Download Pintu App

Caution Ahead: These 3 Altcoins Could Face Major Liquidations This Week

Jakarta, Pintu News – Entering the second half of November, the overall market capitalization of altcoins has dropped below the $1 trillion mark. The ability of altcoins to bounce back amid extremely negative market sentiment has the potential to trigger high volatility and massive liquidation actions on a number of assets.

Which altcoins are at risk, and what specific factors need to be looked at carefully? Details are available below.

Ethereum (ETH)

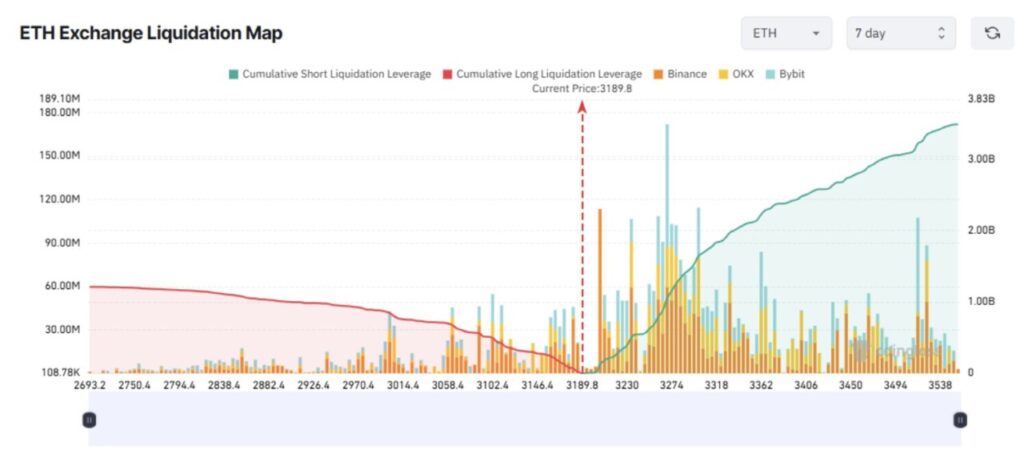

According to BeInCrypto, the Ethereum (ETH) liquidation map shows a stark imbalance between the potential liquidation volume of Long and Short positions. Currently, traders are allocating more capital and leverage to Short positions. Consequently, they are at risk of incurring huge losses if the ETH price goes up this week.

Read also: Arthur Hayes Moves Millions—Is a Drop Below $3,000 Next for Ethereum?

If ETH breaks above $3,500, more than $3 billion worth of Short positions could potentially be liquidated. Conversely, if ETH falls below $2,700, the liquidation value of Long positions is estimated to be only around $1.2 billion.

Short players still have reasons to hold their positions. ETH ETF funds recorded outflows of $728.3 million last week. In addition, crypto billionaire Arthur Hayes is also known to have offloaded his ETH holdings recently.

From a technical standpoint, ETH is currently in a key support zone around $3,100-a price level that could potentially trigger a significant recovery.

Sentiment indicators for ETH have also fallen to extreme fear levels. Historically, ETH has often experienced sharp rebounds from similar conditions. As such, the chances of ETH price recovery have a strong foundation and could lead to huge losses for Short traders.

Solana (SOL)

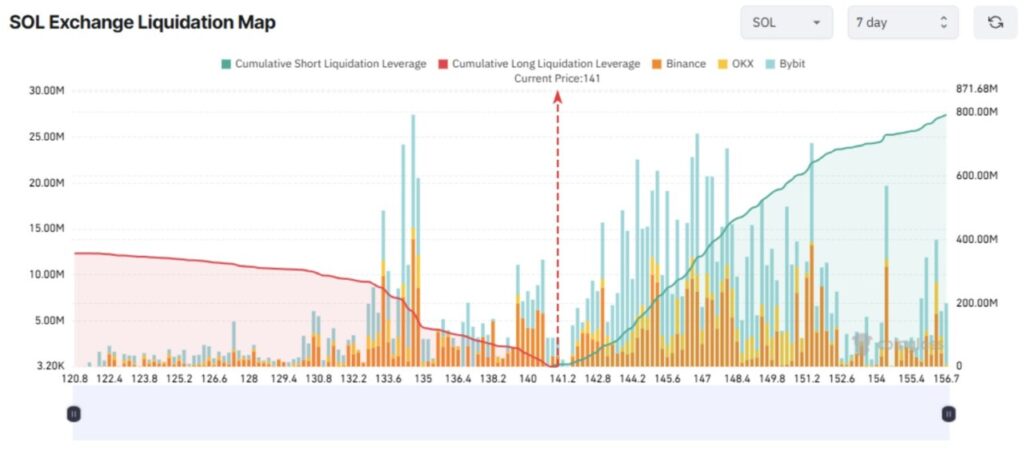

As with ETH, the Solana (SOL) liquidation map also shows a sharp imbalance, with a much larger volume of liquidation of Short positions.

The decline in SOL prices below $150 in November triggered expectations of a further decline towards $100 among short-term traders. Short-selling activity was carried out not only by retail traders, but also by large investors (whales) throughout the month.

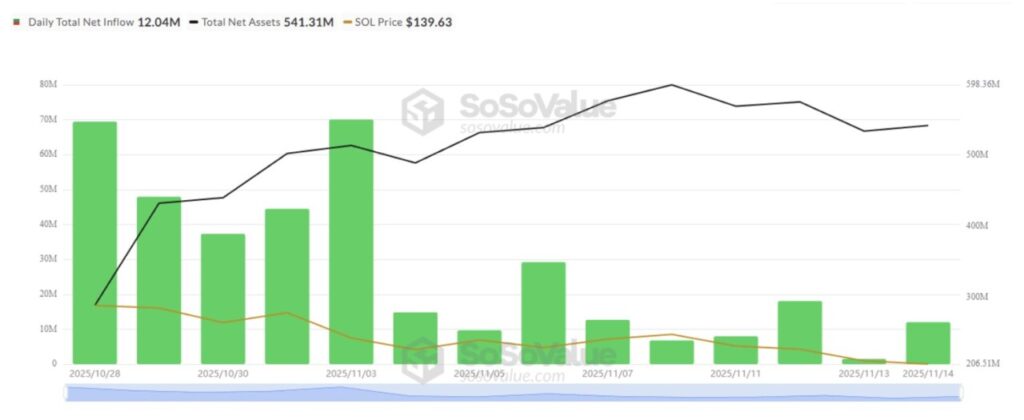

However, SOL ETF data shows a more optimistic outlook. Based on data from SoSoValue, SOL ETFs in the US recorded net inflows of more than $12 million on November 14, and a total of more than $46 million over the past week. In contrast, BTC and ETH ETFs experienced net outflows.

This provides a basis for a potential recovery in SOL prices, given that investor demand for the ETF remains strong. The liquidation map shows that if SOL rises to the $156 level, nearly $800 million worth of Short positions could be liquidated.

Conversely, if the SOL price drops to $120 this week, the potential liquidation of long positions is estimated to be around $350 million.

Read also: Whale Buys 150,000 $LINK — Is a Chainlink Price Surge on the Horizon?

Zcash (ZEC)

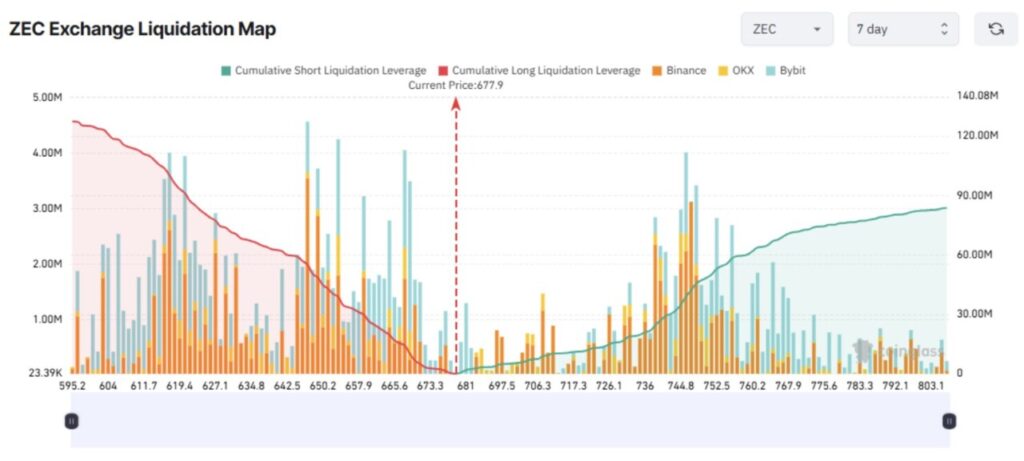

In contrast to ETH and SOL, the Zcash (ZEC) liquidation map shows that Long traders bear most of the potential liquidation risk.

Short-term traders appear optimistic that ZEC will continue to print higher highs throughout November. This optimism is supported by the sharp increase in the amount of ZEC locked in the Zcash Shielded Pool this month, as well as the expectations of some analysts who still expect the potential ZEC price to reach $10,000.

However, the price of ZEC repeatedly experienced rejection in the $700 area. This condition raises concerns among analysts about the potential price correction this week.

If a correction occurs and ZEC falls below $600, the liquidation value of Long’s position is expected to exceed $123 million.

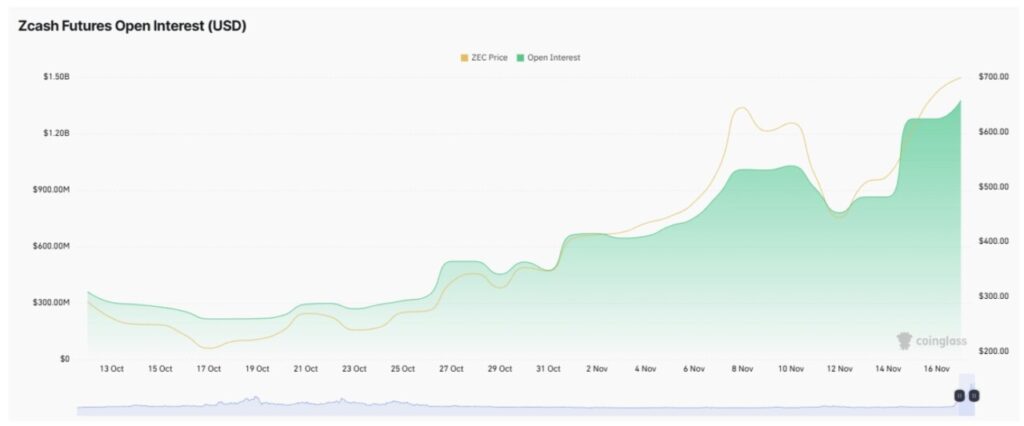

In addition, data from Coinglass shows that ZEC’s total open interest hit a record high of $1.38 billion in November. This signifies high leverage exposure, which increases the risk of volatile price movements and large-scale liquidation.

Against this backdrop, a long position on ZEC can indeed generate short-term profits, but without a clear take-profit or stop-loss strategy, the position is highly vulnerable to liquidation pressure.

FAQ

What is liquidation in the context of crypto trading?

Liquidation in crypto trading occurs when a trading position is forcibly closed by an exchange because the trader is unable to meet the required safety margin, often when the price moves significantly against the trader’s prediction.

Why is Ethereum (ETH) potentially subject to large liquidations on Short positions?

Ethereum (ETH) has the potential to experience a large liquidation of Short positions because if the price of ETH rises above $3,500, there will be a liquidation of more than $3 billion in such positions, caused by the imbalance between the capital allocated to Long and Short positions.

How do ETF market conditions affect Solana (SOL) price?

Positive ETF market conditions, with significant net inflows, suggest that there is still strong demand for Solana (SOL), which could support a potential price rebound despite selling pressure in the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Facing Liquidation Risk in the Third Week of November. Accessed on November 21, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.