Download Pintu App

4 Bitcoin (BTC) Market Pressure: 148,000 BTC Released, Can Price Hold at Rp1.6 Billion?

Jakarta, Pintu News – Bitcoin (BTC) price is under pressure again after experiencing a massive sell-off from Short-Term Holders (STH) and mid-sized investors (sharks). This decline comes amid market uncertainty and technical signals that have yet to show recovery. Here are four important indicators that market participants are currently monitoring.

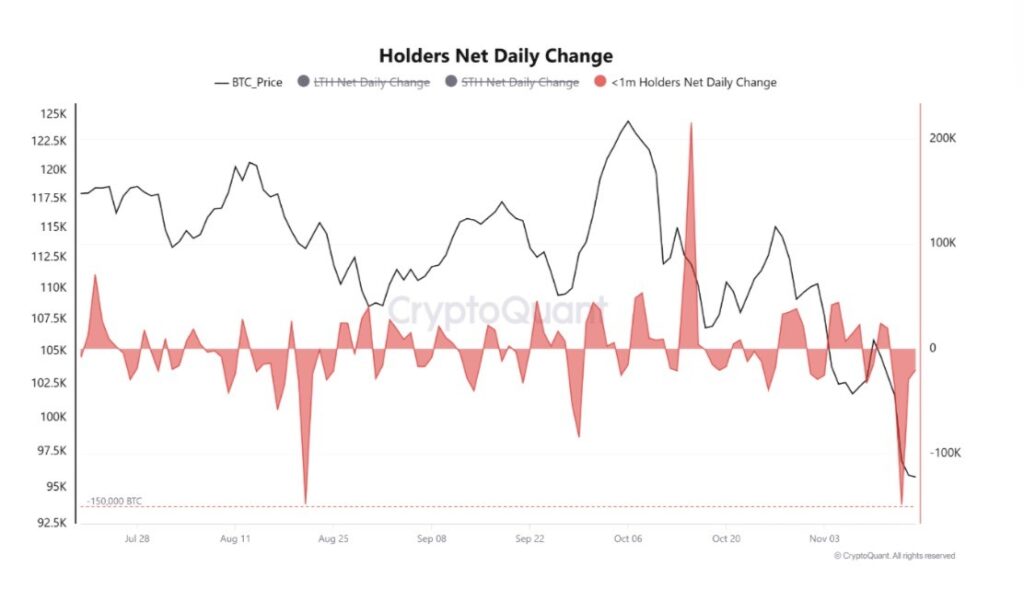

1. STH Offloads 148,000 BTC and Triggers Huge Selling Pressure

Based on data from CryptoQuant, short-term holders (STHs) have sold around 148,000 BTC in the past two days at prices below Rp1.67 billion (USD 100,000). This number is significant and directly contributed to the price of BTC dropping towards the Rp1.6 billion (USD 96,000) range at the end of last week.

According to AMBCrypto, this sell-off reflects capitulation – when investors give up and sell assets at a loss – which signals the dominance of short-term negative sentiment.

Also Read: 3 Powerful Altcoins Predicted to Rival Solana, What Are They?

2. Loss-making BTC supply hits 8-month high

Data from Checkonchain shows that the amount of BTC STH has at a loss increased to 4.9 million BTC, the highest since April 2025. This means that most of the new buyers entered at prices higher than the current value.

This phenomenon has historically often triggered further sell-offs as investors tend to avoid deeper losses. If this pressure continues without any new demand from the spot market, then the risk of further correction will increase.

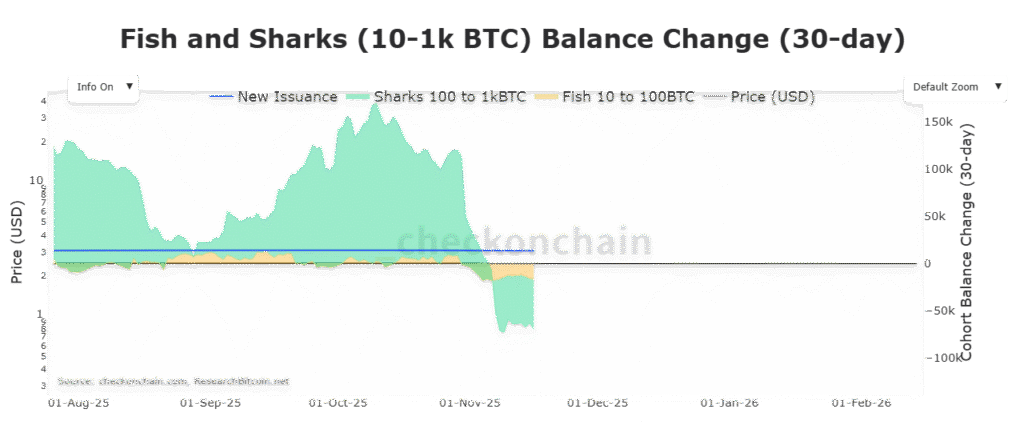

3. Additional Pressure Coming from Shark and Fish

Not only STH, the large and medium-sized investor groups such as sharks (holders of 100-1,000 BTC) are also showing distribution behavior. Checkonchain notes that this group has reduced their holdings by 53,700 BTC in the last 30 days to November 16.

Meanwhile, the fish group (10-100 BTC) also offloaded 16,400 BTC in the same period. This shows that the selling pressure is not only coming from retail traders, but also from investors who have larger volumes.

4. Support and Resistance Levels: Risk to IDR1.57 M vs Potential Rebound to IDR1.66 M

The evenly distributed selling pressure from various investor groups is holding back BTC from establishing recovery momentum. If the selling from STH continues without any increase in spot demand, BTC price is expected to drop to the next support at IDR 1.57 billion (USD 94,106).

However, if the selling pressure subsides and spot demand picks up again, BTC has the opportunity to test the short-term resistance at IDR 1.66 billion (USD 99,314). This point is important as an early confirmation of a potential trend reversal.

Also Read: 10 Most Popular Coin Memes of November 2025: The talk of the town!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What caused the huge selling pressure on Bitcoin (BTC) in the past two days?

Based on data from CryptoQuant, the selling pressure occurred as Short-Term Holders (STH) offloaded around 148,000 BTC at prices below Rp1.67 billion ($100,000), which caused the price to drop to around Rp1.6 billion ($96,000).

How much of the Bitcoin (BTC) supply is currently at a loss?

Data from Checkonchain noted that the supply of Bitcoin held by STHs at a loss reached 4.9 million BTC, the highest since April 2025, indicating emotional and financial stress on new investors.

Who else is contributing to the selling pressure besides STH?

In addition to STH, mid-range investor groups such as shark (100-1,000 BTC) and fish (10-100 BTC) also showed distribution action, with holdings decreasing by 53,700 BTC and 16,400 BTC respectively in the past 30 days.

What are the important price levels that the market is monitoring for Bitcoin (BTC) right now?

The key support level to watch is IDR1.57 billion ($94,106), while a potential rebound could occur if BTC is able to break resistance around IDR1.66 billion ($99,314) on the back of increased spot demand.

Reference:

- Gladys Makena/AMBCrypto. Bitcoin: STHs dump 148k BTC – Can BTC hold $96k before sharks add pressure? Accessed on November 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.