Download Pintu App

Bitcoin Slips Back to $113,000 Today — Are BTC Holders Turning Cautious?

Jakarta, Pintu News – Bitcoin (BTC) price is showing a steady recovery after a sharp drop on Friday, where it plummeted from $122,000 to a low of $102,000.

However, this rise was not caused by leveraged traders, but by spot holders who showed remarkable resilience amid volatile market conditions. So, how is the current Bitcoin price moving?

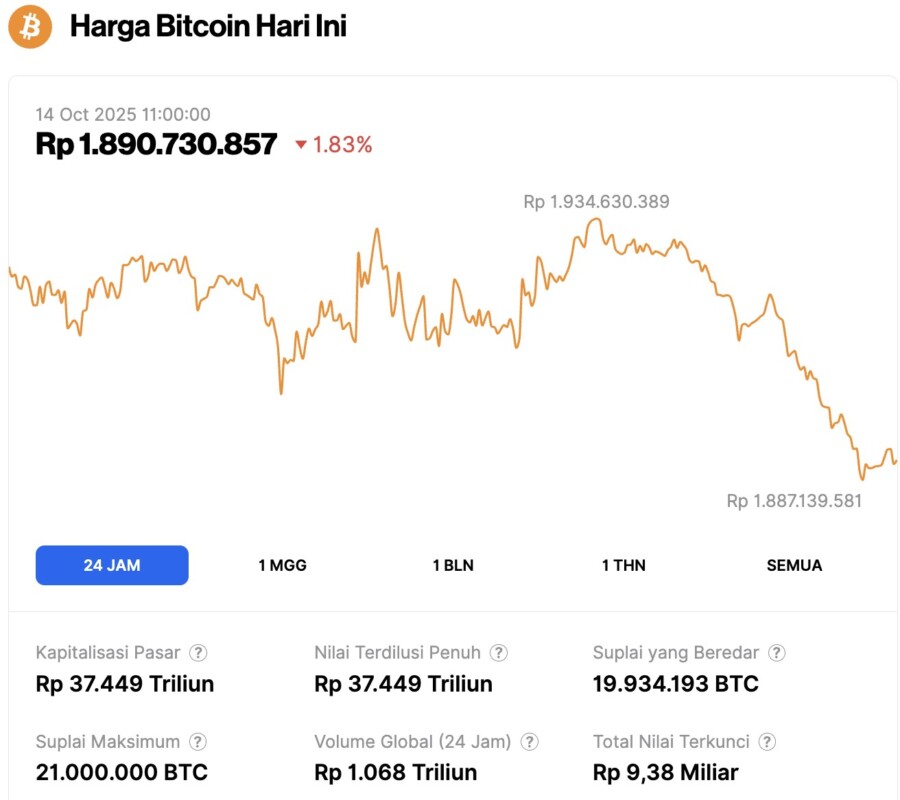

Bitcoin Price Drops 1.83% in 24 Hours

As of October 14, 2025, Bitcoin was trading at $113,658, or approximately IDR 1,890,730,857 — marking a 1.83% drop over the past 24 hours. During this timeframe, BTC reached a low of IDR 1,887,139,581 and a high of IDR 1,934,630,389.

At the time of writing, Bitcoin’s market capitalization is around IDR 37,449 trillion, while its 24-hour trading volume has declined by 24% to IDR 1,068 trillion.

Read also: Bitcoin Facing Pressure at $100K – 3 Chart Signals to Watch Closely

Bitcoin Holders Show Caution

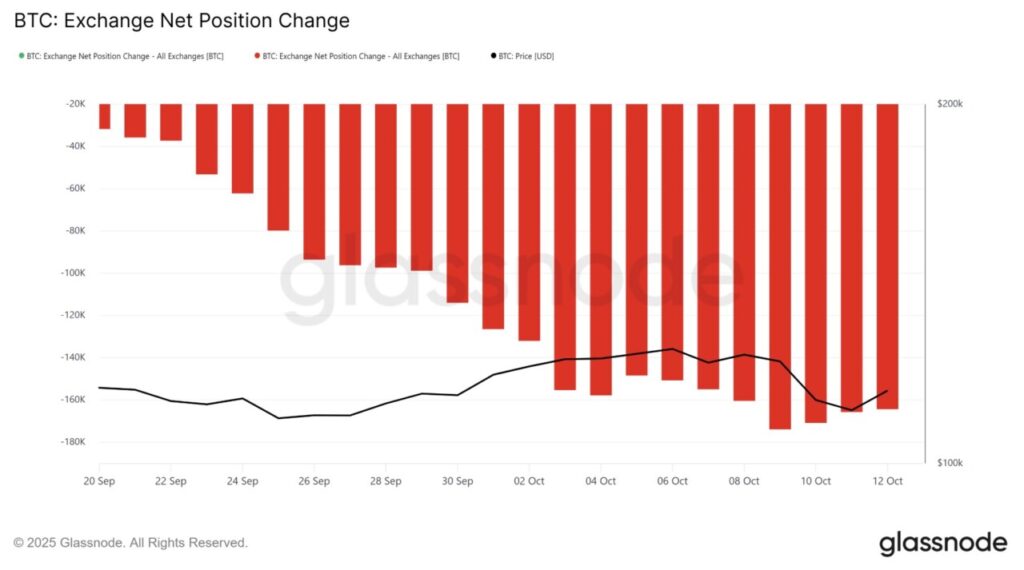

Despite the market’s sharp decline, Bitcoin investors continue to show strong conviction.

Data from the exchange’s net position shows that in the last three days, as BTC prices slumped, only about 6,000 BTC – worth about $688 million – entered the exchange. This limited inflow indicates minimal selling activity from coin holders, despite increased market volatility.

While many futures traders went into liquidation during the price crash, spot investors stayed the course. Their decision not to sell at a loss has been the stabilizing force that prevented a deeper price drop.

In general, market momentum still tends to be cautious. The Bitcoin Long/Short Bias chart, which measures the aggregate net position of major BTC traders on the Hyperliquid (HYPE) platform, shows a sharp spike in short positions since October 6, a few days before the crash. This early shift signaled increasing bearish sentiment among institutional traders.

Although some of these short positions have been reduced, the chart still shows a negative trend. This indicates that although a recovery is underway, market sentiment has not fully turned optimistic.

Read also: 4 Altcoins that Draw Attention for Futures Trading, Why?

BTC Price Tries to Recover

As of October 13, Bitcoin is trading at around $114,553, slightly below the crucial resistance level of $115,000. The price briefly breached this level on the daily move, but failed to maintain its momentum, signaling that selling pressure is still strong in the area.

In the short-term, Bitcoin’s outlook remains cautiously bullish, supported by strong sentiment from asset holders. If BTC manages to convincingly reclaim the $115,000 level, there is potential to continue its rise to $117,261, even up to $120,000.

However, to truly recover, the price needs to return to the $122,000 level consistently. Conversely, if the selling pressure from traders outweighs the resilience of investors, Bitcoin price could drop below $112,500. This could push BTC to test the support level at $110,000 and invalidate any prospects of an upswing.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Nears $115,000 As Spot Investors Defy Market Fear. Accessed on October 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.