Download Pintu App

Ethereum Slips to $4,300 as Investors Keep Accumulating

Jakarta, Pintu News – As of September 21, Ethereum has remained steady despite market volatility, with the ETH price holding slightly below the $4,500 level. While a sharp surge is yet to be seen, the asset is also protected from a potential deep drop.

Strong accumulation from investors helped the “altcoin king” maintain its stability, while fueling optimism for a possible recovery in the coming days.

Then, how is the current Ethereum (ETH) price movement?

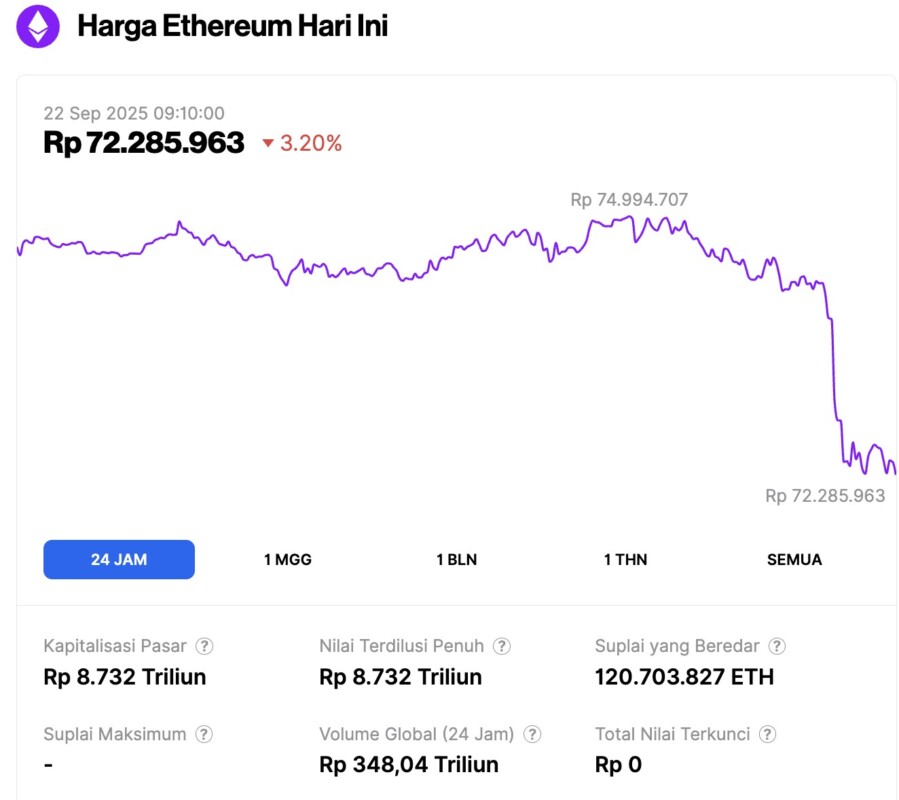

Ethereum Price Drops 3.20% in 24 Hours

On September 22, 2025, Ethereum was trading at around $4,338 (approximately IDR 72,285,963), marking a 3.20% decline over the past 24 hours. Within that period, ETH dipped to a low of IDR 72,298,673 and climbed as high as IDR 74,994,707.

At the time of writing, Ethereum’s market capitalization sits at roughly IDR 8,732 trillion, while its daily trading volume has surged 42% in the past day to reach IDR 348.04 trillion.

Read also: 5 Cryptos Gaining Attention as Trading Activity Heats Up

Ethereum Investors Continue to Accumulate

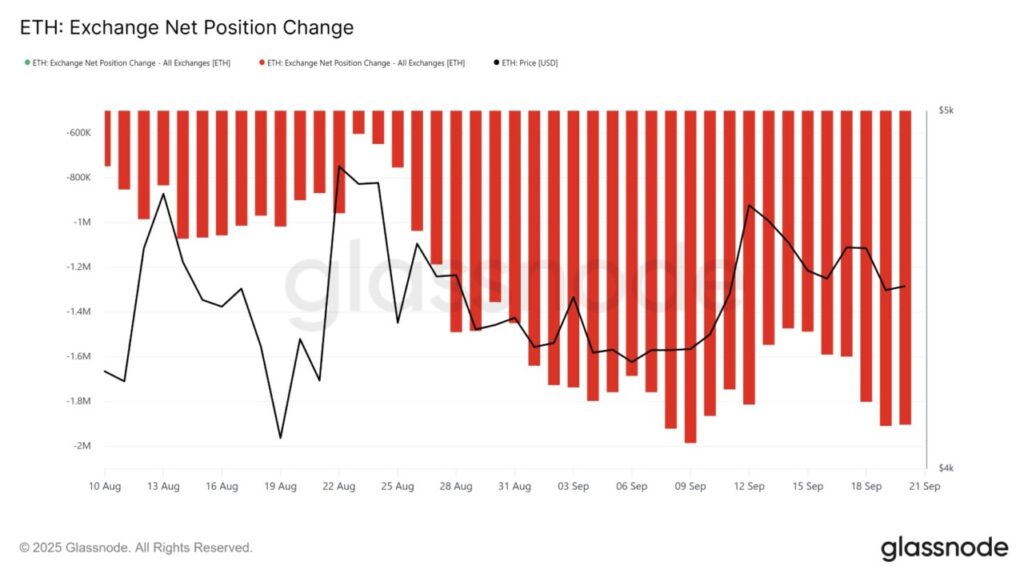

The exchange’s net position data shows that ETH holders are back in the accumulation phase. In the past week, more than 420,000 ETH worth about $1.87 billion left the exchange.

These consistent outflows are a sign of optimism amidst market fluctuations. The displacement of ETH from exchanges usually signals reduced intent to sell, thus strengthening the long-term holding prospects.

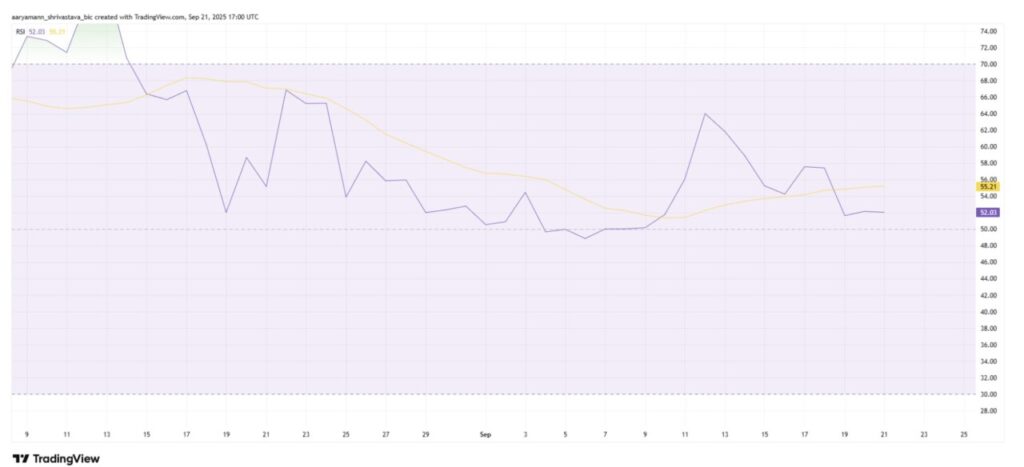

Technically, Ethereum’s RSI is currently in the bullish zone, just above the neutral level of 50.0. This position indicates that upward momentum is still maintained despite the price volatility, supporting the potential for continued growth if market conditions remain favorable.

Throughout the month, the RSI has also been consistently in bullish territory and has only briefly dipped into the negative zone once in a while. Such consistency strengthens ETH’s chances of continuing to get a positive boost in the coming weeks.

Read also: 3 Cryptocurrencies Poised to Hit New All-Time Highs Based on Recent Trends

ETH Price Remains Bullish?

As of September 21, Ethereum (ETH) was briefly trading at $4,468, just slightly below the important resistance at $4,500. The asset has continued to consolidate around this level, showing resilience despite mixed market trends in general.

Backed by positive market sentiment and the trend of investor accumulation, ETH has a great opportunity to make $4,500 a new support level. If successful, this move could pave the way for ETH to test the next resistance around $4,775 in the coming days.

However, downside risks remain if bearish pressure strengthens. In that scenario, ETH has the potential to weaken down to the support level of $4,307. A drop to this zone could temporarily invalidate the bullish outlook and increase potential investor losses.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Holders Keep Price Afloat At $4,500 – Here’s What’s Next For ETH. Accessed on September 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.