Download Pintu App

Will Ripple (XRP) Keep Losing Value? Here’s the Key Level It Needs to Break Through!

Jakarta, Pintu News – XRP (XRP) started the first Monday of November with a lackluster performance. The token fell 3% in 24 hours and has now recorded a 19.1% decline in the last 30 days. This clearly shows the ongoing downward trend in XRP price.

Overall, market conditions for XRP are still weak, and the technical charts indicate further downside potential – unless there is significant buying in the near future.

Hidden Bearish Divergence Hints at Further Weakness in XRP

Between October 13 and November 2, the XRP price made a lower high, while the Relative Strength Index (RSI) indicator made a higher high. This is known as a hidden bearish divergence, a technical pattern that often signals the continuation of an ongoing downward trend.

Read also: Crypto Whales on the Move: Which Coin to Go For While the Market Crashes?

Simply put, although momentum seems to be increasing, the pressure from sellers is still dominant. For XRP, the only way to invalidate this bearish signal is with a daily price close above $2.64 – potentially opening up room for an upward movement.

But as long as it hasn’t happened, the market is still leaning towards sellers.

Profit Taking and Short-Term Selling Add Downward Pressure

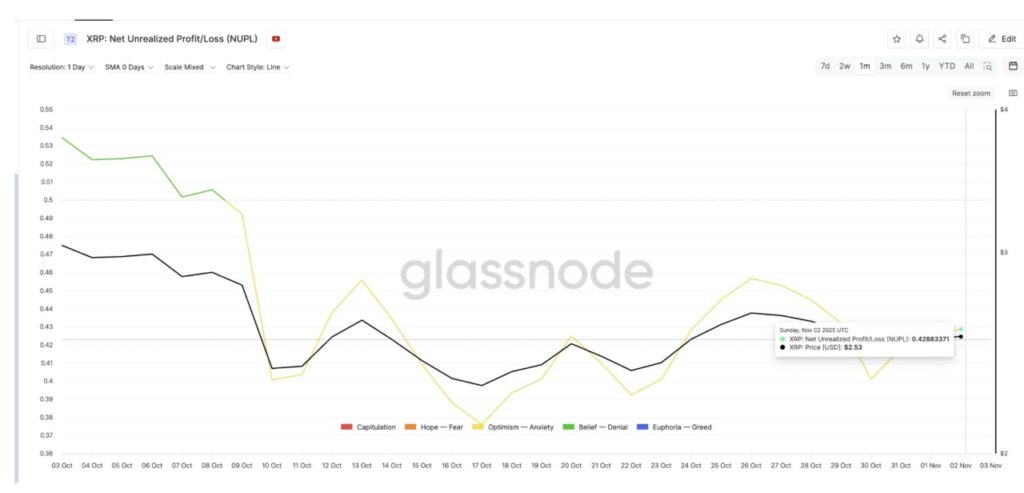

On-chain data supports this bearish view. The Net Unrealized Profit/Loss (NUPL) indicator, which measures the rate of investor gains across the network, stands at 0.428 – almost the same as the local peak of 0.425 reached on October 20. Back then, XRP fell from $2.50 to $2.36 in just two days – a correction of 5.6%.

A high NUPL value usually indicates that investors are still holding profits, so they tend to sell to secure profits.

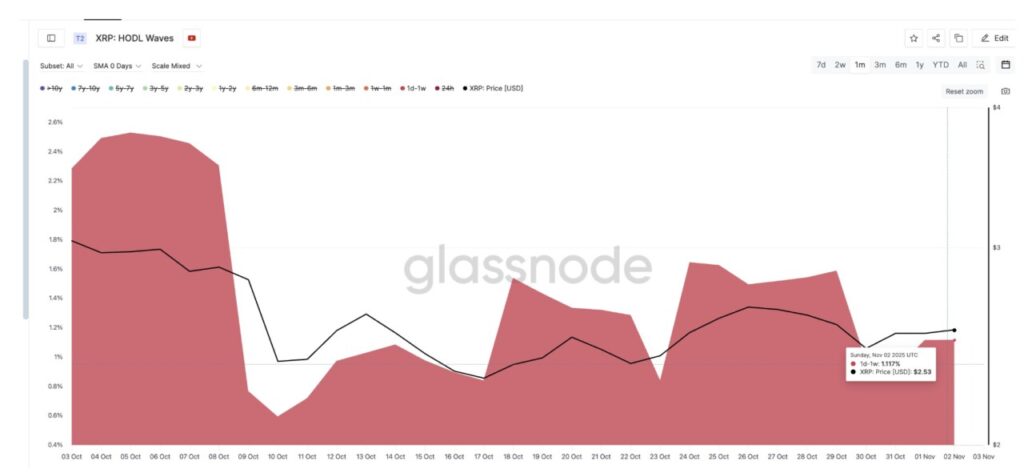

This is what is now happening. Data from Waves’ HODL metric – which tracks how long coins are held by investors – shows that wallets holding XRP for 1 day to 1 week have seen their supply share drop from 2.28% to 1.17% in just two weeks. This represents a nearly 50% drop in short-term reserves.

These short-term traders are actively sellinginto rallies, further adding to the downward pressure on XRP prices.

Read also: Ethereum Price Plunges to $4,600 Today: ETH On-Chain Support Remains Strong

Key XRP Price Levels to Watch as Selling Pressure Increases

With the continued sell-off from short-term holders, XRP’s crucial support level of $2.31 is now under pressure. If this level fails to hold, XRP could potentially drop further towards $2.18 – a further confirmation of the downtrend.

Notably, $2.31 is only about 4.91% away from the current price, still within the downside zone triggered by the NUPL pressure as discussed earlier.

However, if the price is able to hold above $2.31, it could provide enough temporary stability to re-test the resistance at $2.64. Breaking the $2.64 level would invalidate the bearish divergence pattern and signal the beginning of a possible rebound.

If this happens, the momentum will shift back into the hands of buyers, and XRP’s price movement will be in line with the strength of the RSI – which could be an early sign of a medium-term trend recovery.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Price at Critical Price Level in November. Accessed on November 4, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.