Download Pintu App

Bitcoin Hits $108,000 Today as Analysts Predict Continued Volatility

Jakarta, Pintu News – As of October 19, data from TradingView shows that the BTC/USD pair had touched a local high of $108,260.

After a rather painful close to the TradFi trading week – where the price of Bitcoin (BTC) briefly dipped below $104,000 – the selling pressure seems to be easing.

A trader on platform X called Daan Crypto Trades called this week an “interesting week.” Then, how will Bitcoin price move today?

Bitcoin Price Up 1.00% in 24 Hours

On October 20, 2025, Bitcoin was trading at $108,109, equivalent to approximately IDR 1,804,538,499 — a 1.00% increase over the past 24 hours. During the same period, BTC reached a low of IDR 1,773,768,605 and a high of IDR 1,825,869,720.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 35,880 trillion, while 24-hour trading volume has surged by 41% to IDR 760.78 trillion.

Read also: Top 3 Altcoins in the Spotlight of Crypto Traders This Week, What’s Up?

Traders expect BTC price volatility to continue

In an X post, Daan Crypto Trades called this week an “interesting week.”

“Volatility is high at the moment due to the thin order book after the massive correction in the market,” he wrote.

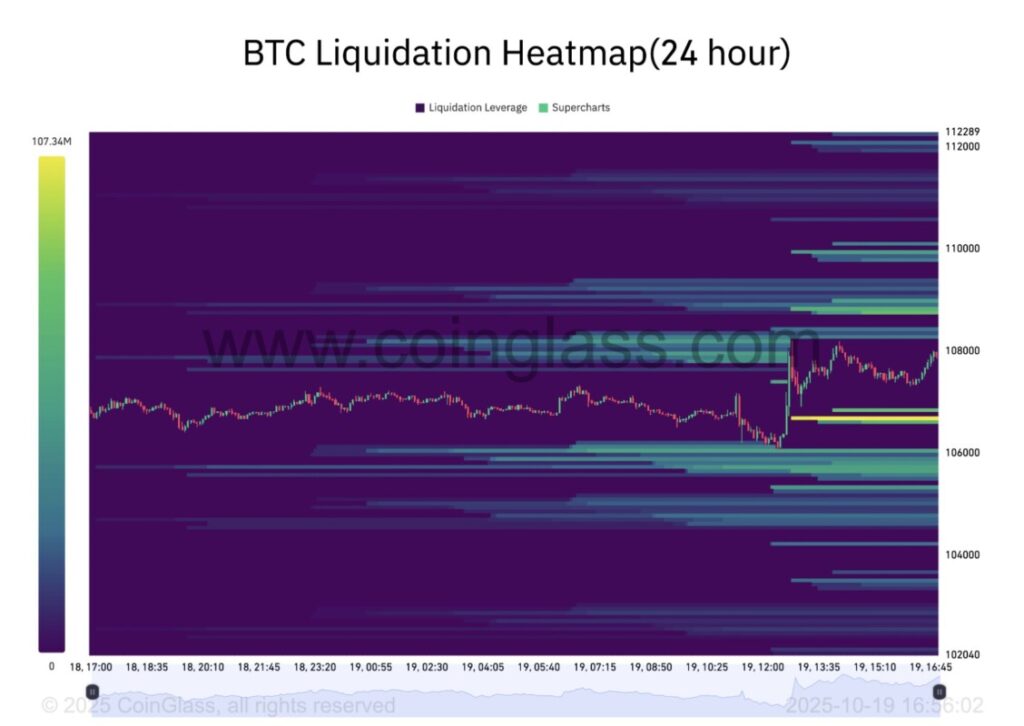

Looking at the liquidation data, Daan Crypto Trades predicts that this volatility will continue “for a while.”

“Order books are still thin, especially after last week’s big liquidation event,” he added. “When combined with the weekend price movements and many emotional traders, this creates quite volatile price movements in the short term.”

The latest data from monitoring source CoinGlass notes that the total liquidation in the crypto market in the last 24 hours has exceeded $200 million.

Liquidity on both the buy (bid) and sell (ask) sides started to strengthen around the price levels in the exchange’s order book a few hours before the weekly close.

“Bitcoin is not too far away from securing a positive weekly close above $108,381, in order to maintain the historical weekly demand area (orange color), despite the price drop below that level,” Rekt Capital traders and analysts said when uploading the weekly chart to platform X.

Read also: 4 Altcoins Targeted by Crypto Whales During Market Crashes

Altcoin Futures Explain the Gloomy Sentiment in the Crypto Market

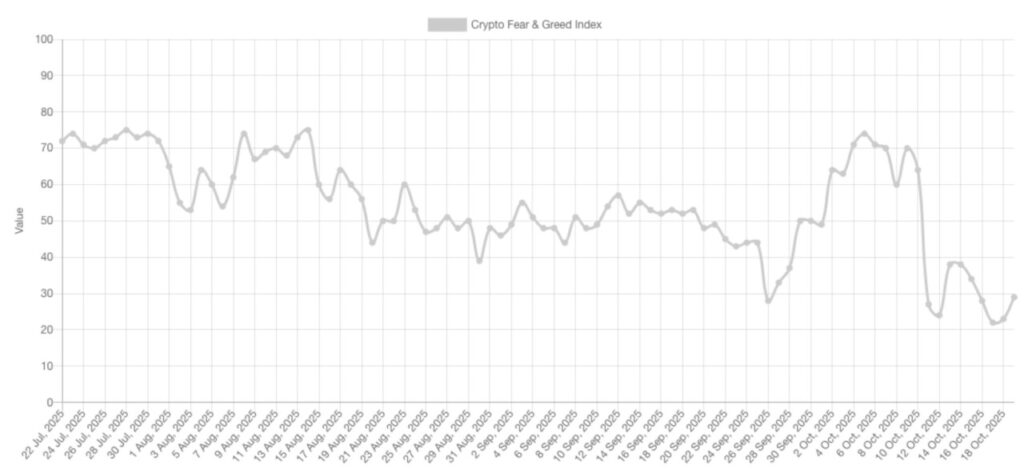

A slight recovery from downward pressure on prices managed to lift crypto market sentiment out of the “extreme fear” zone, according to data from the Crypto Fear & Greed Index.

The index registered 29 out of 100 on Sunday, up seven points from the six-month low recorded a few days earlier.

However, crypto trader and analyst Luke Martin – who is also the host of the STACKS podcast – highlighted that altcoins are to blame for the overall poor mood of the market.

In a post on the X platform on Saturday, Martin shared a chart showing the performance of the top 50 altcoin futures on Binance. The chart was created by Chris Jack, Chief Growth Officer of algorithmic trading firm Robuxio.

“This chart clearly illustrates why market sentiment is still bearish and lethargic, despite the $BTC price still being above $100,000,” he explained.

“A group of the top 50 altcoins are currently trading below their levels after the FTX crash in 2022.”

Martin was referring to the collapse of the infamous FTX crypto exchange that triggered a major downturn in the crypto market and ushered in the bottom phase of the market at the end of 2022.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin weekly close must hit this $108K+ level to rescue key ‘demand area’ Accessed on October 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.