Download Pintu App

Ethereum Drops to $4K on September 25 — Analysts Expect a Correction Before a $10K Rally

Jakarta, Pintu News – The price of Ethereum (ETH) continues to spark debate as cyclical theories and regulatory approvals shape its movements. According to analyst Ted Pillows, the market is currently evolving in a recognizable pattern, characterized by phases of optimism, correction, and euphoria.

The chart he shows depicts the stages of confidence and excitement, which hints at the potential for short-term weakness but also the opportunity for long-term price peaks.

Then, how is Ethereum’s current price movement?

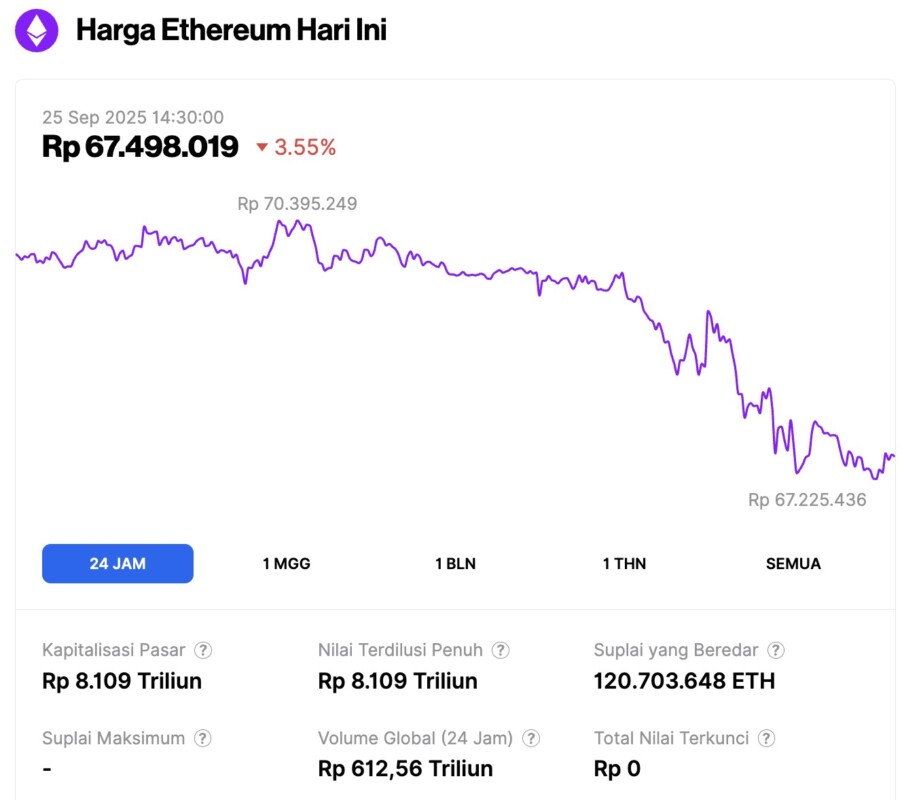

Ethereum Price Drops 3.55% in 24 Hours

On September 25, 2025, Ethereum’s price was recorded at approximately $4,013, or around IDR 67.49 million, marking a 3.55% decline over the past 24 hours. Within that period, ETH slipped to a daily low of IDR 67.23 million and reached as high as IDR 70.40 million.

At the time of writing, Ethereum’s market capitalization is valued at roughly IDR 8,109 trillion, while its 24-hour trading volume has climbed 18%, reaching IDR 612.56 trillion.

Read also: 3 Crypto Price Predictions: Is Weakening BTC, ETH & XRP Momentum Pointing to a Deeper Correction?

Ethereum Price Action Follows the Cycle Roadmap

Currently, ETH price is at $4,149, indicating a consolidation phase after the previous gains. Ted Pillows emphasizes that the correction phase could push the ETH price down to the $3,600-$3,800 range before recovering.

This level corresponds to the previous support zone and is in line with the psychology of market cycles, where optimism shifts to disbelief. Interestingly, the analyst’s chart projects that Ethereum will then advance to the confidence and excitement stage, with a target near $10,000.

In the long term, this ETH price projection suggests that a temporary pullback could be part of a healthier uptrend. However, a decline that breaks $3,600 decisively could trigger a longer consolidation, resulting in a delayed recovery.

However, the pattern of higher lows since 2023 provides structural support that makes a deeper decline seem less likely. As such, the technical map reflects a cautious stance in the short term but remains bullish for the long term.

Ultimately, this roadmap indicates that Ethereum’s price is preparing for a major breakout that will define its cycle, albeit one that is still plagued by short-term volatility.

Read also: Can Shiba Inu Really Hit $1? The Math Tells a Different Story

Ethereum ETF Approval by SEC Strengthens Institutional Legitimacy

The SEC’s decision to approve Grayscale’s Ethereum ETF under common listing standards marks an important turning point. By moving Trust and Mini Trust ETFs into rule 8.201-E, the SEC removed the need for recurring approvals.

This move creates efficiencies for issuers while providing consistency for institutional participants. The rule change also places Ethereum ETFs in the same category as commodity-based trust shares, improving regulatory alignment.

This simplification allows Ethereum products to be traded with fewer barriers, strengthening accessibility in the mainstream. This decision also signals confidence in Ethereum’s role in regulated markets.

With barriers removed, institutions now have a clearer path to gaining exposure to Ethereum’s price performance. As a result, Ethereum’s integration with traditional finance has strengthened and strengthened its prospects in the long term.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum (ETH) Price Faces Pullback Before $10K Surge Amid SEC ETF Approval. Accessed on September 25, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.