Download Pintu App

Can you live on crypto alone? Here are 3 sources of income & challenges you need to know about

Jakarta, Pintu News – In today’s digital era, the question “can you live on crypto?” is increasingly being discussed by many people, especially the younger generation. With many platforms and methods of making money from digital assets, cryptocurrency is now chosen as an alternative source of income, even without a permanent job. But is this really realistic for everyone?

1. Daily Trading: An Easy Way to Get Rich, Really?

Day trading in the cryptocurrency world is attracting attention for its quick profit potential. There are many viral success stories of crypto traders turning small amounts of capital into billions of rupiah in just a matter of months. But the fact is, according to data and community experience, few can consistently profit from trading without adequate skills.

According to analysis from CoinMetro (2025), trading requires technical mastery, high discipline, and strict risk management. Without a clear strategy, capital can be raided by the market in an instant. Even with minimum wage capital, the risk of losing assets is huge if you rely solely on speculation.

Also Read: Potential DOGE Explosion November 2025: Technical Analysis Shows Sharp Rise?

2. Long-term Investment: Stable But Takes Time

Unlike trading, long-term investments are considered safer for investors who cannot monitor the market on a daily basis. It’s common for investors to hold assets like Bitcoin (BTC) or Ethereum (ETH) for years with the belief that their value will soar in the future.

Strategies like Dollar Cost Averaging (DCA) are perfect for workers on a fixed or modest income, as they allow for regular purchases without being affected by daily price fluctuations. Based on historical data, Bitcoin and Ethereum are resilient altcoins that have delivered significant growth in the past five years. However, patience and financial resilience are required as not all years are sweet.

3. Passive Income in Crypto: Staking, Farming, and Airdrops

For those who don’t have much time, passive income methods such as staking, yield farming, and airdrops can be a solution to increase income. According to CoinMetro, staking Ethereum (ETH) or Cardano (ADA) can yield between 4-10% per year, depending on the network and platform used.

Meanwhile, participation in crypto airdrop programs such as those conducted by various DeFi and NFT projects can provide instant profits for active users. Despite the seeming ease, investors still need to be wary of fake projects and potential losses due to token price volatility. All types of passive income should be monitored as they are risky if not done carefully.

4. Real Simulation: How Much Does Crypto Earn?

To be more realistic, let’s take a look at a concrete simulation of how much earning potential there is in the crypto world, whether as a trader, investor, or user of earning features such as staking. This data can be a rough idea for anyone who wants to try living off crypto.

a. Day Trader

A beginner with a capital of $1,000 and a profit target of 2-5% per day can earn between Rp330,000 and Rp830,000 per day if they manage to take profitable trades. In the best case scenario, the monthly profit potential could be as high as IDR10 million – IDR25 million.

A medium-sized trader with a capital of $10,000 (IDR166 million) and a target of 3-7% per day, the earning potential reaches IDR5 million – IDR11 million per day, or up to IDR150 million a month, if the strategy is consistent.

However, the risks are also great. Without a strategy and risk management, capital can be depleted to 100% in a short period of time. In addition, there is a high risk of unpredictable events such as tariff announcements and the like.

b. Professional Trader Experience

However, as mentioned in an article by Vocal Media (2025), even professional traders still face the potential for huge losses when the market moves beyond expectations.

For example, X (Twitter) account @LordCrypto_, on the way to trading “$8,000 to $1,000,000”, lost portfolio value from $115,000 to $80,000 just because he violated his own strategic principles. After returning to the original plan, the value rose back to $115,000 on day 7. In his tweet he wrote:

“Growth is intentional and has principles.”

His post is proof that in the world of crypto trading, strategic discipline is much more important than gut instinct or a momentary “feeling”.

c. Low Income Capital is Not an Obstacle: Andy Crypstocks’ Strategy for Asset Accumulation

According to Andy Crypstocks, success in the crypto world is not only measured by the amount of capital, but by strategy, momentum, and discipline. He emphasizes that even with a modest income, anyone can start building wealth through the accumulation of assets such as Bitcoin (BTC) and Ethereum (ETH), especially when the market is sluggish and not when prices are rising due to FOMO. He rejects the notion that small capital is not worth getting into crypto, and instead advises beginners to focus on gradual savings and measured investments based on time and opportunity.

For those who are under financial pressure, Andy suggests supplementing income through additional work and actively seeking opportunities from trending altcoins. According to him, a small capital such as Rp100,000 can still be the first step towards significant asset growth if managed consistently and dare to try. He emphasizes that crypto should be treated as a tool for long-term wealth accumulation, not a means of getting rich quick without a foundation.

d. From Rp3 Million to Rp3 Billion: Kevin Jonathan’s True Story in the Crypto World

In his interview on The Samuel Christ Show, Kevin Jonathan shares his incredible success story-turning around Rp3 million into Rp3 billion in just under two weeks. The story went viral as his portfolio increased by 20-30% in just one week, partly triggered by market momentum and media exposure. Kevin revealed that the key to his success was consistency in day trading since 2017, understanding market timing, and the use of risk management strategies such as stop-loss plus.

He also explains that his success is not just luck, but the result of time, experience, and the courage to enter when the market is experiencing a big drop. One of the pivotal moments was when he capitalized on a 90% drop in the price of a token and managed to use low leverage to make huge profits. With all transactions recorded on-chain, Kevin proves that a disciplined and objective approach can bring great results in the crypto world if taken seriously.

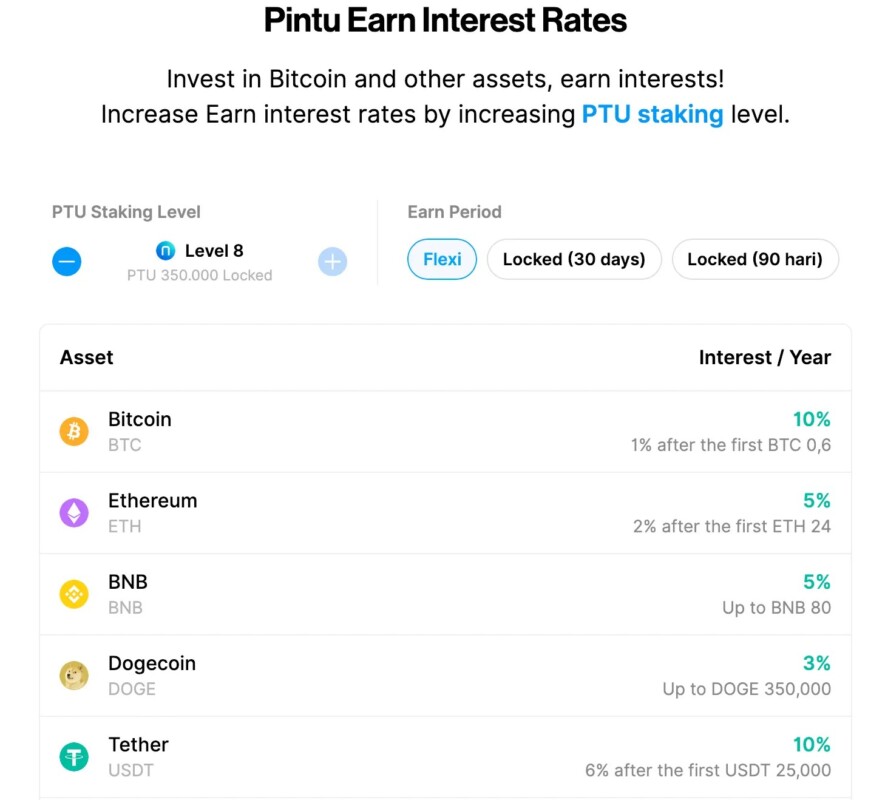

Passive Investing at the Pintu Earn

If you’re not an active trader, you can still earn without trading through the Pintu Earn feature, which is storing crypto and earning annualized interest (APY). Here are some simulations based on Pintu Earn Level 8 data:

| Crypto Assets | APY (%) | Savings | Potential Interest per Year |

|---|---|---|---|

| Bitcoin (BTC) | 10% | 0.1 BTC (~$183 million) | IDR 18.3 million/year |

| Ethereum (ETH) | 5% | 5 ETH (~Rp321 million) | IDR16 million/year |

| Dogecoin (DOGE) | 3% | 350,000 DOGE (~Rp1.1 million) | IDR33,800/year |

| Tether (USDT) | 10% | $10,000 (Rp166 million) | IDR 16.6 million/year |

Can You Live Only on Crypto?

The answer: you can, but it’s not easy and it’s not for everyone. If you don’t have a formal job and intend to live entirely off crypto, then you should:

- Strong knowledge in trading and investment.

- Be ready to face the risk of losing capital.

- Consistent research, evaluation, and adaptation of strategies.

- Able to split asset allocation for active and passive income.

Even for salaried workers, crypto can be a source of additional income through long-term investment strategies(DCA) and participation in staking platforms. However, to truly replace the main income, it requires time, capital, and high commitment.

In other words, living solely on crypto is possible, but not as easy as it may seem on social media. The journey to financial freedom from cryptocurrency is a long process that requires mental, financial readiness, and constantly updated education.

The Pintu app provides an Auto DCA feature that makes it easier for investors to implement this strategy. Using the Pintu app, investors can set up automatic Bitcoin purchases at specific time intervals, such as weekly or monthly. This allows investors to consistently accumulate Bitcoin without the need to constantly monitor the market or make complex investment decisions.

Also Read: Bitcoin Reserve Drop on Binance: A Bullish Signal for BTC Price in November 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Plasbit. Can You Make a Living Trading Crypto. Accessed on October 28, 2025

- Quora. Is it possible to make a living from crypto. Accessed on October 28, 2025

- CoinMetro. Passive Income in Crypto. Accessed on October 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.