Download Pintu App

3 Altcoins Facing Major Liquidation Risks This Week — What Could Happen Next?

Jakarta, Pintu News – Although total open interest in the crypto market saw a decline in October – indicating that leveraged exposure among altcoin investors is starting to ease – some individual altcoins still carry the potential risk of large losses.

Which altcoins fall into this category, and what are the factors driving it? Here’s a further review, based on the BeInCrypto page.

Solana (SOL)

Solana (SOL) fell below the $200 mark in October, which sparked increased concern among investors. Many SOL holders began transferring their assets to crypto exchanges, indicating an intention to sell.

Read also: Solana price flirts with breakout – 20% rise could be a turning point?

The latest report from BeInCrypto shows that Solana investors sent a total of 688,000 SOL – worth more than $132 million – to crypto exchanges last week.

The liquidation map for the past 7 days also reflects the bearish sentiment, with the range of short liquidation levels (shown on the bar chart on the right side) spreading from $193 to over $200.

However, this negative outlook could be reversed, as some data suggests that the SOL could potentially experience positive momentum this week.

First, Solana is about to enter a week full of potentially bullish ecosystem events that could fuel short-term optimism. Second, analyst Lark Davis notes that SOL’s price structure appears to be forming a double bottom pattern, with a potential upside target of $250.

In addition, BeInCrypto also reported that the a16z company has invested $50 million into the Jito project to strengthen Solana’s MEV infrastructure.

If SOL manages to recover and break above $214 this week, over $1 billion of short positions could potentially see liquidation. Conversely, if SOL drops below $165, around $800 million of long positions are likely to be liquidated.

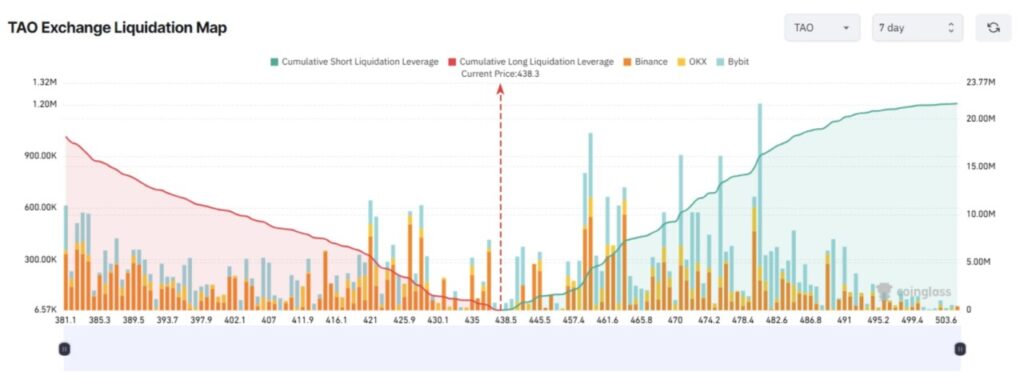

Bittensor (TAO)

In October, Bittensor (TAO) not only managed to bounce back strongly after the market correction on October 11, but also took center stage in community discussions in the DePIN(Decentralized Physical Infrastructure Networks) sector.

When most altcoins experienced a sharp decline, investors became more selective and started focusing on projects with more solid fundamentals. TAO emerged as one of the top choices.

Grayscale’s latest move also strengthens institutional confidence in TAO. The company allocated over 33% of its Grayscale Decentralized AI Fund to TAO, as well as filed a Form 10 with the SEC to form the Grayscale Bittensor Trust.

From a technical standpoint, Crypto Eagles analysts mentioned that TAO’s current price structure is similar to that of Zcash (ZEC) in its early growth phase – indicating the potential appearance of a large bullish candle in the near future.

This development could be bad news for short traders. If TAO’s price rises to $500 this week, short positions could incur losses of more than $20 million. Conversely, if TAO drops to $381, long positions will face potential liquidation worth $18 million.

Read also: Jupiter Crypto Partners with Kalshi to Provide Market Prediction Feature

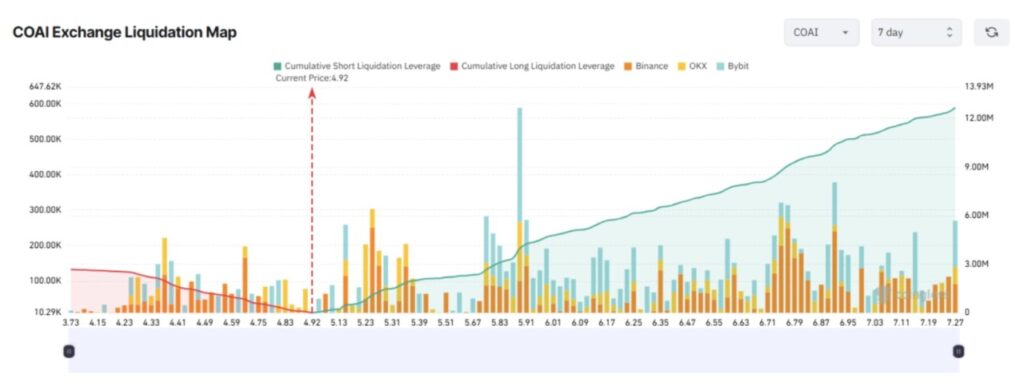

ChainOpera AI (COAI)

ChainOpera AI (COAI) emerged as one of the most striking names in October. Its market capitalization jumped from under $100 million at the beginning of the month to over $5 billion in just a matter of weeks.

However, this rapid growth came with consequences. COAI’s price plummeted almost 90% from its high of $46. This sharp decline prompted an increase in short positions, creating a huge imbalance on the liquidation map.

The data shows that if COAI manages to recover and rise above $7 this week, around $11.5 million of short positions could be liquidated. Conversely, if the price drops to $3.73, around $2.7 million of long positions are at risk of liquidation.

Under these conditions, short traders need to be cautious. After a 90% correction, buying pressure could potentially return and trigger a short squeeze.

The renewed interest from both retail and institutional investors in AI-based crypto projects also suggests that COAI’s journey may not be over – and the token could soon recover some of its lost value.

While these three altcoins have unique catalysts that could drive a recovery, the majority of the altcoin market is still under selling pressure. October painted a complex and risky picture for both long and short positions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins to Watch This Week: ADA, COTI, TONCOIN. Accessed on October 24, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.