Download Pintu App

Bitcoin Hits $88,000 as Holders See Profits Plunge

Jakarta, Pintu News – Bitcoin (BTC) has shown mixed price movements in recent sessions, characterized by sharp fluctuations and cautious recovery efforts. BTC briefly bounced back after a brief decline, but the momentum is still fragile.

One of the main concerns is the weakening of trust among influential groups within the Bitcoin ecosystem, which could complicate efforts to sustain a broader price recovery. So, how will Bitcoin price move today?

Bitcoin Price Rises 1.25% in 24 Hours

As of December 22, 2025, Bitcoin was trading at $88,625, equivalent to IDR 1,490,359,133, marking a 1.25% increase over the past 24 hours. During this period, BTC hit a low of IDR 1,468,195,409 and reached a high of IDR 1,495,896,836.

At the time of writing, Bitcoin’s market capitalization stands at approximately IDR 29,649 trillion, while 24-hour trading volume has surged 54% to around IDR 425 trillion.

Read also: 3 Altcoins that Crypto Whale is Eyeing for 2026, What Makes Them Interesting?

Bitcoin Holders Experience Declining Profits

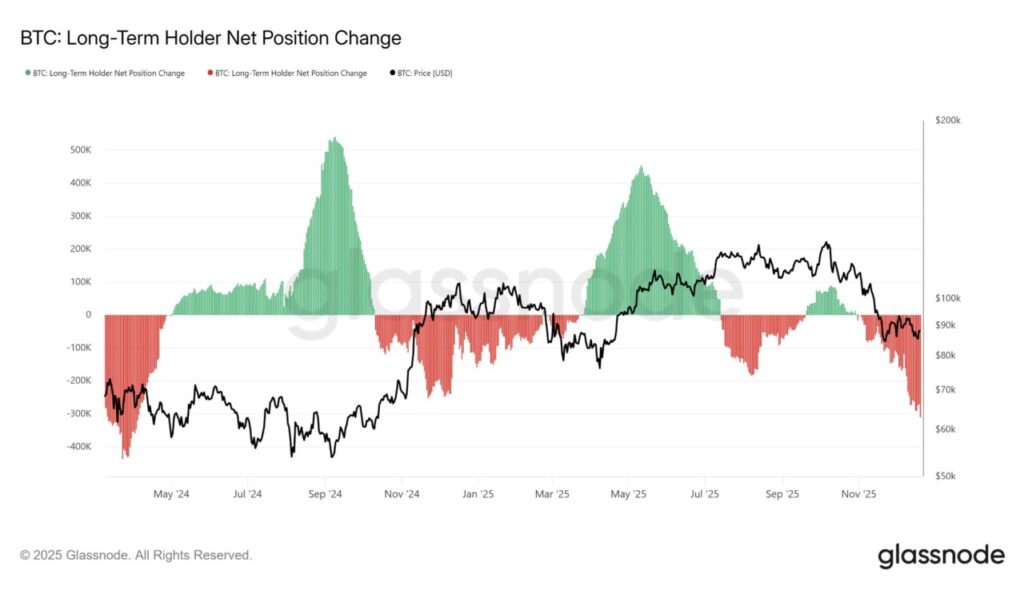

Bitcoin long-term holders have shown increased selling activity in recent days. On-chain data shows that the change in supply of long-term holders over the past 30 days has fallen to its lowest level in 20 months.

A similar level was last recorded in April 2024, signaling increasing distribution pressure.

This behavior indicates that long-term holders are starting to reduce their exposure to protect residual profits. As unrealized profits shrink, sell-offs tend to increase to avoid potential losses. This move usually weighs on the price recovery process, as supply increases without being matched by new demand growth.

Macro indicators provide additional context. The long-term holder net unrealized profit or loss (LTH NUPL) metric fell to a monthly low. This decline signals that profits among this group are dwindling, thus increasing sensitivity to potential further price declines.

Historically, falling LTH NUPL values often trigger a defensive sell-off. However, when this indicator drops deeper, the selling pressure usually starts to subside.

At those levels, long-term holders are likely to stop distributions, giving Bitcoin price room to stabilize and potentially recover if demand increases.

BTC Price Awaits Stronger Signals

Bitcoin briefly traded at around $87,900, still below the $88,210 resistance level. The asset bounced back after briefly dropping below the $86,247 support level. This recovery suggests that buyers are still active at the lower levels, although market conviction remains cautious.

Read also: 3 Altcoins That Have the Potential to Set New Records Before the End of 2025, What’s the Reason?

A short-term rise towards $90.308 is still possible. However, the resistance area around that level could limit the upside potential. With continued selling pressure from long-term holders, Bitcoin is likely to remain flat around the $88,201 zone while the market absorbs excess supply.

Upside potential could increase if long-term holders start to change their stance. A slowdown in selling activity could ease supply-side pressure.

In that scenario, Bitcoin has a chance to break above $90,308 and target $92,933. Such a move would invalidate the bearish outlook and signal a return of confidence among major market participants.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Critical Holders’ Profit Crashes To Monthly Low: Will Price Further Suffer? Accessed on December 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.