Download Pintu App

4 Altcoins Facing Crucial Events Ahead of Christmas: Ready to Soar or Plummet?

Jakarta, Pintu News – As the last week before Christmas approaches, crypto markets are bracing for a number of important events: several major altcoins will undergo governance votes and tokenomic changes that have the potential to significantly affect their long-term supply dynamics.

From the long-awaited activation of the Uniswap (UNI) fee switch to Hyperliquid’s (HYPE) planned billion-dollar token burn, the next few days will be crucial for many crypto ecosystems.

4 Major Altcoins with Important News This Week

Uniswap (UNI), Hyperliquid (HYPE), Aster (ASTER), and Huma Finance (HUMA) are each scheduled to undergo protocol level changes between December 22 to 25.

This puts token holders and validators in a central position to make important decisions towards the end of 2025.

Uniswap “Fee Switch” Voting Ahead of Christmas Deadline

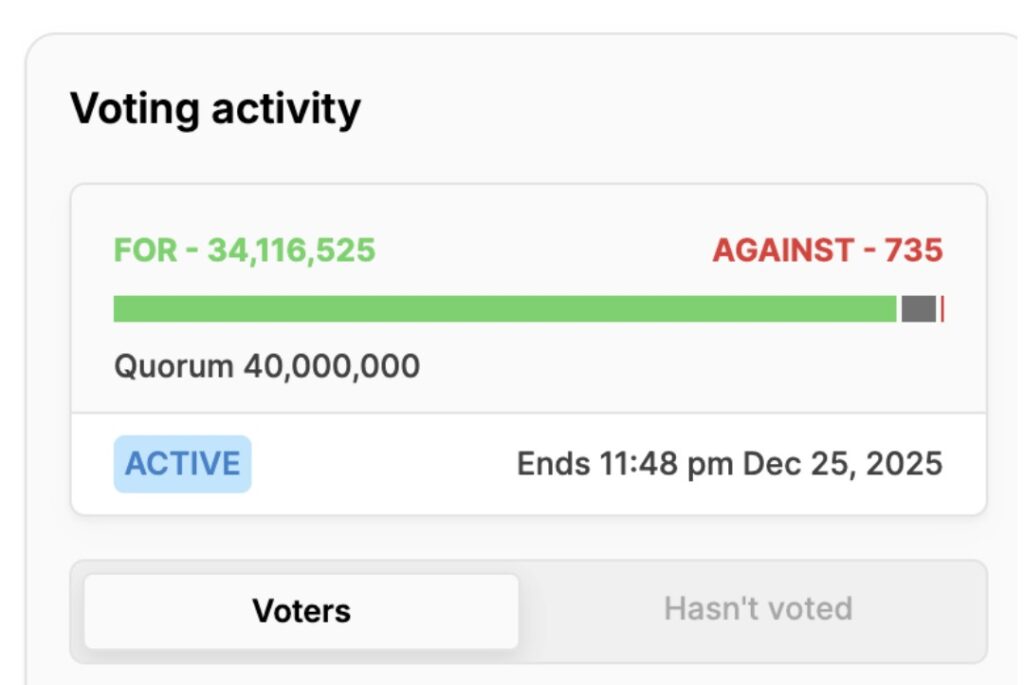

Voting for Uniswap’s UNIfication proposal will end on December 25, marking a possible end to the years-long debate over protocol fees and the value-sharing mechanism for UNI holders.

Read also: “Altcoin Season Isn’t Over” – Why is 2026 Worth the Spotlight?

Uniswap founder Hayden Adams has also confirmed that voting for the proposal has now officially begun.

The proposal, co-developed by Uniswap Labs and the Uniswap Foundation, aims to enable protocol fees across the ecosystem. In addition, the proposal includes the burning of 100 million UNI from the treasury, an amount that reflects the total tokens that would have been burned if protocol fees had been active since the beginning of the launch.

According to the proposal summary, a “For” vote means supporting the following measures:

- Enable Uniswap protocol fees and use them to burn UNI tokens.

- Directing the Unichain sequencer charge to the same combustion mechanism.

- Establish a Protocol Fee Discount Auctions (PFDA) system.

- Developed aggregator hooks for Uniswap v4.

- Burning 100 million UNI from the treasury.

- Refocused Uniswap Labs’ activities entirely on protocol development.

- Migrated the liquidity of governance-owned Unisocks to v4 on Unichain and burned its LP position.

The Uniswap Foundation expressed positive momentum ahead of the blockchain vote, stating:

“Last month, we put forward a governance proposal to enable protocol fees and align incentives across the Uniswap ecosystem… UNIfication has passed the snapshot stage with over 63 million votes in favor. Tomorrow, this proposal will proceed to the on-chain voting stage,” Uniswap wrote on platform X (Twitter).

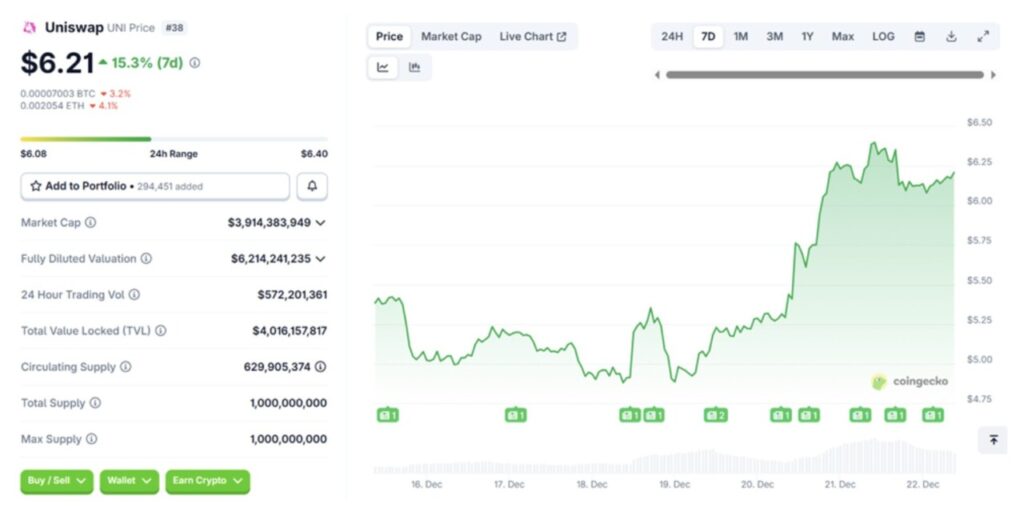

Amidst this situation, the UNI token surged by 30% on Sunday. At the time of writing, UNI is trading at $6.21, up more than 15% on December 22.

If approved, this proposal will enter a two-day lock-up period before execution, after which the token burning and fee switch activation process will take effect immediately.

Hyperliquid Validator Decides to Burn $1 Billion Worth of HYPE Tokens

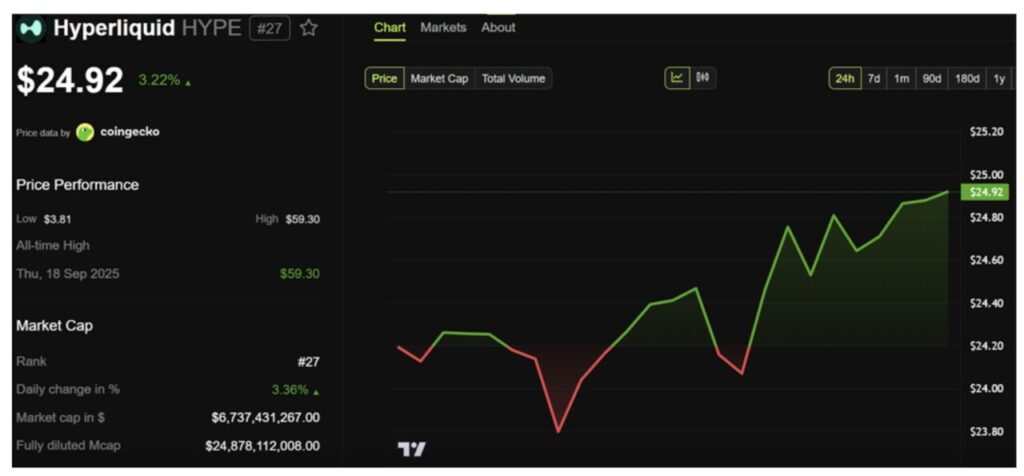

Hyperliquid’s governance process reaches its final frontier on December 24, when validators will complete a vote to officially recognize nearly $1 billion of HYPE tokens from the Assistance Fund as permanently burned. This move could remove more than 10% of HYPE from both the circulating supply and the overall total supply.

“Hyper Foundation proposes a validator vote to officially recognize HYPE in the Assistance Fund as burned, permanently removing the token from the circulating and total supply,” Hyper Foundation explained.

The Assistance Fund currently holds $998,965,886.59, most of which is in the form of spot holdings at protocol-controlled system addresses.

The tokens reside in a system address without a private key, making them mathematically inaccessible except through a hard fork. This vote aims to form a binding social consensus to never access these funds.

This proposal further strengthens Hyperliquid’s reputation as one of the high-growth crypto protocols with an unconventional approach – without venture capital funding and with revenues directly allocated to token buybacks.

Towards the last two days before the voting ended, the HYPE token was recorded trading at $24.92, up more than 3% on December 22, 2025.

Read also: AI Tokens Dominate Crypto Market-But Data Shows a Different Story

Aster Reduces Token Emissions and Launches New Rewards Program

On December 22, Aster (ASTER) will reduce its token emission while launching a new $12 million rewards program, named Crystal Weekly Drops.

“We are excited to launch the $12 million Crystal Weekly Drops – Aster’s newest weekly cash rewards program following Double Harvest,” Aster wrote.

Phase 1 of the program will run from December 22 to 28, with a prize distribution of up to $2 million in USDF, based on perpetual trading volume across the platform.

This emission rate adjustment signals Aster’s move towards tighter supply control, in an effort to balance user incentives with long-term sustainability.

Huma Finance Shares Vanguard Utility Badge with Staker

Huma Finance will conclude its run-up to the Christmas holidays on December 24, by distributing Huma Vanguard utility badges to eligible HUMA stakers.

In addition, Huma provided a short grace period for users who missed staking from the Season 2 airdrop, allowing them to re-qualify until December 21.

Overall, the concentration of events such as governance votes, token burns, emissions reductions, and staking incentives made this year’s pre-Christmas period one of the most active times in terms of altcoin tokenism.

While the price reaction in the short term remains uncertain, decisions taken in the next few days could shape the supply curve, incentive model, and development direction of the protocol through 2026.

This makes UNI, HYPE, ASTER, and HUMA assets that are highly watched by the market towards the close of 2025.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 4 Altcoins Face Critical Events Before Christmas: UNI, HYPE, ASTER, and HUMA. Accessed on December 24, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.