Download Pintu App

Bitcoin Holds Above Gaussian Channel, Bull Market Structure Still Sturdy (10/20/25)

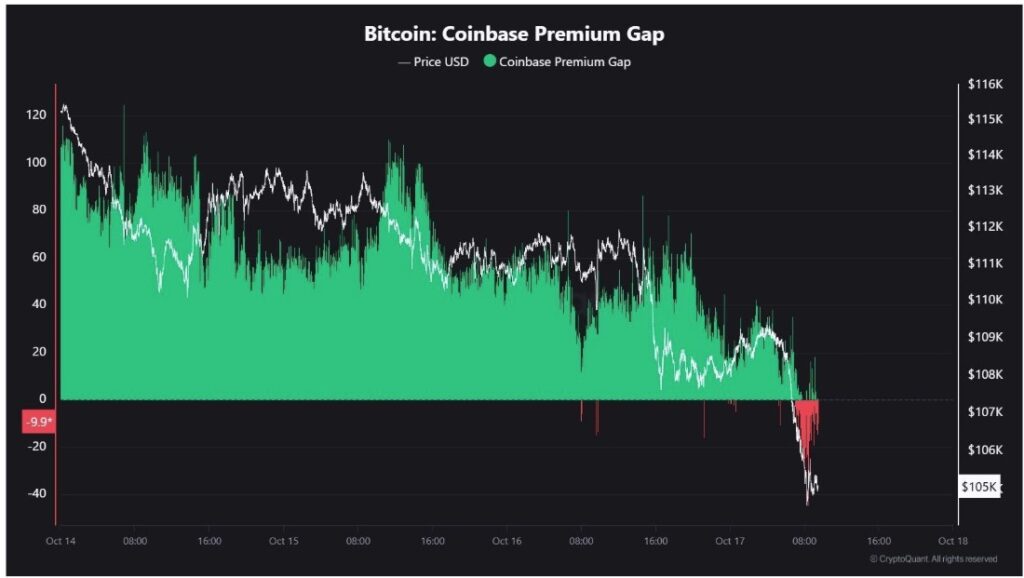

Jakarta, Pintu News – Bitcoin (BTC) is currently trading at around $107,000 after experiencing a sudden sharp drop, but managed to maintain stability to prevent further declines. Although it has yet to return to levels above $110,000, a Gaussian Channel analysis conducted by renowned crypto analyst, Titan of Crypto, shows that Bitcoin’s bull market structure is still intact despite short-term volatility.

Gaussian Channel Analysis Shows Strength

Titan of Crypto points out that Bitcoin’s position above the Gaussian Channel indicates strength in the long-term trend. In the weekly candlestick price chart shown, the green channel signifies a bullish phase, while the red area indicates a bearish decline, as it did in the bear market of 2022. Currently, the upper band of the channel is around $101,300 and continues to show an uptrend.

With the Bitcoin price around $107,000, it shows that Bitcoin has not broken into the Gaussian Channel and the overall market structure is still solid. This suggests that Bitcoin’s price pullback from its October 6 all-time high peak above $126,000 was only a temporary pause in a larger bull market.

Also Read: 5 Reasons Why Avalanche (AVAX) Price Exploded in Q4 & is in the Crypto Whale Spotlight!

Macro Context Indicator, Not Trade Trigger

Although the Gaussian Channel readings look favorable, the Titan of Crypto emphasized that this indicator should not be used as a trading trigger. “It’s not a buy signal, it’s a macro context indicator,” he said. Being above the Gaussian Channel does not automatically mean one should buy more.

It works best when combined with other indicators such as trading volume, moving averages, and on-chain accumulated trends to confirm directional momentum. As such, investors and traders can have a better understanding of current market conditions and make more informed decisions.

Indicator Combinations for Momentum Confirmation

To maximize the effectiveness of the Gaussian Channel, it is highly recommended to combine it with other indicators. Trading volume, for example, can provide insight into the forces behind price movements. Moving averages can help identify long and short-term trends.

In addition, the on-chain accumulation trend provides a snapshot of investor behavior, which can be very useful for understanding market dynamics. By using a combination of these indicators, market participants can be more confident in assessing whether the bull market structure is still in place or if there are significant changes to note.

Conclusion

Although Bitcoin (BTC) has yet to return to its previous price level above $110,000, recent analysis shows that the bull market structure is still intact. The Gaussian Channel, as an analysis tool, provides important insights into the strength of Bitcoin’s long-term trend. However, it is important to use this indicator along with other tools to get a more complete and accurate picture of the market.

Also Read: ChatGPT Prediction: XRP, DOGE & PEPE could hit an all-time high by the end of 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Holding Above Gaussian Channel, Bull Market Structure Still Intact. Accessed on October 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.