Download Pintu App

5 Reasons XRP Could Be Heading Toward the $5 Mark

Jakarta, Pintu News – XRP’s (XRP) price gains are stuck at its 50-day moving average as traders await the Fed’s interest rate decision in October as well as the meeting between Donald Trump and Xi Jinping.

The Ripple token is trading at around $2.6290, which is the price range in recent days. Even so, the coin has a number of driving factors that could potentially increase its price by 92% to $5 this year, cites Crypto News.

XRP price could reach $5 thanks to ETF inflows

One of the main triggers that could push up the price of Ripple (XRP) is the increased demand from institutional investors.

Read also: Shiba Inu 2025 Price Prediction: SHIB Likely to Soar to $0.0000222?

Existing XRP ETFs have performed solidly a few months after their launch. For example, the newly launched REX-Osprey XRP ETF has managed to accumulate over $115 million in assets.

Meanwhile, the Teucrium 2x XRP ETF has amassed over $400 million in assets, and this figure continues to rise.

This growth reinforces expectations that mainstream XRP ETFs from major firms such as Franklin Templeton, Bitwise, and Canary will manage to amass billions of dollars worth of assets within their first year. This is because investors see XRP as a high-quality utility asset.

XRP Accumulation by Treasury Company

Another driving factor is the potential accumulation of XRP by treasury companies. One of the latest players in the industry is Evernorth, which has purchased over $1 billion worth of XRP tokens.

Other companies that have also accumulated XRP include Trident, Webus, and VivoPower. This suggests there is strong institutional demand for XRP.

Another sign is the performance of the newly launched CME XRP Futures, which has remained solid so far this year. The notional value of its contracts has jumped to over $26 billion in just about 5 months, and open interest in the futures continues to rise.

Macro Factors that Could Push Ripple Price Up

On the other hand, macroeconomic factors in the United States are expected to favor XRP price increases towards the end of this year.

One factor is the Federal Reserve’s upcoming interest rate decision, where most analysts predict a 0.25% cut. Cryptocurrency prices usually rise when the Fed cuts interest rates, as it did during the pandemic.

Another macro factor that is important to the price of XRP is the upcoming meeting between Donald Trump and Xi Jinping at the APEC Summit to be held in South Korea.

An agreement between the two leaders could reduce one of the biggest macro risks in global markets, which would likely boost demand for riskier assets such as stocks and cryptocurrencies.

Read also: Jupiter Launches Limit Order V2 on Solana with Privacy Features!

Stablecoin Market and XRP’s Potential Price Rise to $5

Another important catalyst that could potentially push the price of XRP to the $5 level this year is the increasing market share of stablecoins. Ripple USD is currently approaching the $1 billion mark in total assets, which reinforces the fundamentals of this coin.

Technical Analysis Indicates Further Rise

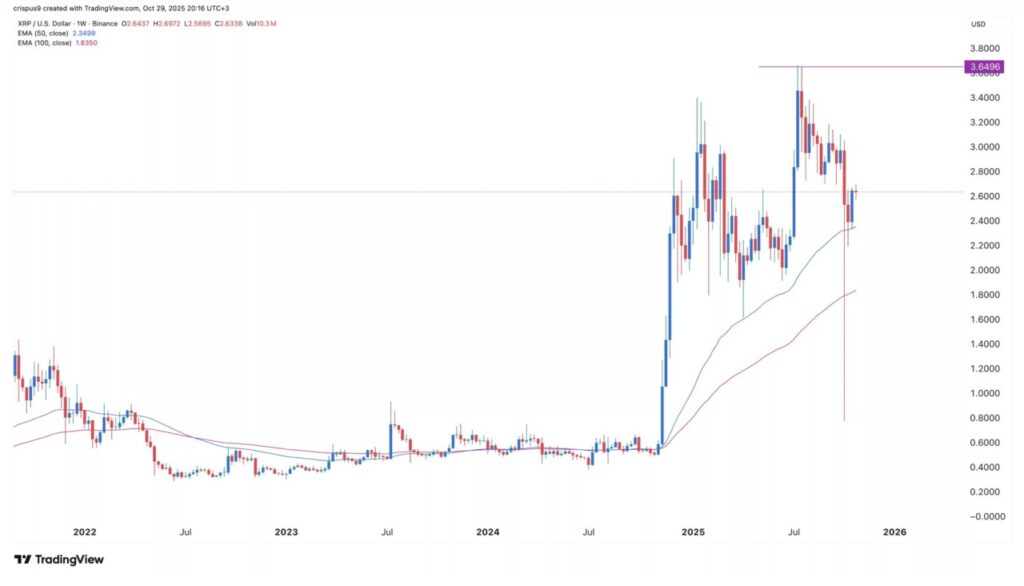

Technically, the weekly chart shows that XRP has strong bullish signals for further upside. The candlestick pattern formed is a giant hammer – characterized by a small body and a long lower shadow.

The Hammer is known as one of the most bullish candlestick patterns in technical analysis. In addition, the price of XRP has also broken above its 50-week and 100-week exponential moving averages (EMAs).

Thus, the chances of a bullish breakout are quite high, with the potential for the price to break up to $5. This opportunity will be even greater if the price manages to pass this year’s high at $3.6.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Top Catalysts That May Push XRP Price to $5 in 2025. Accessed on October 31, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.