Download Pintu App

7 Crypto Facts of the Day: DOGE Futures Explode 53.255% & BTC Reaches New Records!

Jakarta, Pintu News – Recent cryptocurrency market reports show a remarkable surge in Dogecoin (DOGE) futures activity alongside huge momentum in the Bitcoin (BTC) market throughout 2025. This market activity comes at the end of the year as market participants adjust positions and traditional institutions and governments show more interest in Bitcoin, according to reports by U.Today and Decrypt.

1. Dogecoin Futures Activity Surges Dramatically

In the last 24 hours leading up to the end of 2025, the trading volume of Dogecoin futures on the BitMEX exchange shot up by approximately 53,255%, reaching over $260.34 million according to CoinGlass data. This surge reflects the heightened dynamics of the crypto market as market participants are repositioning their exposure ahead of the year-end.

The large increase in futures volume suggests that traders are getting more active in taking risks and placing short-term positions against DOGE, even as DOGE’s spot price itself continues to consolidate within a narrow range.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Dogecoin Spot Price Movement Limited

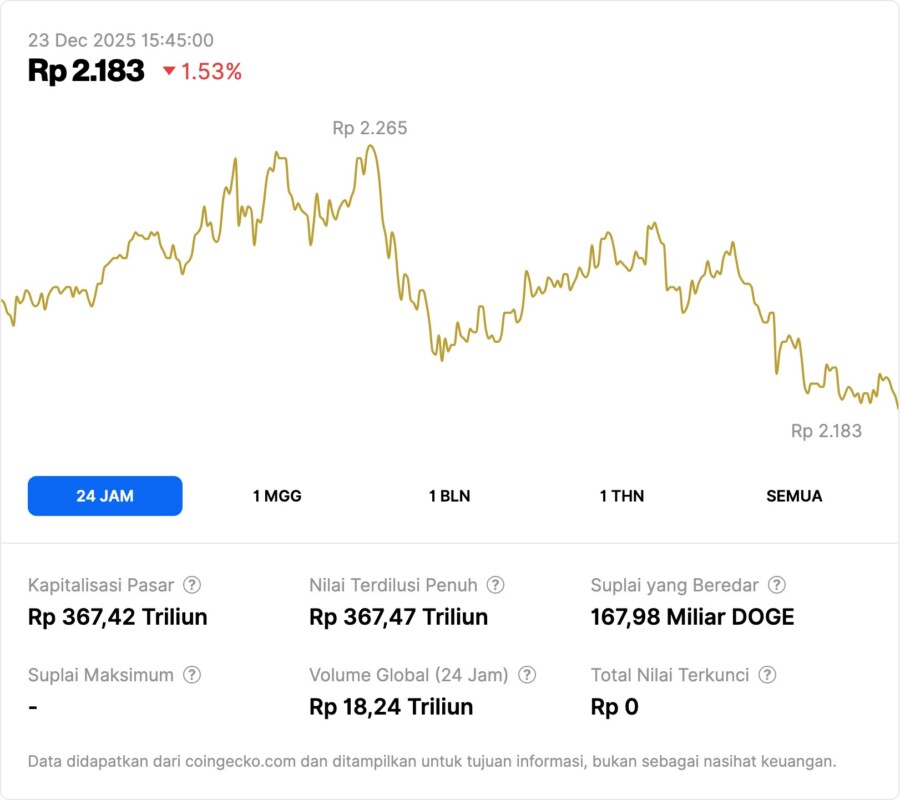

Despite the sharp jump in futures volume, the price of DOGE on the spot market did not move as strongly as the surge in derivatives activity. The token traded in a range between approximately $0.128 to $0.134 during the same period, suggesting price consolidation within a relatively tight range.

DOGE prices are down around 58.5% on an annualized basis according to CoinGecko data, reflecting long-term price pressure despite futures showing very high activity.

3. Market Liquidity and Year-end De-Risking

Market analyst reports suggest that the surge in Dogecoin futures comes amid thinning market liquidity and signals that traders-both retail and institutional-are de-risking or adjusting positions as 2025 comes to a close. This kind of activity is often seen at the end of the year when investors evaluate and close out their short-term positions.

The coordination between futures, ETFs and options markets gives an indication of how risk sentiment is changing, although it doesn’t necessarily lead to a rise in spot prices.

4. Bitcoin 2025: Record Prices & Government Interest

The year 2025 has been a significant period for Bitcoin, with the price of BTC reaching a record high above $126,000 in October 2025, up from around $94,000 at the beginning of the year, according to a Decrypt report. Great interest came not only from the market but also from institutions and governments in various countries.

The US government even issued an executive order to establish a Bitcoin strategic reserve, indicating a change in regulatory outlook and the integration of BTC as a strategic asset, not just a crypto asset.

5. Institutional Adoption on Wall Street & Bitcoin Companies

In addition to government interest, a number of companies focused on buying Bitcoin emerged on Wall Street throughout 2025, with dozens of public companies holding BTC on their balance sheets. This trend suggests that traditional institutions are increasingly considering Bitcoin as part of their asset diversification strategy.

The company’s buying strategy is motivated by the anticipation of regulatory recognition and clearer regulations, fueling broader institutional demand for BTC.

6. Bitcoin Community Challenges and Tensions

Throughout the year, Bitcoin also faced internal challenges related to code changes and utility limitations, including controversy over Bitcoin Core updates that spawned debate about the potential for network “spam” and its impact on Bitcoin’s fundamental principle as a permissionless ledger.

This issue shows that in addition to price factors and institutional adoption, technical dynamics and community principles remain an important part of Bitcoin’s development.

7. Macro Implications of Crypto Market

The combination of Dogecoin futures spikes and Bitcoin momentum throughout 2025 reflects the highly liquid nature of the cryptocurrency market and its responsiveness to risk sentiment, year-end seasonality, and growing adoption from traditional institutions and governments.

While the spot prices of some assets may not move dramatically, derivatives activity and the structural changes underneath give a sense of how market participants are managing risks and opportunities in the global crypto ecosystem.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What’s happening with the Dogecoin futures market?

Dogecoin futures volume surged by about 53,255% in 24 hours on the BitMEX exchange as traders adjusted their positions ahead of the 2025 end.

Does a spike in futures mean DOGE prices are rising?

Not always; although futures show high activity, DOGE spot prices keep consolidating in narrow ranges without sharp spikes.

How will BTC perform in 2025?

Bitcoin reached a record of over $126,000 in October 2025 and attracted the interest of governments and large institutions throughout the year.

Why are institutions interested in Bitcoin?

Institutions are looking for asset diversification and growth potential, so they are adding BTC to their balance sheets during 2025.

Is the government buying Bitcoin too?

Some governments are considering or starting to accumulate Bitcoin as part of their strategic reserves.

Reference:

Tomiwabold Olajide/U.Today. Dogecoin’s Wild 53,255% Futures Market Surge, What’s Behind It? Accessed December 23, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.