Download Pintu App

7 Shiba Inu (SHIB) Crypto Facts: Binance Traders Now Net Long 62.3% & Critical Price Area

Jakarta, Pintu News – The latest data from Binance exchange shows that top traders are now net long on Shiba Inu (SHIB), a meme-grade cryptocurrency, with the long percentage reaching around 62.3% compared to short 37.0% among large accounts.

This indicator recorded from the position data reported and analyzed in the report by crypto news U.Today shows the relative preference of large market participants towards the upward direction of SHIB prices in the near term despite moderate exposure. SHIB’s price movements and position structure provide a snapshot of the latest derivatives market dynamics for the meme asset on Binance.

1. Binance Trader Positioning Data Shows Long Bias

Position data from Binance shows that among top traders’ accounts, the percentage of long positions stands at 62.3%, while shorts stand at 37.0%, resulting in a long/short ratio of around 1.65. This ratio reflects that the majority of large traders are going long, signaling a bullish preference relative to SHIB.

When looking atopen positions, the record was even stronger at 67.9% long versus 32.1% short, with a ratio of 2.12, indicating the dominance of long positions on SHIB derivative contracts.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Difference Between Positional Bias & Real Exposure

Although the data showed a bullish bias, the actual market exposure to SHIB remained relatively low, meaning that although more large accounts opted for long positions, the volume and position size were not as extensive as the extreme bullish trend. This suggests that large market participants are cautious in their risk-taking on SHIB.

Such positions are often understood as options against potential price reversals in the context of the general volatility of the crypto market, rather than as a strong indication that an uptrend is already underway.

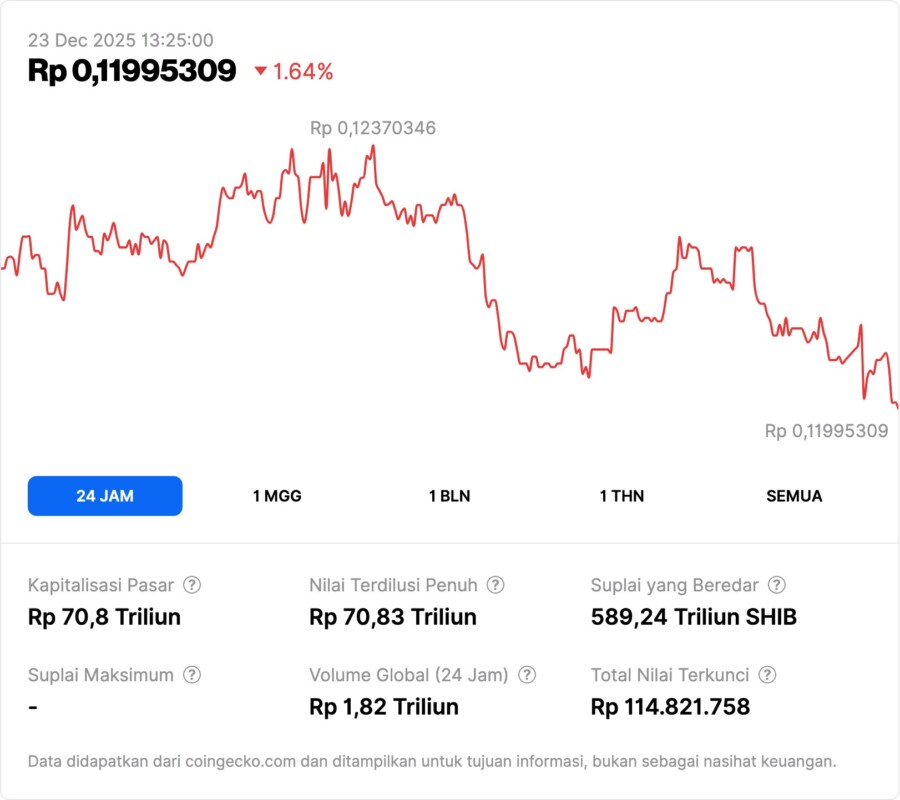

3. Current SHIB Price on Binance

The spot price of SHIB against USDT on Binance was trading around $0.0000073 when this data was released, showing a small increase but not a significant breakout from previous levels. This market price data provides actual context to the derivative positions reported by large traders.

The so-called critical zone is around $0.0000072 as the main support level, and the initial resistance is around $0.0000076 as the point that must be broken to confirm further technical momentum.

4. Price Dynamics: Base Building Vs Clear Trend

SHIB’s price movement has previously shown fluctuations between a top around $0.0000078 and a bottom at $0.0000070, which looks like a base building or inventory balancing phase rather than a consistent upward trend. This kind of market condition is often encountered when large traders are waiting for technical confirmation or broader market sentiment to strengthen.

This phase illustrates how the crypto meme market can experience price consolidation without major spikes in volume or volatility.

5. Technical Levels to Observe

Large traders seem to be monitoring whether SHIB price can hold above the key support area at $0.0000072 and break through the resistance at $0.0000076; this level is considered a point that could possibly trigger a change in position structure if price does cross it.

If the support level fails to hold, the long bias on large accounts could potentially disappear quickly as the ratio of such positions is relatively flat and easily reversed.

6. Role of Derivatives & Liquidity in SHIB Market

Derivative positions such as longs and shorts reflect speculative expectations of SHIB price volatility, which can impact market liquidity if large volumes become active in spot trading. Especially on Binance, this position data is an early indicator of the sentiment of large market participants.

Derivative movements are also often used to measure liquidity risk in the event of a large stop-loss or chain liquidation in volatile crypto markets.

7. Crypto Meme Market Context

Crypto meme markets like SHIB often move with the liquidity and sentiment of small retail and institutional traders, while important technical levels become the focus in determining short-term direction. Data on long positions on Binance provides context that large players are focused on potential rebalancing or price reversals, not just aggressive uptrends.

This dynamic contrasts with stronger price trends in crypto assets with larger fundamentals such as Bitcoin (BTC) or Ethereum (ETH), which typically exhibit more directional volatility.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What does the 62.3% net long position on Binance mean?

A net long position of 62.3% means that the majority of large trader accounts on Binance are long SHIB rather than short, reflecting a bullish sentiment relative to short-term price direction.TradingView

What is the long/short ratio of 2.12 by open positions?

The long/short ratio on open positions of 2.12 means that among active contracts, there are more than double the number of long positions than shorts, indicating the dominance of the bullish direction at the time.

What is the current price of SHIB according to Binance data?

SHIB was trading around $0.0000073 against USDT on Binance when this report was compiled.

What price levels to watch for SHIB?

Important levels to watch are support around $0.0000072 and resistance around $0.0000076 as key technical zones.

Does this long bias mean the uptrend is strong?

The long bias in derivative positions indicates a relative bullish preference, but does not immediately indicate a strong uptrend without confirmation of a price breakout in the technical zone.

Reference:

Gamza Khanzadaev/U.Today. Top Binance Traders Flip Bullish on Shiba Inu (SHIB): What’s Going On? Accessed December 22, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.