Download Pintu App

5 Factors for XRP’s Freefall While Bitcoin Investors Reap Profits

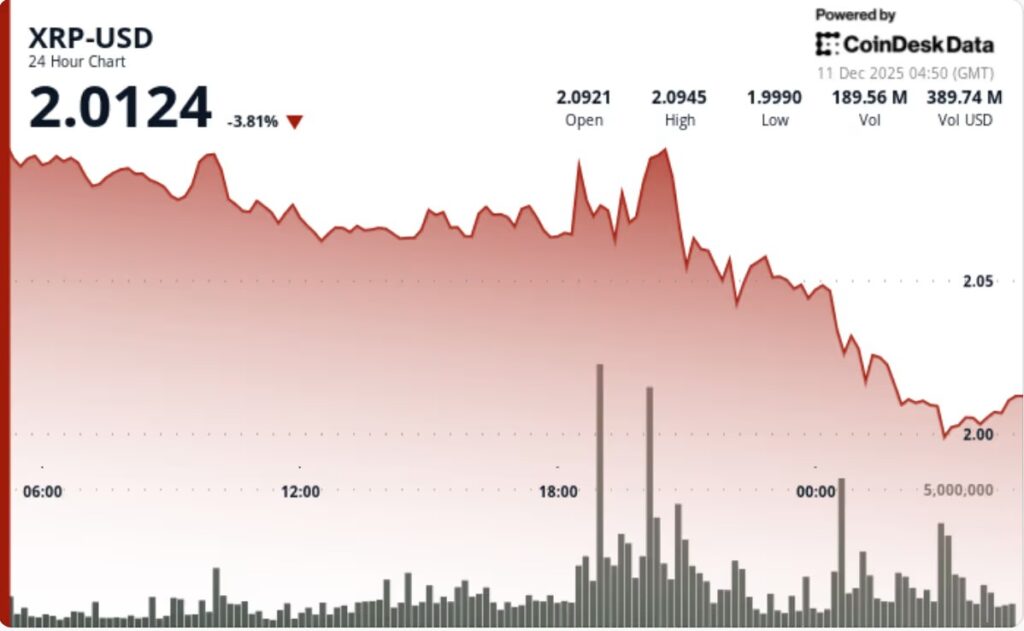

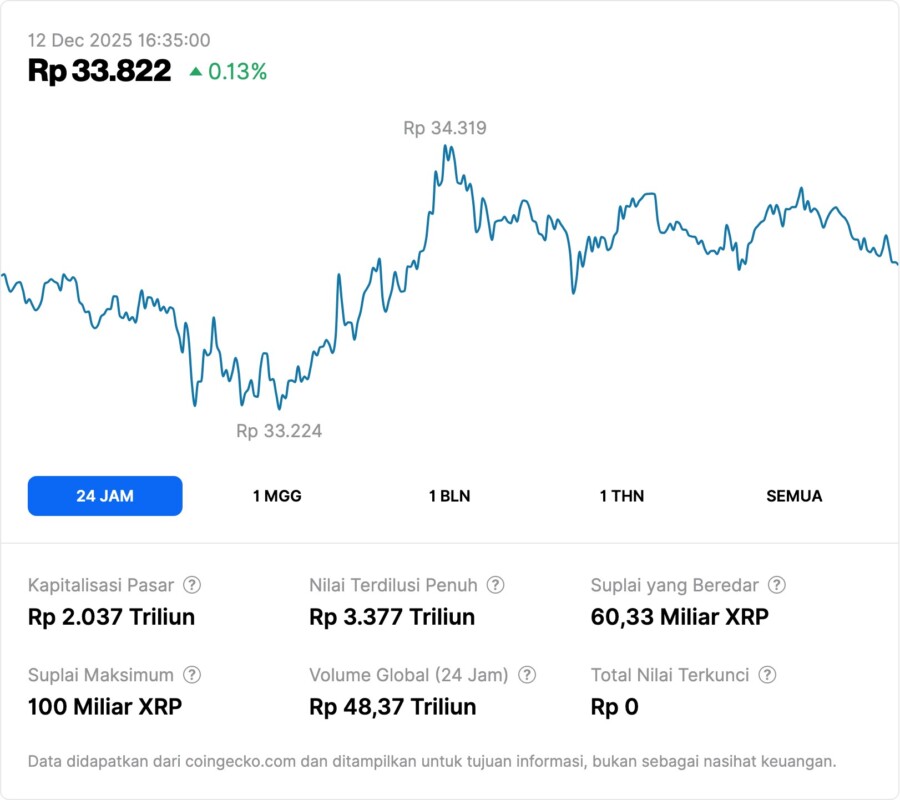

Jakarta, Pintu News – The cryptocurrency market is in turmoil again after Ripple (XRP) failed to maintain bullish momentum at the crucial resistance area of $2.09 to $2.10. According to a Coindesk report, a surge in institutional flows of more than 50% above the weekly trend was the main trigger for this major move, signaling strategic selling by large market participants.

On the other hand, Bitcoin (BTC) investors took advantage of the moment to realize profits, especially with ETF fund flows continuing to strengthen.

1. Strong rejection at $2.10 triggers XRP correction

Coindesk noted that XRP experienced a decline of about 4.3% from $2.09 to $2.00 in a single trading session, with daily volatility reaching 5.4%. Repeated rejections in the range of $2.08 to $2.10 reinforced this zone as an important resistance that XRP has not been able to break. The level became a volatility release point that triggered a structured sell-off.

Trading volume also jumped dramatically to 172.8 million at 19:00 UTC, an increase of 205% above the daily average. This increase in volume suggests there was significant institutional activity when the price hit the resistance area.

Also Read: 5 Strong Signals from Dogecoin: Price Resilience, New Adoptions, to Potential $1!

2. Institutional Flows Indicate Planned Selling

According to data cited by Coindesk, institutional flows surged more than 50% above the weekly trend. This surge indicates that institutional players used the short XRP rally to sell some of their positions, rather than getting caught up in the market panic. This shows that XRP’s decline was not caused by spontaneous negative sentiment, but by risk control strategies from large market participants.

Amidst the price pressure on XRP, funds are flowing towards ETF products, suggesting a rotation of capital from high-risk assets to instruments that are considered more stable.

3. Bitcoin Investors Profit Amid XRP Decline

Coindesk explains that Bitcoin traders took advantage of the market situation to realize profits, especially after BTC made gains in recent days. Strong ETF inflows tightened Bitcoin’s supply indirectly, allowing investors to benefit from the bullish momentum that occurred in the previous period.

The contrast between the movement of XRP and BTC shows that the market is experiencing divergence, where some assets are weakening while others are gaining support from institutional flows.

4. ETFs Tighten Supply, Affect Market Structure

ETFs continue to record significant inflows of funds, tightening the supply of underlying assets, especially Bitcoin. According to Coindesk, this ETF dynamic not only affects BTC but also creates an indirect impact on other assets such as XRP. As liquidity flows into ETFs, tightening supply can amplify market volatility more broadly.

In the context of XRP, the ETF effect that “works behind the scenes” is one of the drivers why the price was unable to break resistance despite showing recovery momentum.

5. End-of-Session Stability: Recovery Hope or Just Consolidation?

Coindesk reported that while XRP experienced a significant drop, prices began to show signs of stability late in the trading session. This indicates that the big sell-off may have subsided, making room for a potential short-term recovery.

However, crypto market volatility remains high, and without a decisive breakout above $2.10, bearish pressure could return to dominate. A recovery will only be confirmed if the price structure is able to move consistently above this resistance area.

Also Read: 5 Highlights of TRUMP Meme Coin’s $1 Million Game Campaign: New Strategy to Boost Token Value?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Ripple (XRP)?

Ripple (XRP) is a crypto asset used in the Ripple network to facilitate cross-currency transfers at low cost and high speed.

Why did XRP fail to break through the $2.10 resistance area?

According to Coindesk, repeated rejections in the $2.08-$2.10 area triggered high volatility and prompted strategic sell-offs by institutions.

What role do ETFs play in XRP’s price dynamics?

Strong fund flows into ETFs tighten the supply of Bitcoin and create capital rotation, affecting market sentiment towards other assets including XRP.

What are institutional flows?

Institutional flows refer to the buying or selling activities of large investors such as hedge funds, financial institutions, or whales, who often have more mature strategies than retail investors.

Does XRP have the potential to recover in the near future?

The price stabilization at the end of the session could open up recovery opportunities, but a bullish trend can only be established if XRP is able to break the strong resistance at $2.10.

Reference

- Coindesk. XRP Slides as Traders Take Bitcoin Profits With ETF Flows Still Strong. Accessed on December 11, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.