Download Pintu App

21Shares Moves a Step Closer to Launching Its Dogecoin ETF with Fresh SEC Filing

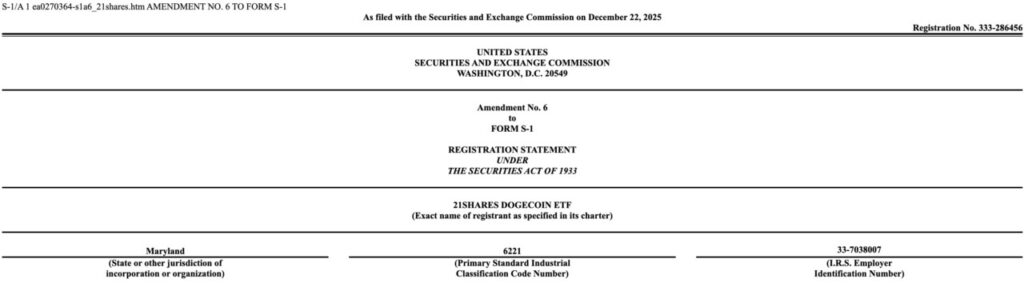

Jakarta, Pintu News – Crypto ETF issuer 21Shares stated that it still plans to launch a Dogecoin ETF, having just filed an amended S-1 document with the United States Securities and Exchange Commission (SEC).

The move comes amid the DOGE ETF’s disappointing performance, with no new fund flows recorded to date.

21Shares Amends S-1 Document for Dogecoin ETF

A filing with the SEC (United States Securities and Exchange Commission) shows that crypto ETF issuer 21Shares has again made changes to the registration document (Form S-1) for their Dogecoin (DOGE) ETF product. This is the sixth amendment to the document, made as the asset manager prepares to launch the DOGE ETF fund.

Read also: Dogecoin Price is Sluggish Today: DOGE ETF Flows Have Not Provided New Triggers

Earlier this month, 21Shares had updated its S-1 document to reveal some important details, including the 0.5% management fee. In the latest amendment, these details have been retained.

The company still plans to list the Dogecoin ETF under the symbol “TDOG” on the Nasdaq exchange. In addition, Coinbase, one of the world’s largest crypto exchanges, will serve as the custodian of the assets in the trust.

There is no mention of a fee waiver, although 21Shares is trying to compete with Grayscale and Bitwise’s existing Dogecoin ETFs. The asset manager also stated that it will buy $1.5 million worth of Dogecoin when the ETF begins trading on exchanges.

Meanwhile, 21Shares confirmed that the Dogecoin ETF will not become effective until it files an additional amendment to make it effective under Section 8(a) of the Securities Act of 1933, or until the SEC approves the registration statement.

Previously, 21Shares has launched Solana and XRP ETFs this year, and the DOGE ETF is potentially the fifth crypto asset they offer with 100% spot exposure.

Dogecoin ETF continues to show weak performance

Data from SoSo Value shows that the Dogecoin ETF (DOGE) has continued to underperform since its launch in late November. These funds have recorded eight consecutive days of zero flows since December 11.

Read also: Midnight (NIGHT) Token Price Plummets, But Big Investors Keep Hunting!

During the trading period, the Dogecoin ETF only recorded positive net inflows on 5 out of 20 trading days. As a result, the total funds raised by the Grayscale and Bitwise DOGE ETF have only amounted to about $2.05 million since launch.

In detail, Grayscale recorded a total net inflow of US$3.03 million, while Bitwise experienced a net outflow of close to US$1 million. In addition, the daily trading volume of the two ETFs is still unable to break the US $ 1 million mark.

This underperformance is also reflected in the Dogecoin price, which continues to decline in line with the weak performance of the associated ETF. In the past month, the price of DOGE fell by more than 6%, coinciding with the ETF’s launch period. On a year-to-date (YTD) basis, Dogecoin has fallen by more than 58%.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Crypto ETF Issuer 21Shares Advances Dogecoin ETF Bid with Amended S-1 Filing. Accessed on December 24, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.