Download Pintu App

Antam Gold Price Chart Today November 5, 2025: Up or Down?

Jakarta, Pintu News – Based on data from the HargaEmas.com website as of November 5, 2025 at 10:40 am GMT, spot gold prices on the world market recorded a decline. The price of gold in USD/oz is at $3,956.90, down $4.50 compared to the previous day. Meanwhile, the USD/IDR exchange rate was at Rp16,719.78, a slight increase of Rp0.52.

If converted, the spot gold price in rupiah per gram(IDR/gr) fell by IDR 1,439, to IDR 2,127,045. The highest level (high) today was at IDR 2,133,379 and the lowest (low) at IDR 2,111,688.

World Gold Price Chart: Significant Decline at the Start of the Day

The chart of world gold spot prices in Rupiah shows a downward trend since early morning. Price movement data from the HargaEmas.com website shows that since 00:00 WIB on November 5, the price of gold was above IDR 2,135,000 per gram, but continued to decline until it touched the lowest range of IDR 2,111,688 around 06:00 WIB.

Despite a slow recovery in the morning to afternoon, the chart shows that the price trend is still unstable. This decline occurred despite the strengthening of the dollar exchange rate against the rupiah, which usually supports the price of gold in rupiah.

Also Read: 5 Reasons Why Analysts Think November Could Be the Most Bullish Month for XRP (XRP)

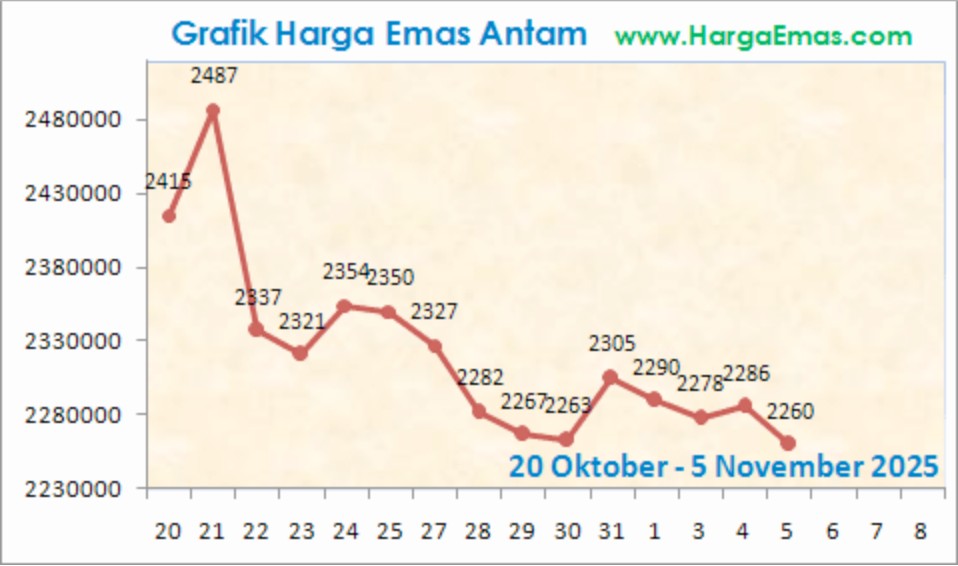

Antam Gold Price Chart: Continuously Falling Since Late October

In the daily trend chart of Antam gold bullion prices from October 20 to November 5, 2025, a sharp decline can be seen. The peak occurred on October 21 at a price of IDR 2,487,000 per gram, but after that the trend continued to decline. Until today, November 5, 2025, the price of Antam gold closed at IDR 2,260,000 per gram.

This decline means that there has been a correction of IDR 227,000 in the past two weeks. Price movements showed small fluctuations from late October to early November, but have not been able to return to prices above IDR2,300,000. This pattern shows that global market pressures and exchange rate influences have not supported price recovery.

What Causes Gold Prices to Fall?

According to various analysts, the current decline in gold prices is influenced by several global factors, including:

- US Dollar Stability – A stronger dollar tends to depress gold prices as gold becomes more expensive for non-dollar buyers.

- US Interest Rate Policy – Expectations that the Fed will keep interest rates high also weighed on gold prices.

- Lack of Geopolitical Tensions – When global conditions are relatively stable, demand for safe haven assets like gold tends to weaken.

Spot gold data as of November 5, 2025 quoted from HargaEmas.com also reflects this condition, with a decline in gold prices amid a slight strengthening of the rupiah against the dollar.

Is Now the Right Time to Buy Gold?

With gold prices having declined in recent days, some investors see this as an accumulation opportunity. However, investment decisions should be tailored to long-term financial goals and dynamic market conditions.

For those who regularly invest in physical gold such as Antam gold, it is important to monitor daily and weekly price trends as shown in the chart above, in order to determine the best buying and selling times.

Also Read: Can You Live Only on Crypto? Here are 3 Sources of Income & Challenges You Need to Know About

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- HargaEmas.com. Spot Gold & World Gold Price Chart and Antam Today. Accessed on November 5, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.