Download Pintu App

When did the Bitcoin Bull Run Start? Here’s the Timeline to Know!

Jakarta, Pintu News – Bitcoin (BTC), as the pioneer cryptocurrency, slumped to a four-week low of below $109,500, leaving many traders anxiously awaiting its next move.

However, seasoned analyst Timothy Peterson thinks this drop could be just part of a larger scenario.

Based on Bitcoin’s 10-year seasonal trend, he estimates BTC could potentially rise to $200,000 by June 2026, and even higher if the seasonal pattern is repeated.

Bitcoin Bull Run Timeline

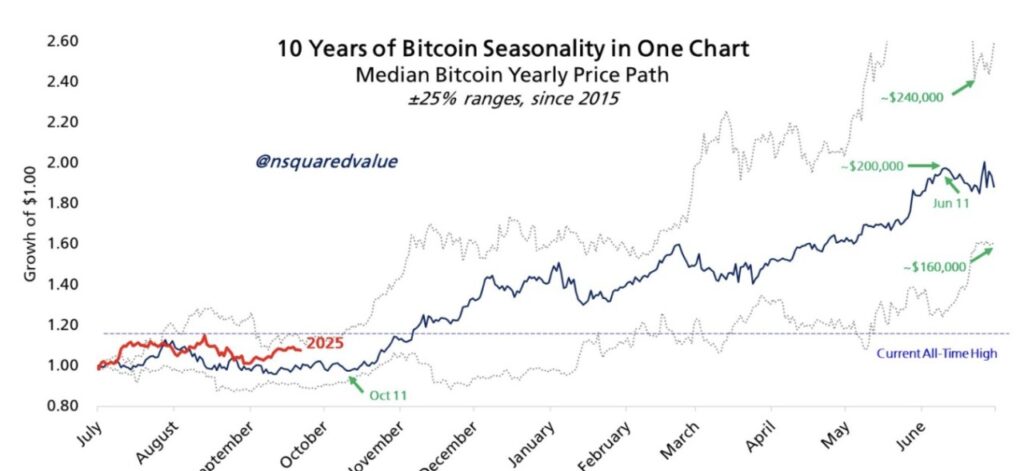

In his analysis, Peterson highlights Bitcoin’s 10-year seasonal chart that records the asset’s typical movement patterns throughout the year. Instead of following a regular calendar, he shifted the timeline by six months to capture Bitcoin’s bull run cycle more accurately.

Read also: HYPE Price Forecast: With Bitwise Proposing a Hyperliquid ETF, Could $55 Be Within Reach?

Based on his research, Bitcoin’s strongest performance period runs from October 11 to June 11. Historically, this time span has produced the sharpest price spikes in the Bitcoin cycle.

If history repeats itself, Bitcoin could potentially rise by an average of 7% per month, which translates to about a 120% increase per year.

Bitcoin Price Prediction

According to Peterson analysts, Bitcoin currently has a 50% or more chance of reaching $200,000 by June 2026. This means the price has the potential to almost double from current levels in less than a year.

In a stronger rally scenario, the movement could continue further, with Bitcoin potentially climbing up to $240,000 in the next phase of its cycle.

Peterson also emphasized early November as an important period to watch, as Bitcoin has a history of breaking new record highs at that time. Therefore, he thinks a more cautious scenario would be for Bitcoin to rise towards $160,000 as the first major milestone.

Read also: Nvidia Stock Price Prediction 2025: How High Can NVDA Rise in the Next 1 Year?

BTC Price Forecast – Short Term

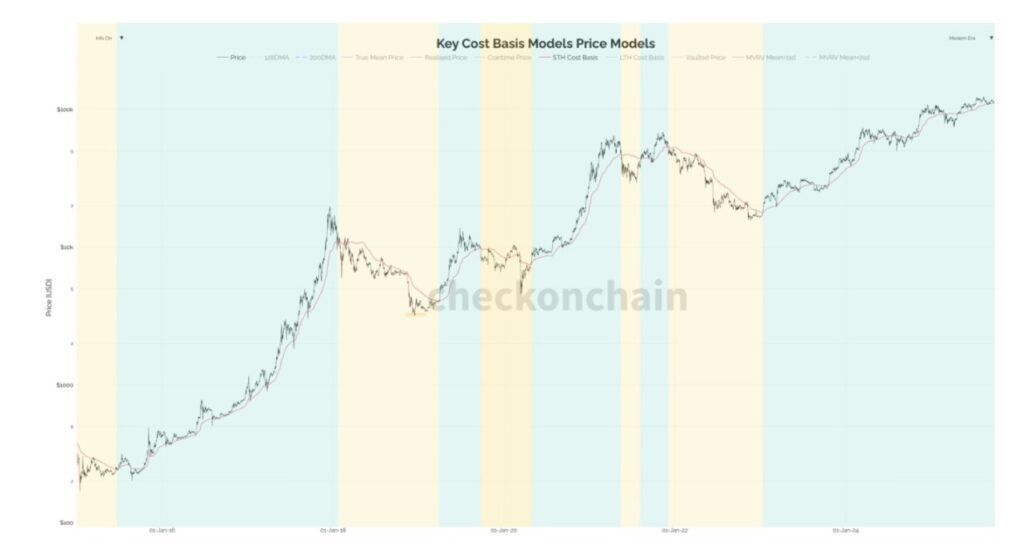

Currently, Bitcoin price is trading at $109,422, down 3% in the last 24 hours and wiping billions of dollars off the market. Meanwhile, one of the main factors that analysts are watching is the Short-Term Holder (STH) Cost Basis, which currently stands at $111,500.

The level is increasingly considered a crucial line that differentiates between bullish and bearish market behavior. As such, the closest support is at $108.600, with stronger support around $108.000.

If the price breaks below these levels, the decline could sharpen and potentially drag Bitcoin to the $105,000 zone, which could trigger more widespread panic in the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Here’s When Bitcoin Bull Run Will Start – Timeline To Watch. Accessed on September 26, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.