Download Pintu App

“Altcoin Season Isn’t Over Yet” – Why is 2026 Worth the Spotlight?

Jakarta, Pintu News – Expectations of an alt-season are on the rise again, with projections going as far back as 2026. But for now, Bitcoin (BTC) still holds the ultimate control over the crypto market.

Meanwhile, Arthur Hayes, co-founder of BitMEX, argues that the advantages of altcoins are never really lost – they’re just displaced.

As such, the question is no longer when the altseason will come, but where it has already begun.

2026 – The Year of Altcoin Revival?

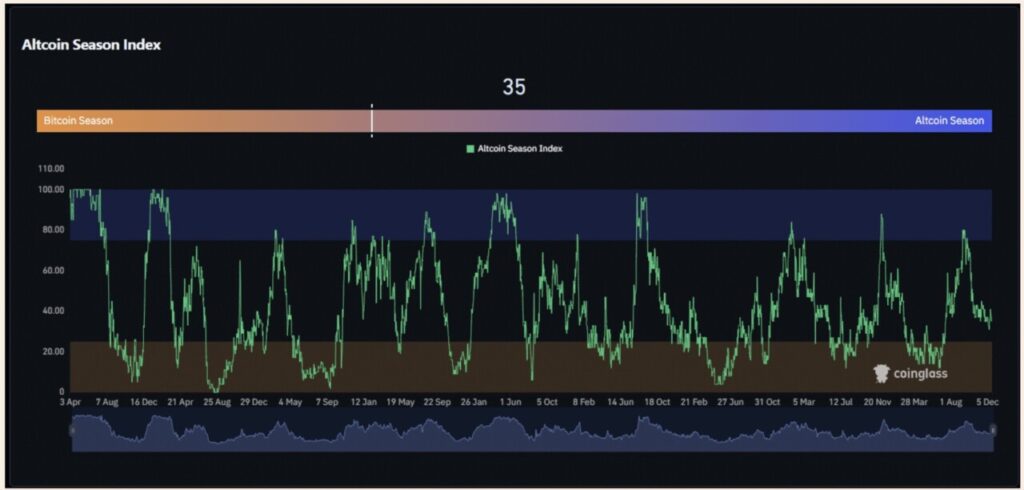

The crypto community is now starting to look ahead to next year with hope. The following chart shows why: major altcoin rallies took place in 2018 and 2021, which were then followed by long periods of weak performance.

Read also: Solana Price Depends on the Current SOL Holder, Here’s Why!

Currently, altcoins are back at long-term support levels against BTC, similar to the previous pre-altseason phase. However, instead of experiencing a breakout in the near future, many projections point to 2026 as the next big window for altcoins.

Technically, the chart does show the potential for an alt-season – but for now, the market is still calculating patience.

The caution is evident. At the time of writing, Bitcoin’s dominance has climbed back to around 59.6%, holding near recent highs instead of weakening. Capital is still heavily concentrated on BTC. On the other hand, the altcoin season index is at 35, well below the threshold that signals altcoin outperformance.

Altseason usually only begins when BTC dominance drops significantly and the altcoin season index holds at higher levels.

Industry experts expect altseason to happen next year, although their reasons vary. Historically, Ethereum (ETH) has always been the leader of altcoin rallies. This pattern could potentially repeat itself, especially with increased institutional activity.

For example, JPMorgan recently launched an on-chain fund on the Ethereum network, while stablecoin volumes have reached record highs.

These factors combined strengthen the argument for a potential Ethereum-led alt-season in 2026.

As Kevin Rusher, founder of RAAC, told the AMBCrypto page:

“Institutions and retail investors alike are looking for returns in the DeFi ecosystem that runs on the world’s computers. So, as we head towards 2026, investors can count on ETH alongside other big projects.”

Altseason is always there, but…

However, Arthur Hayes has a different take on the market. According to him, altcoin season is not one single moment that everyone is waiting for – but rather something that always happens somewhere in the crypto ecosystem.

Read also: Brazil Experiences Crypto Investment Boom, Up 43% Through 2025

The reason why many traders feel as though they have “missed the moment,” Hayes says, is because they are holding the wrong assets. In a recent podcast, he said:

“There’s always an altcoin season going on… and if you keep saying altcoin season hasn’t come yet, it’s because you don’t have an asset that’s going up.”

Hayes also warned against expecting the next cycle to be the same as the previous one, where tokens and old narratives dominate again. This time, the winners will be different.

“The altcoin season is already happening. You just didn’t participate in it.”

As examples, he cited Hyperliquid (HYPE), which soared from a single-digit launch price to huge gains, and Solana (SOL), which crashed in 2022 but then bounced back strongly.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. ‘Altcoin season isn’t gone’ – Why 2026 may be the year to watch. Accessed on December 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.