Download Pintu App

Ondo and xStocks Ignite a Multichain Race for Tokenized Stocks in the World of DeFi

Jakarta, Pintu News – As the popularity of homogenized stocks grows, their adoption is increasingly being driven by decentralized platforms, while centralized exchanges risk being left behind.

Meanwhile, two leading platforms-Ondo Global Markets and xStocks-continue to expand their reach in the multichain ecosystem in a bid to compete for users’ attention.

Tokenized Shares Now Present on Many Blockchains

Throughout 2025, Ondo (ONDO) and xStocks continue to expand the reach of their stock tokens to various blockchain networks.

Read also: Bhutan Introduces ‘TER’ Digital Gold Token on Solana Blockchain

Backed Finance first launched xStocks on the Solana (SOL) network. Shortly after, xStocks also arrived on BNB Chain, Tron (TRX), and Ethereum (ETH), while integration to the TON network is currently under development.

Ondo Global Markets is not far behind. The platform debuted on Ethereum in September, then expanded to BNB Chain a month later.

Going forward, Ondo plans to bring more than 100 stocks and ETFs from the US in tokenized form to the Solana network as well as its own blockchain.

The Role of Decentralized Platforms

When centralized exchanges launch tokenized stocks, they tend to pick one blockchain network and stick with it. For example, all xStocks tokens traded on Kraken are issued on the Solana network. But more and more decentralized exchanges (DEXs) are now supporting stock tokens from Ondo and xStocks.

Whenever they launch on a new network, those stock tokens are usually quickly made available on the main DEXs of related ecosystems-such as PancakeSwap on BNB Chain or Jupiter on Solana.

However, the existence of a pool on DEX is not a guarantee that trading will always be possible.

While centralized exchanges usually work with institutional market makers to ensure adequate liquidity, on DEX, the use of automated market makers (AMMs) can cause the liquidity of homogenized stocks to become fragmented.

This is where the role of DEX aggregators becomes important.

For example, on Thursday, December 11, Bitget Wallet integrated Ondo Global Markets on the BNB Chain network, allowing users to access tokenized stocks through a single platform connected with PancakeSwap (CAKE), Uniswap (UNI), or other DEX liquidity sources.

DEX Domination Grows Stronger

In comments to CCN, Bitget Wallet’s CMO, Jamie Elkaleh, stated that decentralized and non-custodial platforms are “gaining ground” as interest in homogenized stocks grows.

According to Elkaleh, the appeal of this platform is not solely due to its ideology or technological sophistication, but rather its ease of access.

In contrast to centralized exchanges, DEXs give “users around the world direct access to tokenized stocks, without regional restrictions or custody requirements,” he explains.

Read also: Silver Price Has Set an All-Time Record High: What’s the Impact on Bitcoin?

This means that users in countries or regions where official exchanges cannot list tokenized stocks can still buy and trade these assets through non-custodial interfaces.

Elkaleh also emphasized that this change in user preference is closely related to the characteristics of the tokenized asset itself.

In a decentralized environment, tokenized shares can be moved across blockchains, integrated into DeFi protocols, and remain under the direct control of their owners – an advantage that custodial platforms lack.

This flexibility and portability, he adds, are the main reasons why non-custodial platforms are increasingly being adopted. However, this does not mean that centralized exchanges have lost relevance. Elkaleh admits that their infrastructure is still very important to reach new users and institutional participants.

Even so, the long-term direction of user behavior shows a steady shift towards non-custodial options. As he puts it, “decentralized access points are becoming an increasingly preferred place for users to store and interact with tokenized shares.”

Trading US Stock Tokens on the Door

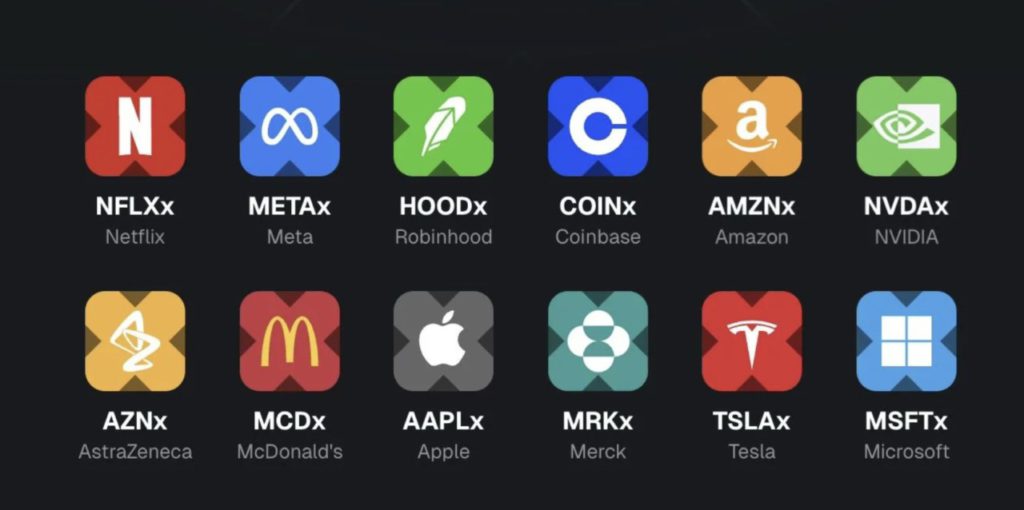

Imagine being able to buy shares of big companies like Nvidia (NVDAX), Tesla (TSLAX), and Amazon (AMZNX) in tokenized form for just a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks and Ondo at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Ondo and xStocks Spark a Multichain Race for Tokenized Stocks in DeFi. Accessed on December 12, 2025

*Featured Image: Bingx

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.