Download Pintu App

Bitcoin & Altcoins Plummet: AI and Fed Leadership Change Shake Up Markets!

Jakarta, Pintu News – The crypto market has recently experienced a significant drop, triggered by various factors that have increased anxiety among investors. From speculation about the change of Federal Reserve chairman to concerns about bubbles in the artificial intelligence sector, various elements have contributed to the decline in Bitcoin (BTC) and Ethereum (ETH) prices. This has been exacerbated by increased leverage and massive liquidation in the market.

Market Dynamics and Their Impact on Crypto

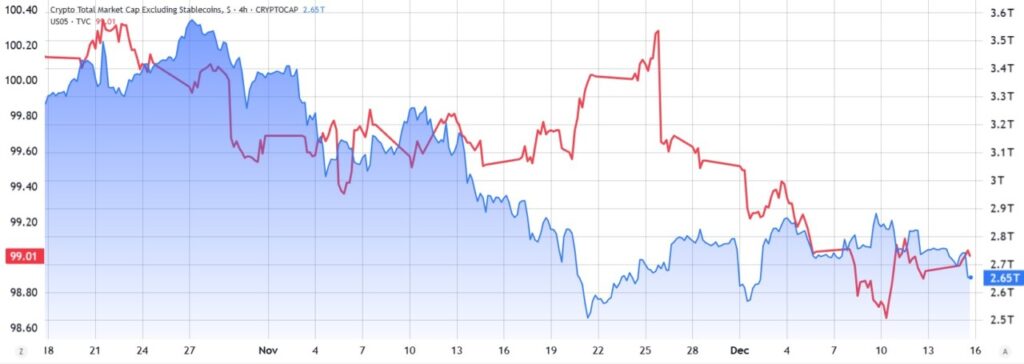

The crypto market is under immense pressure with Bitcoin (BTC) testing the $85,000 level again and Ethereum (ETH) dropping to $2,900. Deteriorating economic conditions in the United States and changing investor expectations for the next Federal Reserve chairman were some of the main factors.

Recent surveys show that economic conditions in the US are worsening, which increases caution among traders. In addition, tightening liquidity conditions and increased fiscal pressure following recent tax and spending packages have exacerbated the situation.

The Federal Reserve announced that it will start purchasing short-term Treasury bills worth about $40 billion per month as part of its technical reserve management operations to maintain sufficient liquidity, emphasizing this is not a quantitative easing policy.

Also Read: 7 Reasons Ripple (XRP) Prediction to Break $100 is the Global Crypto Talk

Consumer Sector Concerns and its Impact on the Market

The consumer sector is showing signs of weakness with 41% of Americans planning to reduce spending during the holidays this year, up from 35% in 2024. This is due to affordability concerns resulting from wage stagnation amidst rising prices.

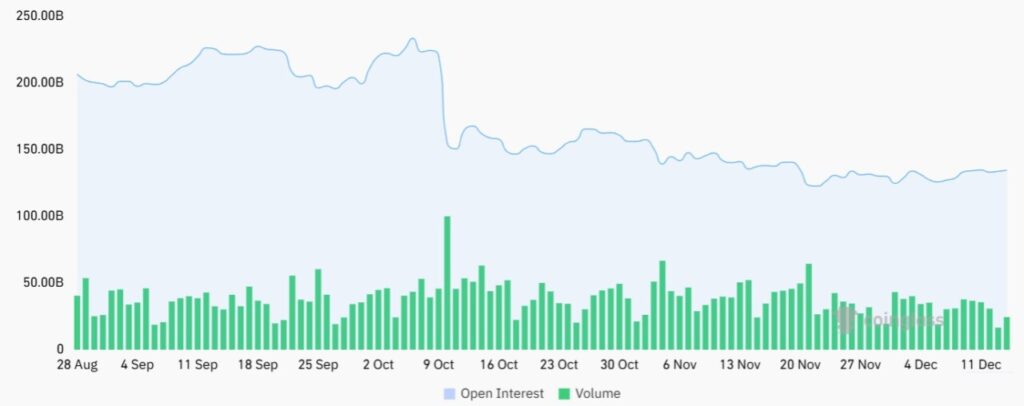

US retail sales data for October will be released alongside November’s nonfarm payrolls figures, which could provide more insight into economic conditions. At the same time, excessive leverage in the crypto market continues to be a big issue, with futures open interest reaching $135 billion.

More than $527 million of bullish leveraged positions have been liquidated in the past 24 hours, raising fears of further declines. This suggests that investors are increasingly cautious and choosing to increase their cash positions.

Implications for the Future of the Crypto Market

According to Bridgewater Associates, a leading hedge fund firm, technology companies that rely heavily on the debt market for funding AI investments have reached a dangerous stage. “It is likely that we will soon be in a bubble,” Greg Jensen, Bridgewater’s co-chief investment officer, wrote in a note.

This suggests potentially greater risks that the market may face going forward. In addition, the decline in the US stock market on Monday was also influenced by Kevin Hassett’s reduced chances of replacing Jerome Powell as the next Fed chairman.

The stability of the US Dollar Index (DXY) which found support at the 98 level after four consecutive weeks of decline, suggests higher confidence in the US government’s ability to avoid a recession. However, this is less supportive of the crypto market.

Conclusion

With various challenges facing the crypto market, from macroeconomic uncertainty to liquidity pressures, the future of Bitcoin (BTC), Ethereum (ETH), and other altcoins looks set to continue to be affected by global dynamics. Investors and traders should stay alert to the changes taking place in the financial markets to anticipate and adjust their strategies accordingly.

Also Read: Bitcoin Stuck Below $94,000: When Will Price Recovery Happen?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What caused the recent Bitcoin and Ethereum price drops?

A1: Bitcoin (BTC) and Ethereum (ETH) price declines are due to speculation of a change in Federal Reserve leadership, tight liquidity, and fears of bubbles in the artificial intelligence sector.

Q2: How many liquidations have occurred in the crypto market in the last 24 hours?

A2: Over $527 million of bullish leveraged positions have been liquidated in the crypto market in the last 24 hours.

Q3: What is the state of the consumer sector in the US and how will it affect the market?

A3: The consumer sector in the US showed weakness, with 41% of citizens planning to reduce holiday spending, which negatively impacted the market.

Q4: What is Bridgewater Associates’ warning about the tech and AI market?

A4: Bridgewater Associates warns that tech companies relying on debt markets for AI funding have reached a dangerous stage, which could trigger a bubble.

Q5: How does the stability of the US Dollar Index affect the crypto market?

A5: The stability of the US Dollar Index (DXY) finding support at the 98 level indicates higher confidence in the US government’s ability to avoid a recession, but is less supportive for crypto markets.

Reference

- Cointelegraph. Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets. Accessed on December 17, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.