Download Pintu App

Ethereum Climbs to $3,300 as Whale Activity Signals a Potential Breakout

Jakarta, Pintu News – The price of Ethereum (ETH) briefly traded around $3,105 on December 9, moving within a narrowing triangle pattern that has shaped the direction of movement since July. The market is now right at the apex of the pattern, and the next move is expected to be decisive.

Sellers are still actively pressuring the price along the downtrend line, while buyers continue to defend the long-term support level near the $3,000 mark. So, how will Ethereum price move today?

Ethereum Price Rises 5.81% in 24 Hours

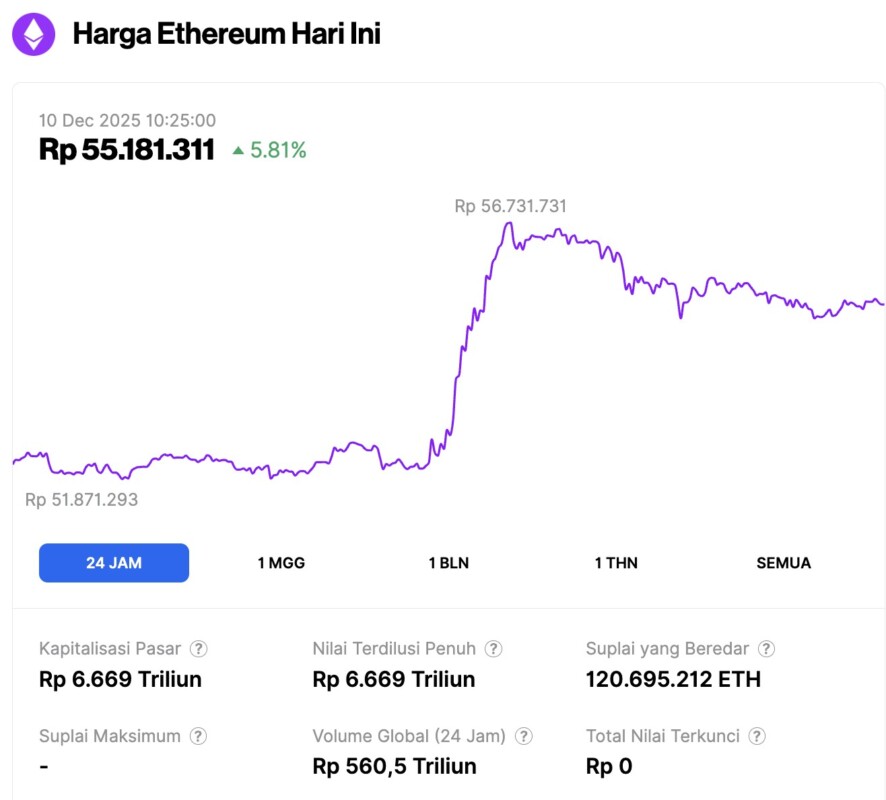

As of December 10, 2025, Ethereum was trading at approximately $3,306, or about IDR 55,181,311 — marking a 5.81% increase over the past 24 hours. During this time, ETH dipped to a low of IDR 51,871,293 and reached a high of IDR 56,731,731.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 6,669 trillion, while its 24-hour trading volume has surged by 36% to IDR 560.5 trillion.

Read also: Bitcoin Climbs to $92,000 as Analysts Anticipate Possible Holiday Rally

Whale Activity and ETF Fund Flows Change Ethereum Market Sentiment

A large whale who was short before the market crash on October 10 is now aggressively adding to his long position, and currently holds $218.18 million worth of Ethereum. His liquidity level stands at $2,117, giving him ample room to deal with market volatility.

Currently, the whale has an unrealized gain of $3.37 million – signaling medium- or long-term conviction, not just short-term speculative action. This behavior lifts market sentiment as the whale has also successfully predicted big moves before.

Moreover, the demand for Ethereum ETFs has also changed the course of the market narrative. The latest data shows an inflow of $35.5 million into ETH ETFs on December 8.

BlackRock alone bought $23.7 million worth of Ethereum. This is the largest daily inflow in over a week, and lends support to concerns that had been raised regarding Ethereum’s price drop earlier in the month.

Trendline Pressure Increases as Ethereum Price Consolidates Further

Ethereum price is still following the downward trend line formed since the price peak in September. Every time the price tries to break this line, it fails. Today’s resistance zone is in the range of $3,170-$3,200. Breaking this range will be the most important bullish trigger in the short term.

Read also: 3 popular US stocks highlighted by crypto analyst Ali Martinez, potentially soaring?

On the downside, the support area at $3,000-$3,030 continues to be a level that the market does not want to let go of. Every time the price drops to touch this area, there is quick buying, although the continuation of the uptrend tends to be weak. This suggests that buyers are still guarding the technical structure, but don’t have a strong enough push yet.

The apex of the triangle pattern is now just a few days away, and the market is expected to make a decision soon. If the price is able to break $3,200, momentum is expected to push the price towards $3,380 and then $3,510, where the 100 EMA is located. Conversely, in case of a drop, the next targets are at $2,950 and $2,820.

Ethereum’s Short-Term Price Action Shows Mixed Signals

On the 30-minute chart (9/12), Ethereum appears to be struggling to break through the Supertrend resistance at $3,147, with several failed attempts to build upside momentum. The Parabolic SAR indicator also turned bearish again, signaling a short-term loss of control on the part of buyers. This is in line with the broader theme of market indecision ahead of a major breakout.

However, the price structure has not been broken. Higher lows are still visible on the intraday chart, indicating that buyers are still active as the price declines.

These mixed technical signals reflect the consolidation state that the market is experiencing. For now, volatility is still low – but patterns like this are often a sign of big moves to come in the Ethereum price, especially ahead of important market events.

FAQ

What is Ethereum (ETH)?

Ethereum (ETH) is a blockchain platform that allows developers to build and run decentralized applications and smart contracts.

Why is the Ethereum price currently under pressure?

Ethereum’s price is currently under pressure due to the presence of a descending trendline that has directed price action since the September peak, with each rally to this line failing.

How much is the long Ethereum position held by the whale worth?

The whale currently holds a long Ethereum position worth $218,187,000 with a liquidation price of $2,117.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Ethereum Price Prediction: ETH Under Trendline Pressure as Whale Longs Hint at Breakout. Accessed on December 10, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.