Download Pintu App

5 Crypto with the Highest Futures Open Interest Last Week of September 2025!

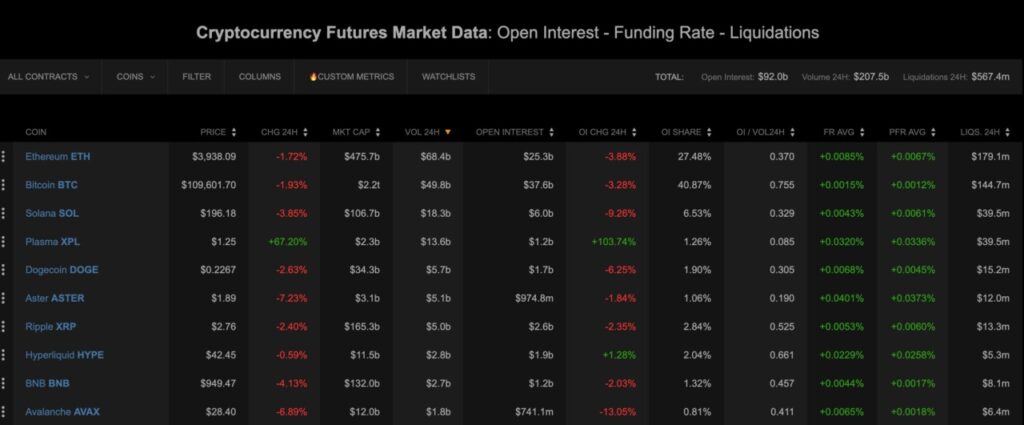

Jakarta, Pintu News – As the cryptocurrency market continues to be dynamic, open interest on futures contracts is becoming an important indicator to gauge crypto market sentiment and liquidity.

The last week of September saw significant increases across several assets, suggesting that market participants are paying extra attention to futures contracts. Here are 5 cryptos that recorded the highest futures open interest last week, and what it means for investors and market watchers.

1. Bitcoin (BTC) – Highest OI and Market Dominance

The depth of this market also means that its volatility can have a major impact on the overall crypto index. The high accumulation of futures positions shows that traders are placing significant bets on the direction of BTC’s price movements in the medium to long term.

Also Read: 5 Big Impacts of US Crypto Regulation: Novogratz Predicts Market Cycles Will Change Forever

2. Ethereum (ETH) – The Strongest Competitor in the Futures Segment

Ethereum (ETH) recorded a futures open interest of US$ 25.6 billion (± IDR 429.0 trillion) according to a ranking on Coinalyze. As the second largest crypto asset by capitalization, ETH is often a focal point for derivatives traders. Its futures volume shows that ETH is not only used for DeFi and smart contract applications, but also as a speculation and hedging vehicle.

High engagement in the futures segment indicates that many parties are ready to risk large capital based on expectations of volatility or price movements of ETH in the near future.

Also Read: 5 Big Impacts of US Crypto Regulation: Novogratz Predicts Market Cycles Will Change Forever

3. Solana (SOL) – Following with Significant Liquidity

Solana (SOL) recorded US$6.0 billion in futures open interest over the same period. Although far below BTC and ETH, this figure is quite high for an altcoin and shows that many traders foresee potential big moves in the Solana ecosystem.

The focus on SOL also reflects a trend where high-performing layer-1 altcoins (with transaction speeds and broad ecosystems) are starting to attract derivatives activity that was previously more centered on the underlying asset.

4. Ripple (XRP) – Stable in Derivatives Despite Controversy

XRP also appears on the top open interest list, with a total futures OI of US$2.6 billion. Despite often being under the legal/regulatory spotlight, XRP still maintains a strong position in the derivatives market – indicating that many traders utilize liquidity and price predictability through futures contracts.

XRP’s presence on this list shows that despite its often contentious regulation, the market’s belief in utility or technical sentiment is still strong.

5. BNB (Binance Coin) – Leading Exchange Ecosystem

BNB recorded a futures open interest of approximately US$1.2 billion over the past week. As the native token of Binance exchange, BNB is often used in functionalities including gas payments, staking, and as a liquid asset. Its futures activity suggests that the market is also pricing in the direction of BNB’s movement in the context of Binance ecosystem activity.

Although its value is relatively smaller than BTC/ETH, its position in the top OI indicates that not only generic assets are attractive in derivatives, but also token exchanges have great potential.

Why is Futures Open Interest Important?

- Measures market liquidity and awareness: High open interest indicates a large number of open positions which supports that the market has a large exposure and is not eager to close.

- Sentiment indicators: A rise in OI along with a rise in price can signal a “strong trend”, while a fall in OI as price rises can signal weakness.

- Confirmation of trend strength: If the price moves significantly with high OI support, the trend is likely to be stronger and sustainable.

Tips for Crypto Investors & Traders

While high open interest signals high activity, it also carries the risk of extreme volatility if the market reverses. Day traders should manage stop losses and capital wisely. Long-term investors should see this as a signal of a big market, not an expectation of instant profits.

For Indonesian traders, local platforms like Pintu Futures can provide easy and transparent access to the futures market, complete with competitive spreads.

Also Read: 7 Astonishing Facts: Number of Crypto Billionaires to Rise 40% by 2025, Who Benefits?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinalyze. Cryptocurrency Futures Market Data: Open Interest, Funding Rate, Liquidations. Accessed September 26, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.