Download Pintu App

Ethereum Surges to $3,000 as Technical Indicators Confirm a Bullish Shift

Jakarta, Pintu News – Bitcoin (BTC) hit a pivotal point when Arthur Hayes moved more than $3 million from Ethereum (ETH) to the DeFi asset, signaling a tactical shift that has more to do with liquidity expectations than risk aversion sentiment.

On-chain data suggests a deliberate reallocation to yield-focused tokens amid ETH’s stagnation below resistance levels. This move highlights the broader market dynamics, where capital rotates within the crypto ecosystem, shaping the direction of short-term price movements for Bitcoin and altcoins.

Then, how will Ethereum price move today?

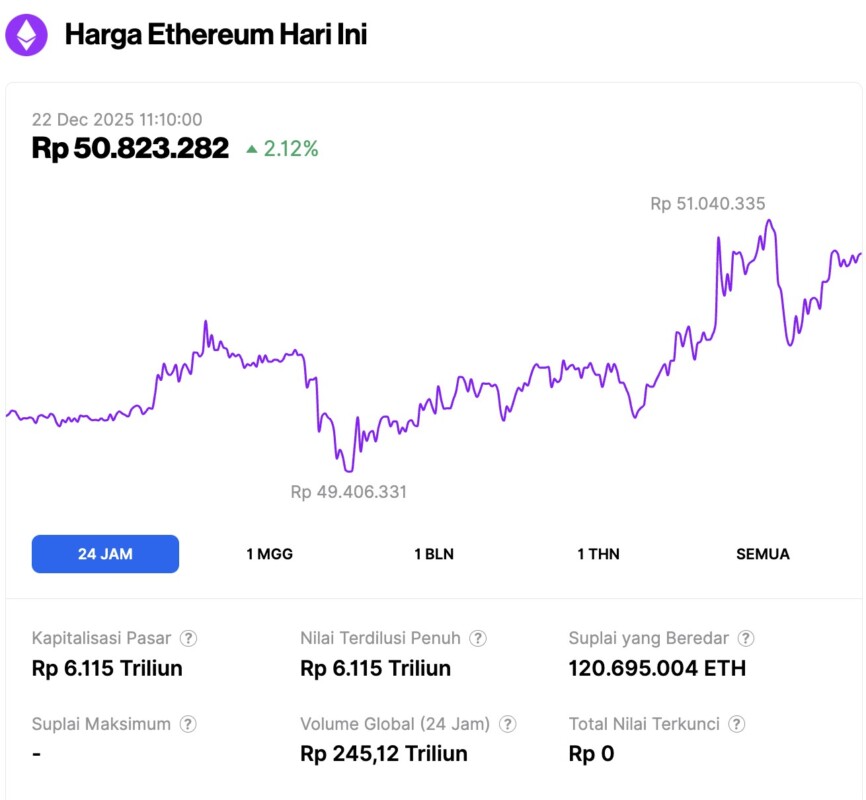

Ethereum Price Up 2.12% in 24 Hours

As of December 22, 2025, Ethereum was trading at approximately $3,021, equivalent to IDR 50,823,282, marking a 2.12% increase over the past 24 hours. During this period, ETH reached a low of IDR 49,406,331 and a high of IDR 51,040,335.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 6,115 trillion, while its daily trading volume has surged by 83% to IDR 245.12 trillion within the last 24 hours.

Read also: Bitcoin Hits $88,000 as Holders See Profits Plunge

Arthur Hayes Moves $3 Million from Ethereum to DeFi

Significant changes are taking place in Arthur Hayes’ portfolio, with on-chain data confirming an active shift away from Ethereum towards a select number of decentralized finance (DeFi) tokens.

The move follows Hayes’ public statement on December 20, when he highlighted improving global liquidity conditions and hinted at a tactical repositioning rather than an across-the-board risk reduction.

Data from Lookonchain shows that the move is not just symbolic. More than 1,100 ETH has been moved and reallocated, signaling a real change in strategy with millions of dollars in capital backing.

Ethereum Becomes a Funding Asset

Arthur Hayes is not abandoning Ethereum as a long-term asset. Instead, this rotation suggests that ETH is being used as a funding layer while capital is shifted to higher-beta opportunities in the DeFi sector.

Between December 19 and 20, Hayes transferred ETH to exchanges and market-making platforms, where the funds were immediately converted into exposure to DeFi tokens. The speed and magnitude of the transactions suggest a planned execution, rather than a mere portfolio trial or hedging strategy. This is important because it shows that Hayes is rotating within crypto risk, not out of it.

Focus on Ethena, Pendle, and ether.fi

The largest allocation went to Ethena (ENA), where Hayes added around 1.22 million tokens in a single session, increasing his total holdings to over 6 million ENA.

It also added positions in Pendle (PENDLE) and ether.fi (ETHFI), both related to yield tokenization and liquid restaking.

Read also: As the Crypto Market Fluctuates, These 4 Cryptos Are Catching Analysts’ Attention!

This combination of positions is in line with Hayes’ long-standing view that liquidity-sensitive protocols tend to excel during the initial phase of monetary policy easing.

Ethereum Price Prediction – Technical Signals Reinforce Shift

This rotation is also in line with Ethereum’s current technical condition. ETH is trading in a descending channel pattern on the 4-hour chart and has repeatedly failed to break through the $3,100-$3,150 resistance zone.

Momentum indicators show signs of stabilization instead of renewed strength, with the RSI in the neutral area and the price consolidating below the major moving averages.

In contrast, some DeFi tokens have managed to break the short-term downtrend or return above important EMAs, signaling strength relative to ETH. From a trader’s perspective, this divergence supports Hayes’ move to seek alpha in yield-based assets while Ethereum is still digesting its correction.

Rotation Signal for Traders

Hayes is positioning for relative outperformance, not making predictions of overall market direction. Ethereum retains an important structural role, but in the short term, capital seems to be leaning more towards protocols that directly monetize yield, liquidity, and on-chain activity.

On-chain data clearly confirms this movement. This is not just a narrative – it’s a capital movement that precedes a possible change in the direction of liquidity in the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Ethereum Price Prediction: Hayes Moves $3M as ETH Loses Momentum to DeFi. Accessed on December 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.