shares and debt to buy Bitcoin caught the market’s attention, and although it successfully increased MicroStrategy’s market capitalization, there is a big risk if the Bitcoin price experiences a sharp decline.

Also read: Who is the Biggest XRP Owner in 2025?

In June 2025, MicroStrategy bought more than 10,000 BTC for $1.05 billion, bringing the company’s total spending on Bitcoin to nearly $42 billion.

While this shows great confidence in Bitcoin, systemic risk also increases as companies have to rely on debt and equity issuance to fund purchases.

What Can We Learn from Saylor’s Obsession with Bitcoin?

Saylor provides a valuable lesson in research and investment conviction. Before making the big decision to buy Bitcoin, Saylor did extensive research into the fundamentals of Bitcoin. For novice investors, this teaches the importance of doing good research and avoiding market hype.

In addition, Saylor emphasizes the importance of having a long-term vision and prudent risk management. For retail investors, the dollar-cost averaging strategy that Saylor uses can also be a good approach to mitigate the impact of volatility.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Michael Saylor’s Bitcoin obsession: How it all started. Accessed September 20, 2025.

- Featured Image: Finance Feeds

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.