Download Pintu App

5 Key Facts from the Bitcoin Spike Claimed to be a Fake Breakout

Jakarta, Pintu News – Here are 5 key facts from Bitcoin’s purported “fake breakout” surge

1. Bitcoin (BTC) Surges 5.7% – But Many Analysts Ask, Was It Just a “Fake Breakout”?

According to a report from Decrypt, the price of Bitcoin (BTC) rose 5.7% in a single day – the fifth best daily gain this year. But despite the significant surge, some analysts warned that the price quickly returned to its original range, raising suspicions that the move could be a “fake breakout”.

Because of this, some have concluded that while Bitcoin did “explode,” it’s uncertain whether it’s the start of a long-term uptrend.

Also Read: Ripple CEO’s Shocking Prediction: Bitcoin Will Break $180,000!

2. Fund Flows into Bitcoin ETFs Reach $58.5 Million – But Global Sentiment Fuels Uncertainty

Decrypt reports that Bitcoin-based ETFs recorded $58.5 million in fund inflows on the day of the surge, indicating institutional interest in the crypto asset. For example, BlackRock’s ETF (IBIT) is said to have seen a significant increase in inflows – this briefly lifted positive sentiment towards Bitcoin.

On the other hand, many analysts emphasize that global macroeconomic conditions – including monetary policy and interest rate uncertainties – could hold back the continuation of the rally, keeping the market on its toes.

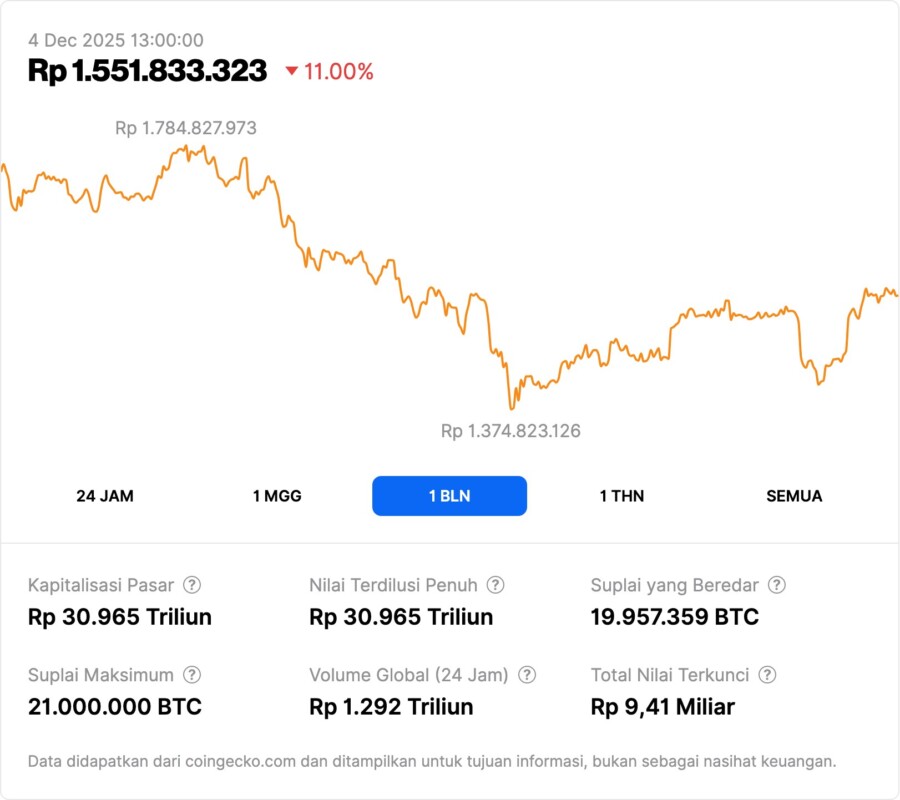

3. BTC price briefly touched USD 93,000 – but immediately “pulled the tip” to the support zone

During its bull session, Bitcoin briefly breached the USD 93,000 level, but the move was short-lived: the price soon retreated to the USD 90,000-91,000 support range.

This kind of movement structure – a quick rise, then a pullback – is similar to a pattern known as a “false breakout” in the crypto market, where a price breakout is not followed by confirmation of volume or stability.

Because of this pattern, analysts warn that the surge could be a trap for market participants who react quickly to price movements.

4. Dependence on External Factors and Monetary Policy Makes Momentum Prone to Faltering

Analysts highlight that the benchmark interest rate decision in the United States, as well as global economic conditions, are big factors determining whether the surge will persist or fade.

Crypto markets – including Bitcoin – are highly sensitive to monetary policy and institutional fund flows; global uncertainty can quickly flip market sentiment. Because of this, many think that the current price increase should be viewed with caution: not all spikes mean a long-term breakout.

5. The term “Fake Breakout” is a concern – Volume Mechanics and Price Confirmation Matter

The term “fake breakout” or “false breakout” refers to a price movement that appears to break through an important resistance, but is not followed by large volume or further confirmation – so the price returns to its previous range.

In the case of Bitcoin right now, despite the surge in volume coming in via the ETF, the quick backward price reaction shows that the market has yet to give full confirmation of the breakout.

As such, market watchers advise that metrics such as volume, price stability and macro sentiment be continuously monitored before confirming that a move is a legitimate breakout.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What does “fake breakout” mean in the context of Bitcoin?

A fake breakout is when the price of an asset appears to break through an important resistance level, but then returns to its original range – giving traders a false signal.

How big was the inflow of funds into Bitcoin ETFs during the surge?

According to Decrypt, fund inflows into Bitcoin ETFs amounted to $58.5 million on the day of the price surge.

Why is the BTC price surge questionable?

Because even though the price bounced, it immediately retreated to the support zone; the combination of market volatility and macro uncertainty led many analysts to assess that the surge could be temporary.

What external factors could potentially reverse the momentum?

Interest rate policy decisions, global economic conditions, as well as institutional fund flows are considered to be the deciding factors on whether the rally will continue or not.

Does it mean that ETF inflows guarantee a long-term breakout?

There are no guarantees: even if an ETF records inflows, breakouts are only considered valid if they are accompanied by large volumes and price stability – factors that some analysts say have not yet been met.

Reference

- Decrypt. Was the Bitcoin Jump a ‘Fake Breakout’? Accessed December 4, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.