Download Pintu App

BTC and ETH Are in the Green — Why Are Crypto Markets Up Today (12/8/25)?

Jakarta, Pintu News – The cryptocurrency market recorded modest gains in the past 24 hours, pushing up market capitalization and improving sentiment after bearish pressure. These gains were driven by increased interest in large assets such as Bitcoin (BTC), Ethereum (ETH), and Zcash (ZEC).

The positive movement occurred amidst global dynamics influenced by tight regulations and strategic moves by international crypto exchanges. This article summarizes the main driving factors, the direction of price movements, and the risks that still loom over the market.

Global Sentiment: Between China’s Crypto Ban and Binance’s Strategic Move

The crypto market received a positive boost despite a stern warning from China’s top financial industry association. The Chinese government reiterated a complete ban on all cryptocurrency activities, including trading of stablecoins and Real World Assets (RWA)-based tokens.

This policy is considered the most decisive action since 2021 and sends a clear signal regarding the tightening of regulations in the digital financial sector. As a result, market participants perceive that there are global risks that need to be anticipated even though this negative sentiment does not fully restrain price increases in the short term.

In contrast to China, the United Arab Emirates gave a positive signal through the Abu Dhabi regulator’s move to grant Binance a full license. The license covers exchange, clearing, custody and broker-dealer activities, making Binance the first international platform to operate with comprehensive regulatory oversight.

This decision is considered to strengthen the legitimacy of the crypto industry in the Middle East region and increase global investor confidence. The combination of these two developments shows a contrast in regulation, but in general the market responded more positively to the news from Abu Dhabi.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (8/12/25)

Crypto market capitalization bounces off psychological support

The total capitalization of the crypto market (TOTAL) increased by $69,000,000,000 or about Rp1,151,540,000,000,000,000 in one day, reaching the level of $3.08 trillion. This increase came after TOTAL bounced off the strong support level of $3.00 trillion, which has been the anchor of market stability.

This bounce shows that market participants maintain moderate optimism despite global pressures. This positive momentum opens the opportunity for TOTAL to test the next resistance.

If the psychological support holds, TOTAL has the potential to break $3.09 trillion and continue its move towards $3.16 trillion or around Rp52,625,600,000,000,000,000. The next target is at $3.21 trillion, reflecting the potential for strengthening if capital inflows continue to increase. This rise shows that interest in crypto assets is still strong, especially among institutional investors and large traders. However, this momentum remains dependent on the stability of market sentiment in the next few days.

Conversely, a weakening sentiment could trigger a drop back towards $2.93 trillion. This level is the lower limit that could potentially invalidate the bullish scenario. TOTAL’s fall below this level signals deeper pressure for most cryptocurrencies. Therefore, market capitalization movements remain an important indicator for short-term trend analysis.

Read also: Ethereum (ETH) at Critical Decision Threshold, Will it Go Up or Down?

Bitcoin (BTC) Gains Slightly but Still on a Downtrend

Bitcoin (BTC) price recorded a mild increase and was trading at $91,596 or equivalent to Rp1,525,055,360 at the time of writing. Despite the upward movement, BTC is still within the downtrend formed since late October and limits the potential for a rally higher. This situation indicates that the selling pressure has not completely disappeared from the market. The movement of BTC in the next few days will largely depend on the strength of investor support.

If buyers show strong interest again, Bitcoin (BTC) has the opportunity to reclaim the support level at $91,521. From that point, a potential rise towards $95,000 or around Rp1,582,700,000 becomes a short-term target if momentum continues to improve. The increase could be a sign of recovery after a long period of stagnation. However, the success of this scenario still requires additional positive catalysts from global markets.

On the other hand, if market conditions deteriorate again, BTC could drop towards support at $86,822. A drop below that level could trigger further pressure and invalidate the short-term bullish scenario. This situation is a major concern for market participants as BTC volatility often has a direct impact on other altcoins. This highlights the importance of BTC as an indicator of general sentiment in the crypto ecosystem.

Read also: PIPPIN Price Increase Reaches 150%, Will it Continue?

Zcash (ZEC) Leads Altcoin Rise

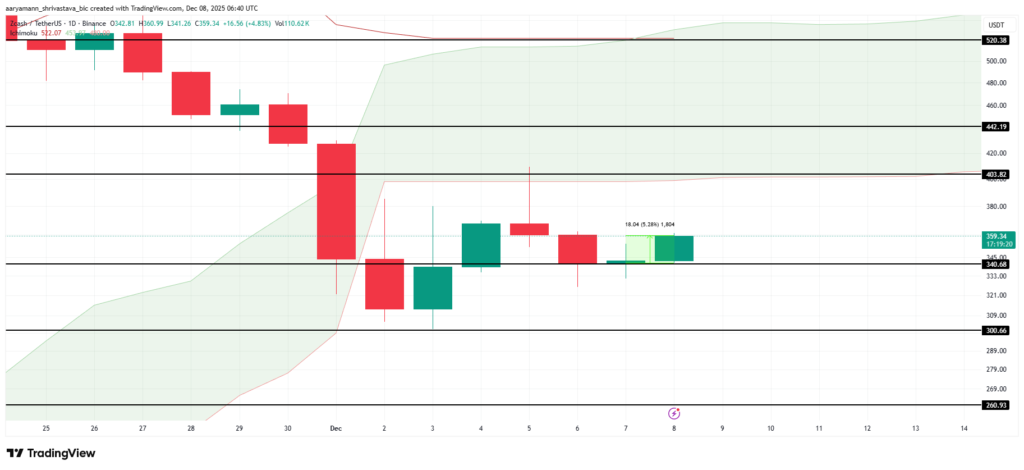

Zcash (ZEC) has been one of the altcoins that recorded the most significant gains in the last 24 hours with a 5% rally. The price of ZEC reached $359 or IDR5,979,940 after maintaining strong support at $340. This strengthening indicates a recovery after a sharp decline in recent weeks. This positive momentum is driving renewed interest in ZEC as one of the altcoins showing resilience amid market volatility.

To extend the upside, ZEC needs to break the resistance at $403 and turn it into a new support. If successful, the next target is at $442, which signals the potential for continued price strength. Technical indicators such as the Ichimoku Cloud are showing bullish signals indicating a chance of a longer uptrend. However, this movement remains dependent on the consistency of buying interest from investors.

Conversely, if the momentum weakens, ZEC could drop back down to the support levels at $340 and $300. A drop below $300 would invalidate the bullish scenario and open the possibility of a deeper correction towards $260. This scenario reflects the risks that market participants should anticipate in the uncertain market conditions.

Conclusion

The crypto market’s rise in the past 24 hours reflects a mix of global sentiment, technical bounces, as well as the strengthening of several key altcoins. Despite facing pressure from Chinese policies, pro-regulatory measures in Abu Dhabi and technical momentum gave the market a positive boost.

Bitcoin (BTC), total market capitalization, and altcoins such as Zcash (ZEC) show movements that need to be monitored to read the continued trend. With dynamic conditions, the cryptocurrency market remains in a crucial phase that could determine the direction of the next move.

FAQ

What are the main reasons the crypto market is up today?

The rise was driven by market capitalization bounce from psychological support and positive sentiment from Abu Dhabi regulation.

Why is China banning crypto activities again?

China reiterated its full ban on cryptocurrencies to tighten supervision of the digital financial sector.

What is the current state of Bitcoin (BTC)?

Bitcoin edged up to around $91,596 but is still moving in a downtrend since late October.

Why is Zcash (ZEC) leading the altcoin bull run?

ZEC rallied 5% after holding $340 support and showing bullish signals in technical indicators.

What are the key risks for the market in the near term?

A weakening of sentiment could push TOTAL below $3.00 trillion and trigger a decline in BTC and other altcoins.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Why Is The Crypto Market Up Today? Accessed on December 8, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.