Download Pintu App

5 Reasons Solana (SOL) was Scooped by Institutions Despite Falling 30%: Whale’s Stealth Strategy?

Jakarta, Pintu News – Solana (SOL) experienced a sharp 30% decline during the fourth quarter of 2025, making it the worst-performing top-cap altcoin in the period. Yet despite the deep correction and weak market sentiment, institutions continue to increase their exposure to SOL. Is this a sign that the price drop is merely an “early capitulation” and not a long-term trend reversal?

1. Solana Drops 30%, Lags behind Other Altcoins

Based on quarterly data, Solana has recorded a 30% decline since the beginning of Q4 2025. This makes it one of the weakest performing altcoins compared to cryptocurrencies like Ethereum (ETH) or Ripple (XRP).

Solana’s highest price was recorded in mid-September at $253, well before the general market decline in October. This means that the SOL selling pressure started earlier than other altcoins.

Also Read: Robert Kiyosaki Remains Optimistic, Plans to Buy More Bitcoin!

2. Capitulation Signal: SOL Net Realized Loss enters the Red Zone

According to on-chain data, Solana’s Net Realized Profit/Loss metric has been recording losses since early November. When the price broke below $180 (IDR 3.01 million), the sell-off increased sharply, resembling the wave of panic that occurred during the October crash.

Whales were also seen unwinding positions. One whale sold 33,366 SOL bought seven months ago, with a realized loss of about $230,000 (Rp3.85 billion). Despite having earned 1,283 SOLs from staking, the position remained at a loss.

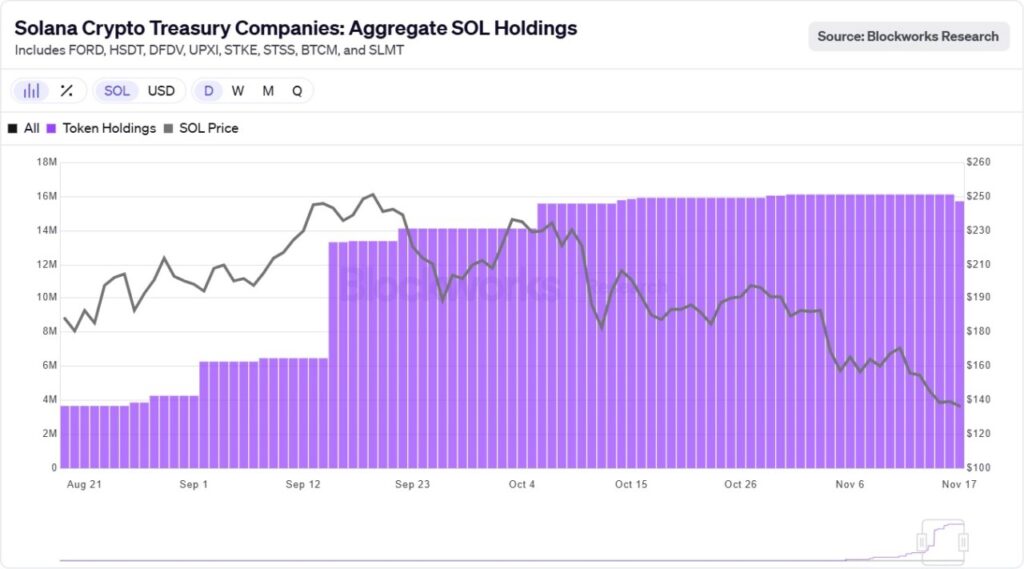

3. Institutions Buy 24 Million SOL

While retail market sentiment has been negative, institutions appear to be taking the opposite position. Data from Blockworks shows that over 20 Digital Asset Treasuries (DATs) and two Exchange-Traded Funds (ETFs) have accumulated a total of 24 million SOLs.

This accumulation action indicates institutions’ long-term confidence in Solana’s fundamentals. In a risk-off market, this move reinforces the perception that falling prices can be used as a buying opportunity.

4. “Buy the Dip” Strategy by Institutions Validating Long-term Confidence

According to analysts from AMBCrypto, buying amid falling prices is a strategy that shows confidence in the future recovery. Although SOL is down 25% so far this year, institutions’ positions have had little impact on their balance sheets.

With losses still within tolerance limits and long-term expectations remaining strong, institutions continue to expand their exposure to SOL as part of a diversified digital asset portfolio.

5. HODLing is still the main narrative among large investors

Despite increasing selling pressure in the retail market, institutions continued to hold positions. This created a classic investor’s dilemma: either sell in the midst of panic, or stick with the big capital flows.

Industry experts suggest that as long as institutional accumulation continues and the Solana network shows growth, the “HODL” strategy is still relevant for those who see this asset as a long-term investment.

FAQ

Why did Solana’s price drop dramatically in Q4 2025?

The decline began as early as September before a broader market correction took place in October, characterized by the failure to hold important support levels and a massive sell-off.

What is capitulation in Solana’s context?

Capitulation occurs when investors sell in large numbers out of fear, often at the lowest price point, as seen by the rising Net Realized Loss metric.

Who bought Solana when the price fell?

Large institutions, including 20+ DATs and 2 ETFs, have accumulated over 24 million SOL despite the price being on a downtrend.

Is it a good time to HODL Solana?

Despite the high volatility, the data shows that institutional investors remain confident in Solana’s long-term prospects, making HODL a strategy that is still being considered.

What are the main risks right now for Solana?

Key risks include macro market pressures, short-term volatility, as well as potential liquidation from lingering retail and whale investors.

Reference

- AMBCrypto. Solana bleeds 30% in Q4, yet institutions buy more – What are they seeing? Accessed on November 18, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.