Download Pintu App

7 Highlights of XRP December 2025 Price Analysis: Resistance, $2 Level & Crypto Market Volume

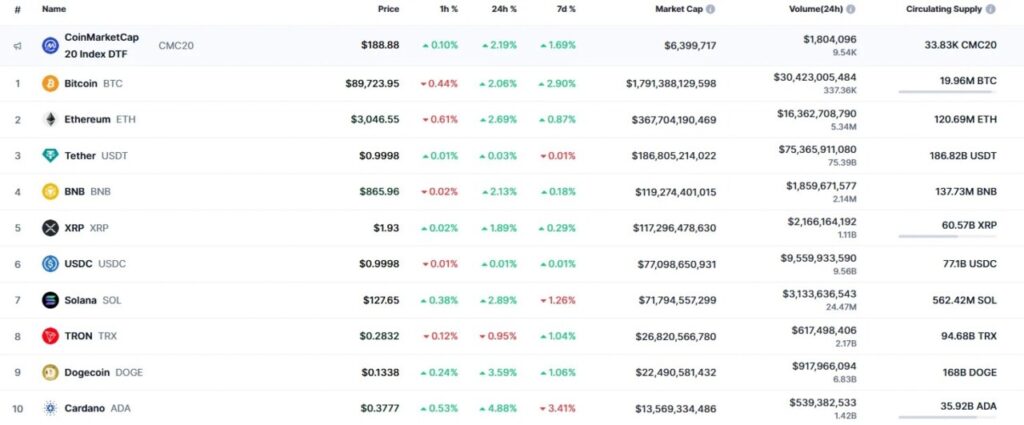

Jakarta, Pintu News – Price analysis of XRP (XRP) cryptocurrency for December 22, 2025 shows technical dynamics depicting a moderate rise in the past 24 hours, but the market is still facing important resistance levels around $1.95-$2.00.

The latest data from the price chart shows that short-term momentum could continue to test this important area, but volume is still low, signaling a lack of major market forces for a sharp move. This information is based on price analysis reports published by U.Today and estimated data available from several market sources.

1. XRP Recent Price Movements

The price of XRP rose about 1.89 % in the last 24 hours according to the analyzed chart, with the price near the local resistance of $1.9493 at the time of analysis. This increase shows the strength of short-term buyers, but the market is still unable to overcome the psychological level of $2.00.

This moderate movement refers to strengthening relative to the previous day, but not enough to break the higher technical levels in the daily time frame. Monitoring this resistance area is important as it will determine the next move.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Key Resistance at $1.95-$2.00

Price analysis suggests that a daily candle close above around $1.9491 would be considered a technical signal that opens up the opportunity for a test of the $2.00 zone. If this resistance is successfully broken with sufficient volume, XRP could register a further technical move.

However, as of this weekend’s deadline, the market is still below that level, so further upside movement will require clear breakout confirmation in the next few sessions.

3. Low Market Volume

In the larger time frame, XRP’s market volume is relatively low, which suggests that there is no dominant buyer or seller force strong enough to drive a significant breakout. Low volume often puts pressure on price consolidation rather than extreme movements.

This reflects that despite the slight increase in prices, overall market participation has not been strong enough to generate high price volatility in the short term.

4. Broader Crypto Market Sentiment Context

In the context of the broader cryptocurrency market, XRP tends to follow the movements of large assets such as Bitcoin (BTC) and Ethereum (ETH), especially when market sentiment strengthens or weakens. Capital rotation into assets with stronger fundamental narratives may limit XRP’s upside in the short term.

The lack of new catalysts such as ETF news, regulatory developments, or major partnerships are also factors that are holding back XRP’s upward price momentum.

5. Short-term Technical Analysis

Some price prediction models suggest that XRP may move in a narrow range around $1.89 to $1.97 in the coming days, in line with short-term consolidation and support-resistance conditions. These forecasts are supported by some technical projections that consider the trend of the last 7-29 days.

The range is also consistent with the daily price predictions from the AI model and the short-term price predictions that indicate the likelihood of prices remaining stable below $2.00.

6. Technical Response to Breakout Confirmation

If the price closes above this key daily resistance, it could give an early signal that short-term bullish momentum is picking up. But without a strong external catalyst, the market is likely to experience a further period of consolidation around this level.

A close below this level again signals that selling pressure is still present, keeping XRP in a sideways phase until technical momentum changes.

7. Short-term Volatility Prognosis

With low volume and price testing important resistance, short-term volatility is expected to remain moderate. XRP may move in a narrow range until a fundamental or technical event drives volumes higher.

Traders often watch for breakouts above $1.95-$2.00 to signal further strength, whereas failing to break out of this area tends to extend the sideways momentum.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What level was XRP trading at on December 22, 2025?

XRP was trading around $1.9292 at the time of the price analysis.

What are the key technical levels to watch out for?

Important resistance levels are around $1.9491 to $2.00; a close above these could signal a continuation of the short-term uptrend.

Why is the volume considered low?

The relatively low market volume indicates that neither buyers nor sellers have yet demonstrated enough dominant power to trigger high volatility.

What are the fundamental factors affecting today’s price?

The lack of new positive catalysts such as ETF news or major partnerships also held back XRP’s upward price momentum.

What role does broader market sentiment play in XRP price movements?

Market sentiment towards Bitcoin and other major altcoins affects XRP, especially as market capital moves to assets with stronger momentum.

Reference:

Denys Serhiichuk/U.Today. XRP Price Analysis for December 22. Accessed on December 22, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.