Download Pintu App

High yields in crypto? Take a look at the 7 best passive income options for 2025

Jakarta, Pintu News – In the ever-growing world of cryptocurrency, the opportunity to earn passive income is one of the main attractions for investors.

With the right strategy, you can earn returns without having to do grueling day trading. Here are 7 popular methods to generate passive income from crypto assets in 2025 – suitable for beginners to seasoned investors.

1. Staking: The Easiest Way to Earn Interest from Crypto

Staking is the process of locking your crypto assets in a blockchain network to help with its operations, such as transaction validation. In return, you will earn interest or rewards in the form of tokens. According to data from Staking Rewards, staking returns for tokens such as Ethereum (ETH) or Cardano (ADA) can be as high as 3%-6% per year (about Rp497,280-Rp994,560 if calculated from $30-$60 using an exchange rate of Rp16,576/USD).

This method is relatively safe and easy, as you only need to store your tokens in a wallet or platform that supports staking. Some centralized platforms like Pintu even provide direct staking without the hassle of technical setup.

Also Read: $45 Million BNB Airdrop Ready to Rock the Meme Coin World in October 2025!

2. Yield Farming in DeFi: High Reward, High Risk

Yield farming is a DeFi (Decentralized Finance) strategy that allows you to provide liquidity to a protocol and receive interest or tokens in return. Platforms like Aave, Compound, or PancakeSwap are popular examples. Based on DeFiLlama’s report, yield farming can generate 10%-20% APY, depending on the asset and platform used.

However, it should be noted that yield farming also carries high risks such as impermanent loss and smart contract bugs. Therefore, be sure to do in-depth research before participating.

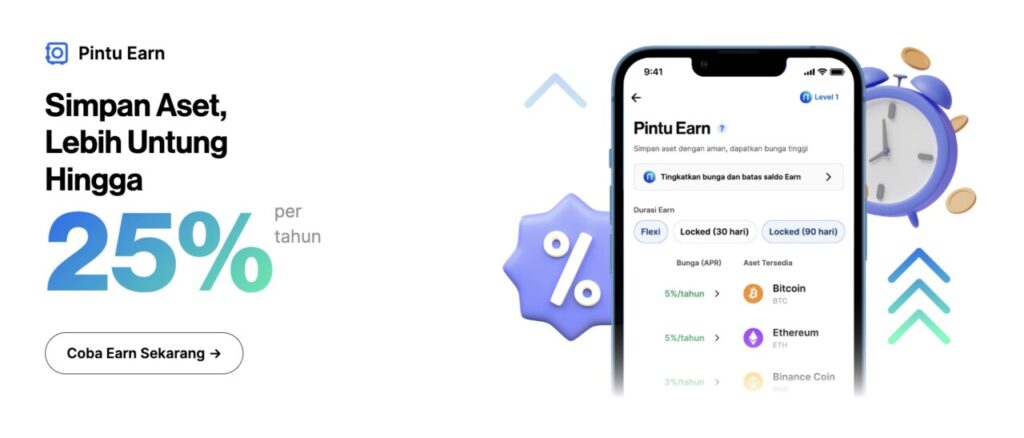

3. Crypto Lending: Like Deposits, But Digital

Crypto lending allows you to lend assets to other users or protocols and receive a fixed interest rate. Platforms like Pintu Earn provide competitive interest rates of up to 25% APY depending on the asset type and tenor. For example, the annualized interest for Solana (SOL) can be as high as 2%, or about Rp331,520 per year for a $20 equivalent balance.

Lending is suitable for investors who are looking for stable income without having to monitor market prices all the time.

4. Masternode: Passive Income for Large Capital Owners

Masternodes are full servers (full nodes) within a particular blockchain network that validate transactions and keep the network secure. To operate a masternode, a large amount of a particular token is usually required, such as Dash (DASH) or Zcoin (XZC).

Returns can range from 5%-15% per year, but you’ll need a large start-up capital and technical understanding to get going. This is more suitable for experienced investors who want to earn returns from actively contributing to crypto infrastructure.

5. NFT Royalties: Earn Money Every Time You Sell

If you’re a digital creator, selling NFTs (Non-Fungible Tokens) on platforms like OpenSea or Rarible can be a long-term source of passive income. You can set a royalty, usually 2.5%-10%, that you will receive whenever your NFTs are resold by others.

Based on data from DappRadar, NFT transaction volumes remain active despite market fluctuations, making this one source of passive income worth considering for content creators.

6. Auto-Invest Trading Bot: Not Active Trading, but Automated

Some platforms offer trading bots or auto-invest features that allow you to buy crypto regularly (DCA – dollar cost averaging). While it’s not a direct passive income, it helps you build your portfolio consistently and achieve long-term gains.

With features like this, investors can enjoy the compounding effect of crypto accumulation, especially during market rallies.

7. Door Earn: Earns up to 25% Interest per Year, Paid Hourly

For those of you who want a practical passive income, Pintu Earn could be the best choice. This platform allows users to store crypto assets and earn interest of up to 25% APY, depending on the asset and lockup period.

There are two options: Flexi Earn (interest paid hourly and can be withdrawn at any time) and Locked Earn (30 or 90 day period with higher interest). All funds deposited are secured, and are suitable for investors who want to start without the hassle of DeFi technicalities.

Conclusion

The crypto world isn’t just about day trading. With the various passive income options available, you can earn a steady income without having to constantly monitor the charts. However, it’s important to always tailor your strategy to your personal risk profile and investment goals.

If you’re looking for an easy, secure, and transparent way to get started, Pintu Earn could be an efficient solution – with competitive interest rates and a beginner-friendly process.

Also Read: Michael Saylor’s Strategy: $27.2 Million Bitcoin Purchase Before the Crypto Market Crash

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- DeFiLlama. DeFi 2025 TVL and Yield Data. Accessed October 16, 2025.

- StakingRewards.com. Staking ROI Tracker 2025. Accessed October 16, 2025.

- DappRadar. NFT Sales Volume 2025. Accessed October 16, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.