Download Pintu App

Christmas Cheer or Crypto Fear? Three Altcoins May Face Heavy Liquidations This Holiday Season

Jakarta, Pintu News – Several altcoins are facing an increased risk of liquidation during the Christmas and new year week of 2026. The liquidation heatmap showed a clear imbalance, while Open Interest increased sharply.

Which altcoins are risky, and what factors do investors need to consider when holding Long or Short positions? The following analysis from the BeInCrypto page explains the details.

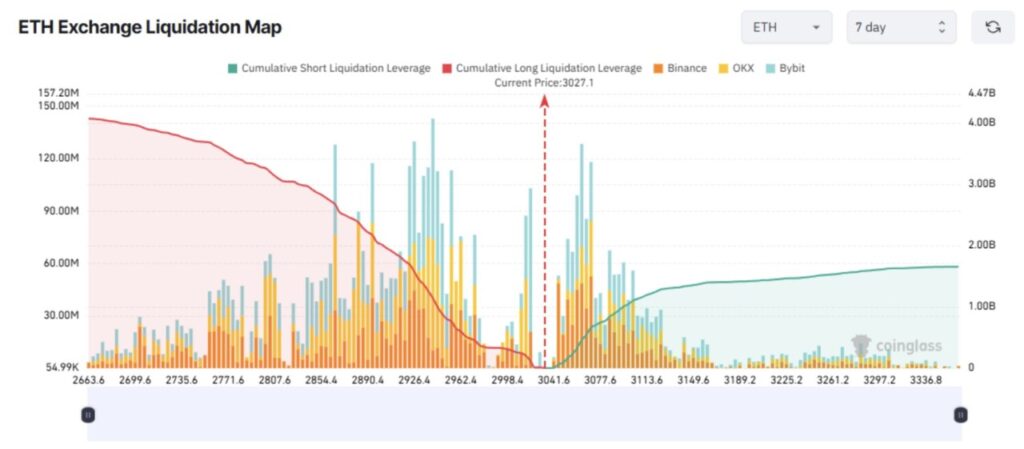

Ethereum (ETH)

The 7-day Ethereum (ETH) liquidation heatmap shows that the potential for liquidation of Long positions is much greater than that of Short positions.

Read also: Vitalik Buterin Calls Prediction Markets the Antidote to Social Media, What’s the Reason?

If the ETH price drops to the $2,660 range during the Christmas week, the total liquidation of Long positions could exceed $4 billion. Conversely, the total liquidation of Short positions is expected to reach around $1.65 billion if the ETH price rises to $3,370.

Factors that Long traders need to monitor to reduce risk:

- Arthur Hayes recently transferred 508.6 ETH (approximately $1.5 million) to Galaxy Digital. This move sparked speculation that he may be reducing his exposure to Ethereum.

- The Ethereum Coinbase Premium Index turned negative in the third week of December. If selling pressure from Coinbase increases, ETH prices could potentially continue to weaken in the coming days.

- Outflows from ETH ETFs reached $643.9 million last week, reflecting increasing selling pressure in the overall market.

If these factors become stronger, it could trigger a sharp bearish scenario, potentially leading to massive liquidation among long traders.

Midnight (NIGHT)

Midnight (NIGHT) has recently attracted great attention from traders. Open Interest jumped from $15 million to over $90 million in just two weeks.

The liquidation data shows that most traders expect the price of NIGHT to continue rising. As a result, traders who take bullish positions risk incurring greater losses due to increased capital usage and leverage.

Cardanians, the company that operates the Cardano stake pool, reported that NIGHT’s daily trading volume now stands at $6.8 billion – higher than the combined volumes of Solana (SOL), XRP (XRP), and BNB (BNB).

Despite the sharp increase in trading activity, NIGHT recorded its first red daily candle today after seven consecutive days of gains. This signaled increasing selling pressure.

In addition, Plutus investors, citing data from DexHunter, stated that 100% of NIGHT holders are currently in a profit position. This means that they could potentially engage in profit-taking at any time.

These signals are a warning that profit-taking selling pressure on NIGHT could increase this week. The liquidation heatmap shows that if NIGHT’s price drops to $0.077, the total liquidation of long positions could reach $15 million.

Read also: Cardano’s Midnight Token Breaks New Record High After 50% Rally

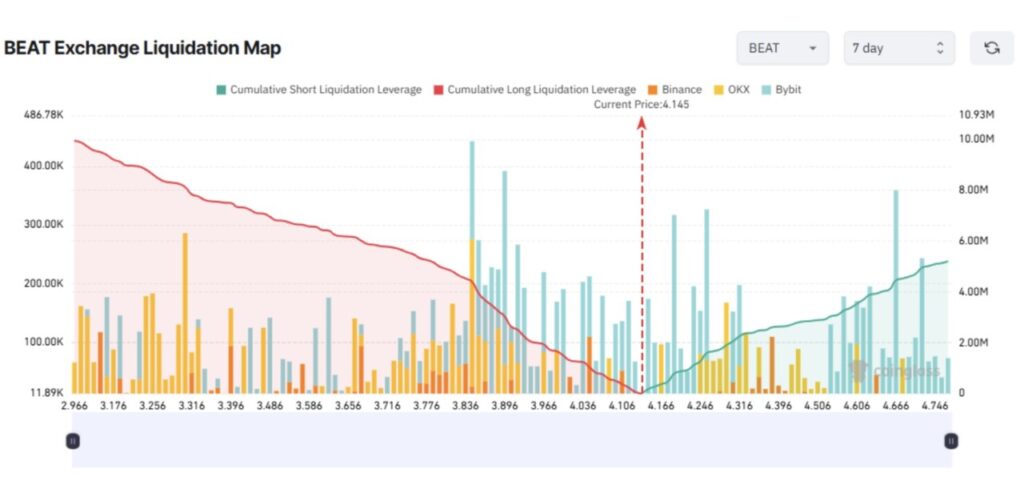

Audiera (BEAT)

A recent report from the BeInCrypto website revealed that BEAT has surged more than 5,000% since its launch in November, reaching an all-time high price of $4.99.

However, many traders still seem unsatisfied and continue to expect further gains. This sentiment can be seen in the liquidation data, where the potential for Long liquidation is much greater than Short.

Some traders are expressing concerns over possible price manipulation, which is reminiscent of Bitlight’s (LIGHT) 75% crash. Some indications that support such concerns include:

- BEAT’s price dropped 30% in one hour, then jumped 50% in just one minute. These extreme fluctuations could be a sign of manipulation by large wallets.

- Audiera’s official website is inaccessible, and the project’s official account on X (Twitter) has not updated its posts other than the announcement that BEAT became the “top gainer”.

- Market data platform CoinAnk has issued a warning about the risk of liquidation.

CoinAnk states:

“Under negative funding rate conditions, even if the cost of holding Short positions remains low, extreme volatility on $BEAT could easily trigger chain liquidation – affecting both Long and Short positions.”

If the price of BEAT falls below $3, the total liquidation of Long positions could reach $10 million.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins That Could Face Major Liquidation Risks During Christmas Week. Accessed on December 24, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.