Download Pintu App

Bitcoin Slips to $89,000 — Is a Drop to $85,000 Coming Next?

Jakarta, Pintu News – Bitcoin (BTC) market sentiment further sank into extreme fear and greed this weekend. The upcoming interest rate decision from the Bank of Japan (BOJ) is the main factor behind this condition.

Then, how will the Bitcoin price move today?

Bitcoin Price Drops 0.99% in 24 Hours

As of December 15, 2025, Bitcoin was trading at $89,270, equivalent to around IDR 1,493,076,407 — marking a 0.99% decline over the past 24 hours. Within that time frame, BTC dipped to a low of IDR 1,463,685,170 and reached a high of IDR 1,508,444,232.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 29,696 trillion, while its 24-hour trading volume has dropped by 26% to IDR 679.33 trillion.

Read also: 3 Altcoins Poised to Benefit from the Fed’s Interest Rate Cut

Analysts Predict Bitcoin to Experience Significant Decline

Reporting from Coin Republic, markets are showing high tension, with many investors predicting a potential contagion of market turmoil if the BOJ decides to raise interest rates.

Analyst Michaël van de Poppe believes that Bitcoin price is likely to experience a significant drop as well as major liquidity movements this week.

The price of Bitcoin itself has experienced a sharp correction, from a high of over $94,000 on Wednesday to $89,270 at the time of writing. This bearish result suggests that investors may have started withdrawing their funds in anticipation of potential upcoming market disruptions.

The fact that the BOJ has been in the spotlight in the past two weeks raises questions regarding how much impact their decisions might have.

Bitcoin’s price impact could be limited if investors anticipate BOJ rate disruption

Bitcoin’s current price drop indicates that the possibility of an interest rate hike by the Bank of Japan (BOJ) may already be priced in by investors. This latest BTC price drop could be a signal that market participants are already moving before the official decision is announced.

In addition, the largest crypto asset has experienced significant price declines throughout the fourth quarter (Q4). Bitcoin’s current price is almost 30% lower than its highest level in October this year.

Long-term holders and institutional investors (smart money) have started unwinding their BTC positions in recent months. This suggests that the next downward pressure on prices may not be so deep.

While Van De Poppe expects the bearish trend to continue this week, it is interesting to note that the whales (large investors) are forecasting a different market direction.

Net flows from the whales were positive by more than $6 million this week – although this amount is relatively small on a broader market scale. However, they executed over $1 billion worth of long positions on the OKX and Binance Futures platforms, indicating bullish short-term expectations.

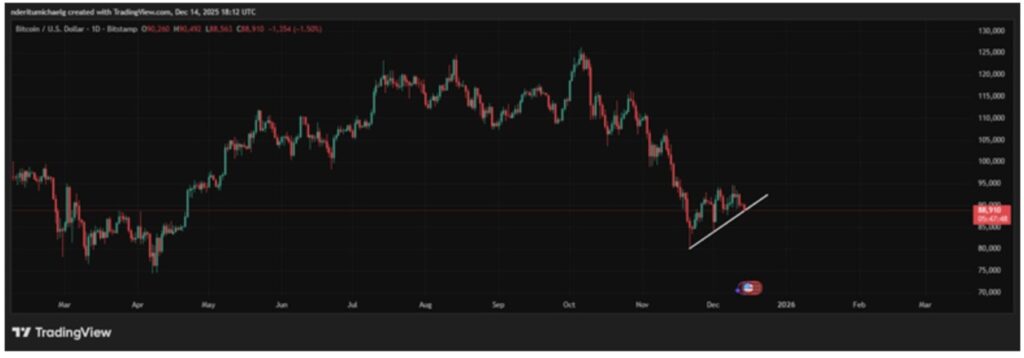

Currently, the price of BTC is also above the short-term rising support line, which increases the chances of an upward reversal. However, if the price breaks the rising support, then further downside potential could occur.

In this scenario, the price of BTC is expected to drop towards the $85,000 level, risking even a deeper fall to the support around $75,000.

Bitcoin Liquidation Profile Highlights the Maximum Pain Point in the Market

Bitcoin’s open interest rate remains relatively low. This is due to high market uncertainty, coupled with expectations that the Bank of Japan (BOJ) will cut interest rates.

Read also: Top 5 Cryptocurrencies Most Targeted by Short Sellers During Bear Markets

Nevertheless, the market continues to show great interest in derivative products. With volatility expectations rising, the likelihood of liquidation this week is expected to increase.

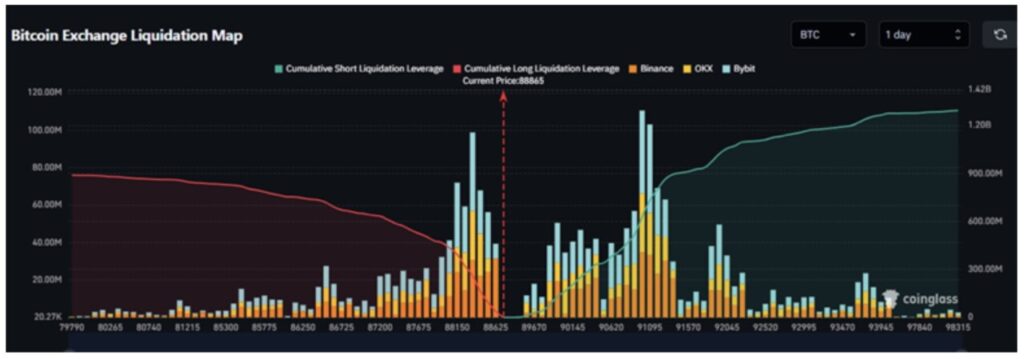

The liquidation map on exchanges shows that bearish expectations dominate over bullish ones. The $91,000 price is the largest short liquidation point for Bitcoin, with approximately $628 million worth of short positions at risk of liquidation at that level.

In contrast, the largest long liquidation point was around the price of $88,340, with a potential liquidation of approximately $262 million. On the downside, the total long leverage at risk around the $80,000 level was recorded at around $887 million.

Meanwhile, the total leverage of shorts that can be liquidated around the price of $95,000 amounts to about $1.28 billion.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinRepublic. Bitcoin Price May Fall To $85,000? Analyst Explains Why. Accessed on December 15, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.