Download Pintu App

Major Crypto Market Events to Keep an Eye on This Week

Jakarta, Pintu News – The cryptocurrency market experienced a significant drop as we entered December. Bitcoin (BTC) price dropped below $90,000, registering a 5% decline. Meanwhile, Ethereum (ETH) is trading below $2,900, also down around 5%.

This continued selling is due to the market slump triggered by the proposed 20% flat tax on crypto assets in Japan.

On the other hand, the People’s Bank of China (PBOC) emphasized that virtual assets cannot be considered to have the same legal status as fiat currencies. With the crypto market continuing to fall, let’s take a look at the various developments in the cryptocurrency world this week.

Cryptocurrency Events That Could Potentially Affect the Market This Week

This week, investors’ attention is on the speech of the US Federal Reserve Chairman, Jerome Powell. This speech will take place after the last Federal Open Market Committee (FOMC) meeting of the year. Investors are eager to know Powell’s views on economic conditions as well as the future direction of interest rates.

Read also: Altcoin Season Coming in 2026? Signs to Watch Out For

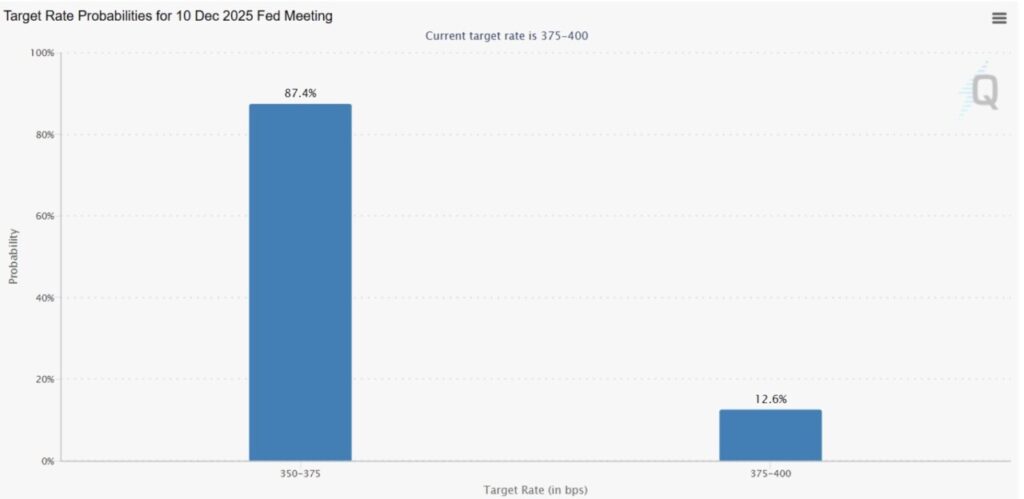

Although inflation is currently under control, the unemployment rate is still low. Many expect interest rates to be cut next week. The CME futures contract shows an 87% probability of a rate cut on December 10.

The week begins on Monday with Powell’s speech as well as the official announcement regarding the Fed’s termination of its quantitative tightening (QT) program.

This policy is a big change, especially for the cryptocurrency market. The end of QT could cause volatility, so investors will be watching for any signals regarding the Fed’s next move.

The crypto market is particularly sensitive to these kinds of policy changes, as stricter policies have previously had a negative impact on digital assets.

This week’s important economic reports begin with the ISM Manufacturing PMI data for November which will be released on Monday. This report provides an important snapshot of the performance of the US manufacturing industry.

Meanwhile, the JOLTS (Job Openings and Labor Turnover Survey) data for September, which was delayed, is scheduled to be released on Tuesday. This information will provide additional insight into labor market conditions.

Economic Data and its Impact on the Market

Wednesday is expected to be a busy day, with a number of important reports due for release. One of the key highlights is the nonfarm payroll employment data for November, which is an important indicator in assessing employment gains.

Read also: Analysts Predict Cardano (ADA) Price Potential to Increase 2,478% in 2026, How Can It Be?

In addition, the S&P Global Services PMI data for November as well as the Non-Manufacturing PMI from ISM will also be published. These reports provide a snapshot of the condition of the services sector, which is a crucial part of the overall economy.

On Thursday, preliminary data on weekly jobless claims will be released. This data provides an overview of the current unemployment situation in the US. In addition, the US trade balance will also be announced, which will help provide a broader context to the national economic conditions.

Friday will close the week with the Personal Consumption Expenditures (PCE) inflation report for September, which is one of the Fed’s preferred inflation indicators. Before that, the Michigan Consumer Sentiment Index for December will also be announced.

The focus this week is on labor market conditions, PMI data, and inflation trends. Volatility in the cryptocurrency market could increase, depending on the results of economic data and decisions from the Fed.

Meanwhile, former President Donald Trump has announced that he has selected a new candidate for the position of Federal Reserve Chairman. An official announcement in this regard is expected to be made in the near future.

With the start of December, global attention is on the Fed’s moves. The direction of economic data throughout this week is expected to determine how the year 2025 will close.

FAQ

What are the main causes of the recent Bitcoin and Ethereum price drops?

Bitcoin (BTC) and Ethereum (ETH) price drops were caused by Japan’s proposed 20% flat tax on cryptocurrencies and statements from the People’s Bank of China (PBOC) asserting that virtual assets cannot have legal status as fiat currencies.

What to expect from US Federal Reserve Chairman Jerome Powell’s speech this week?

From Jerome Powell’s speech, investors expect insight into current economic conditions and future interest rate projections. These speeches are very important as they can influence financial markets, including crypto markets.

What economic data will be released this week and how will it potentially affect the markets?

Data to be released include non-farm employment statistics, Services PMI data, and Non-Manufacturing PMI. This data is important as it can give an indication of the strength of the US economy and potentially influence the Federal Reserve’s monetary policy.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Top 5 Cryptocurrency Market Events to Watch This Week. Accessed on December 2, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.