Download Pintu App

6 Crypto Asset Passive Profit Strategies This Year

Jakarta, Pintu News – The year 2025 is an exciting time for digital investors who want to make their assets “work for themselves” without having to trade every day. From staking to liquidity mining, there are now many smart ways to make passive crypto profits with customizable risk.

With the maturation of the DeFi ecosystem, Web3, and features such as Pintu Earn, the opportunity to get regular returns from digital assets is even wider. The question is, which strategy is most suitable for you to run this year?

1. Proof of Stake (PoS) Staking

Staking is the process of locking your crypto assets on a Proof of Stake (PoS) based blockchain network to help validate transactions. In return, you will receive rewards in the form of native blockchain tokens.

This method is one of the most popular and simple ways to earn passive income in the crypto world. By staking, you not only earn returns, but you also help keep the network safe from spam and malicious attacks.

Interestingly, you don’t need to run your own validator node. On blockchains with a Delegated Proof of Stake (DPoS) system, users can delegate their assets to the validator of their choice. The validator will carry out the verification process and distribute the staking results in proportion to your contribution. This makes staking affordable and accessible to anyone.

2. Airdrops

An airdrop is a blockchain project’s distribution of free tokens to its community – usually as a form of promotion or reward for early adopters. For example, in late 2024, the Sonic SVM (SONIC) project on the Solana network distributed tokens to users who actively interacted with their platform.

To participate, users usually only need to perform simple tasks such as connecting wallets, trying out features, or interacting with certain apps.

You can keep track of the latest airdrop listings through tracking platforms like Airdrops.io or Airdrop Alert.

Some projects also provide airdrop aggregators that collect active airdrop programs from various ecosystems – making it easier for users who want to find opportunities without having to monitor them individually.

Read also: 10 US Blue Chip Stocks in 2025, the Favorite of Investors

3. Pintu Earn

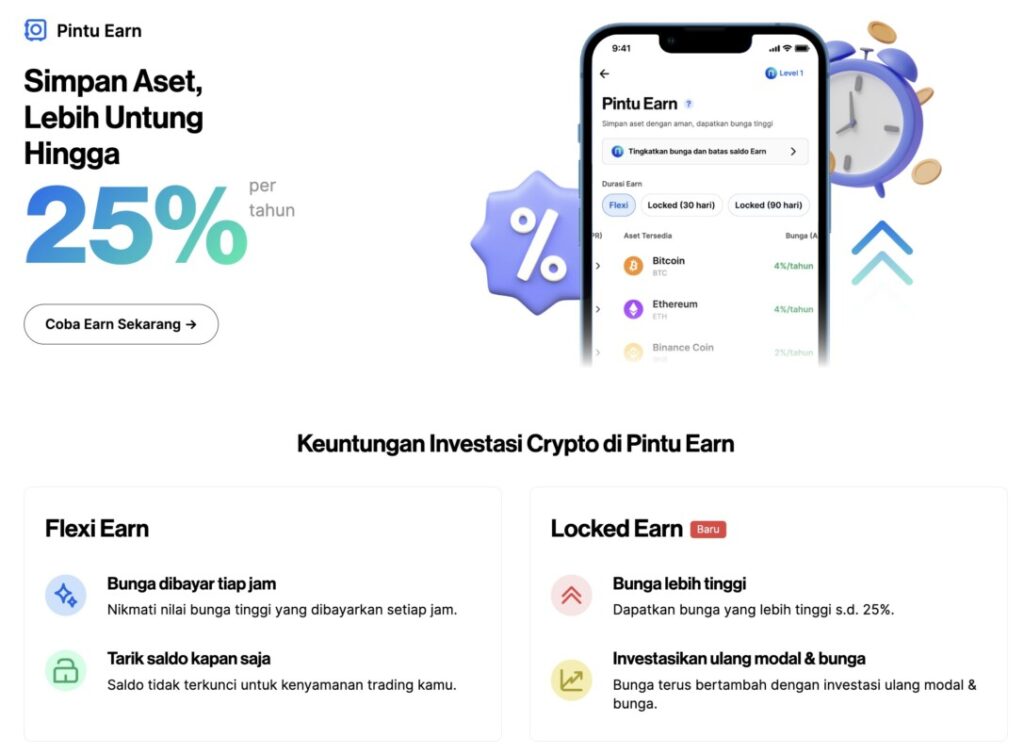

The Pintu Earn feature provides an easy way for users to earn passive income from their crypto assets, with two main options: Flexi Earn and Locked Earn. Through these two features, users can customize their investment strategy according to their needs – whether they want full flexibility or higher returns.

With Flexi Earn, interest is paid every hour, and the balance can be withdrawn at any time without being locked. This is perfect for active users who want to stay invested while still having access to their funds for trading.

Meanwhile, Locked Earn offers a higher interest rate of up to 25% per annum, with an automatic reinvestment system on capital and interest. This feature is designed for medium to long-term investors who want to maximize returns through compound interest.

In addition, in the Super Rate Up campaign, Pintu presents a special opportunity for users to earn up to 25% per year through Flexi Earn, exclusively for some coins. This campaign runs from September to November 2025, providing a golden opportunity for users to enjoy greater profit potential from their crypto assets.

4. Crypto Lending

Crypto lending is one of the most popular ways to earn passive income. The mechanism is simple – you store crypto assets in a lending protocol, and then lend them out to other users. In return, you’ll receive interest or a yield on the loaned assets.

There are two main types in crypto lending:

a. Decentralized Lending (DeFi Lending)

This is an intermediary-free lending system on DeFi platforms like Aave (AAVE), JustLend (JST), or Morpho (MORPHO). You place funds into a “pool”, which automatically adjusts the loan ratio, collateral, and interest with a smart algorithm.

This system is considered more transparent, as all activities are recorded on the blockchain. The funds lent are also protected by an automatic liquidation mechanism, so the risk of default can be minimized.

b. Real-World Asset (RWA) Lending

Different from pure DeFi lending, RWA lending connects digital assets with the real world. The funds you deposit will be borrowed by businesses or institutions that have been audited and passed verification. Examples of popular RWA protocols include Goldfinch (GFI), Maple Finance (MPL), and Centrifuge (CFG).

With this system, lenders earn interest from real businesses, while the risk of default is lower due to the feasibility assessment process and independent audits.

Read also: 3 Crypto Airdrops Worth Monitoring After Weekend Market Crash

5. Liquidity Mining

Liquidity mining is a way to generate passive income by providing liquidity on a decentralized exchange (DEX). You’ll place two types of assets in equal amounts into a “pool” – for example an ETH/DAI pair worth $1,000 each.

By participating, you are helping to maintain smooth transactions on the DEX-based automated market maker (AMM). In return, you will receive LP Tokens, which are proof of ownership in the pool, as well as a share of the swap fees paid by users.

However, liquidity mining also has risks, such as impermanent loss (loss of value due to changes in token prices) and slippage (price difference during large transactions). Therefore, this strategy is more suitable for users who understand the DeFi mechanism deeply.

6. Play-to-Earn (P2E)

Web3 games are a fun way to earn crypto while playing. This phenomenon was first popular through Axie Infinity in 2022, and is now making a comeback thanks to the tap-to-earn trend of games like Hamster Kombat and Notcoin in 2024.

Unlike the monotonous and cash-focused early generation of crypto games, tap-to-earn games are now more interactive and light-hearted. Players can simply perform simple actions such as tapping the screen, completing missions, or participating in community events to earn tokens.

In addition to providing entertainment, this model is a new entry point for Web2 users to get acquainted with the crypto world without the need for large capital or deep technical knowledge.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bybit Learn. Top 13 Crypto Passive Income Strategies of 2025. Accessed October 14, 2025

- Featured Image: OSL

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.