Download Pintu App

3 Important Crypto Events in January 2026: What to Watch Out For?

Jakarta, Pintu News – As 2025 draws to a close, the crypto market enters January 2026 with renewed vigor and cautious optimism. As of December 29, the global crypto market saw a gain of 0.79%, showing a slight recovery from the previous oversold condition.

Bitcoin (BTC) managed to stay above the $87,000 level, while Ethereum (ETH) stabilized above $2,900. Nevertheless, the overall crypto market is still facing pressure. Low liquidity and divided sentiment are negatively impacting altcoin movements.

January 2026 is expected to be the most important price trigger, especially with macroeconomic risks and regulatory decisions on the horizon. The following are some of the key crypto-related events this month that could significantly impact market direction.

Risk of Government Shutdown Increases Ahead of January 31 Deadline

The US Congress went on vacation over Christmas with neither a final budget nor a clear voting schedule. This lack of action leaves the US government on the brink of a possible shutdown, just weeks before the January 31 deadline.

Read also: Nvidia’s Share Price Could Reach $300 by 2026? Here are 2 Key Catalysts!

Although negotiators from the Senate and House of Representatives have reached an agreement on the total budget, debate continues over how the funds will be distributed. Democrats have expressed their willingness to proceed under the new budget caps.

On the other hand, Republican fiscal conservatives insist that agency budgets not be increased and reject bills that increase spending.

If no agreement is reached, this could disrupt the operations of federal agencies, delay services, and create uncertainty in the market. This situation could also impact the regulatory activities of the crypto market, making it one of the most crucial issues to watch in early 2026.

Crypto Events to Watch: Crypto Reserves and the CLARITY Bill

The US House of Representatives has passed the Digital Asset Market Clarity Act of 2025 (known as the CLARITY Act), and the bill now awaits further discussion in the Senate. The legislation aims to clarify the definition of digital assets as commodities, exempt some established blockchains from SEC regulation, and establish new compliance rules for crypto exchanges and brokers.

The CLARITY Act is one of the key developments worth noting, especially as it concerns major assets such as Bitcoin, Ethereum, Solana (SOL), and XRP-all of which have been accepted in ETFs. If the law is passed in January, it is expected to increase regulatory certainty and attract more institutional capital to the crypto market.

On the other hand, there is also political discourse regarding the establishment of a national crypto reserve by the US government. Although former President Trump supports the idea, divisions in Congress still hinder its realization.

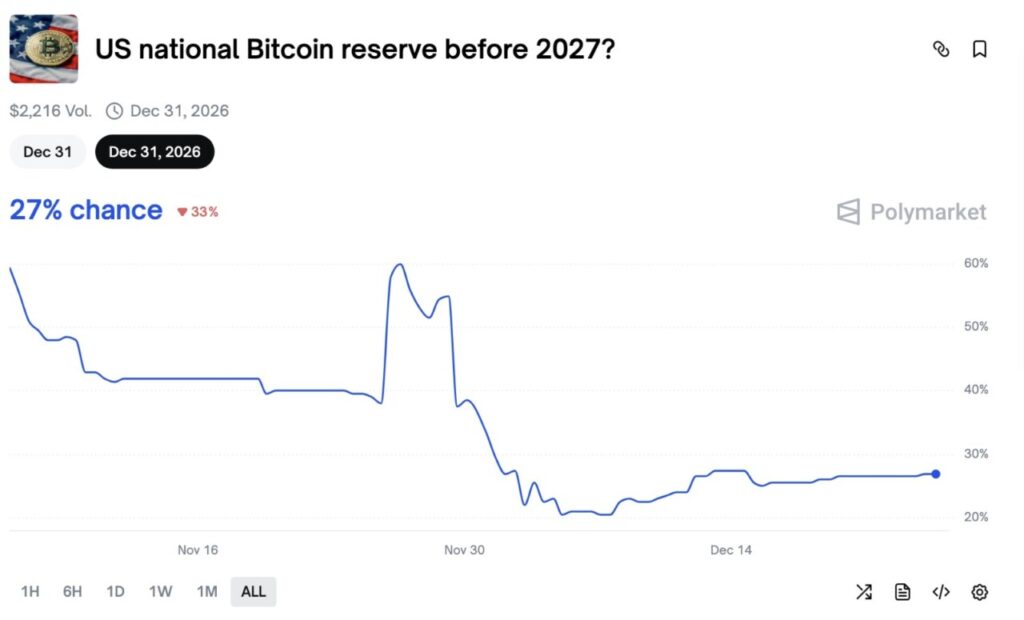

Predictions from Polymarket estimate the likelihood of the US having Bitcoin reserves before 2027 at only 27%.

Read also: Crypto Trends 2026: Focus on Everyday Use, Not Just Hype!

Fed Rate Cut Betting

The likelihood of an interest rate cut at the Federal Reserve’s January meeting has dropped dramatically. According to CME FedWatch, the odds of a 25 basis point cut are now only 13.3% – much lower than before. Meanwhile, there is an 86% chance that interest rates will remain on hold.

This change comes after the release of third-quarter GDP data that exceeded market expectations, as well as a series of significant interest rate cuts that have been made throughout 2025.

Fed officials, such as New York Fed President John Williams, also expressed caution in welcoming 2026.

This reduced expectation of interest rate cuts could put pressure on Bitcoin and other crypto assets, which have previously tended to strengthen whenever there is an easing of monetary policy.

With liquidity tightening again, interest rate movements are one of the key crypto events to monitor. Traders will likely adjust their strategies based on expectations of the direction of interest rate policy.

Conclusion:

From potential government shutdowns, to historical crypto regulations, to Fed policy decisions – January 2026 opens with some major events. All of these developments could trigger new volatility or even shape the future direction of the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Top 3 Important Crypto Events to Watch in January 2026. Accessed on December 31, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.