Download Pintu App

Crypto Whale Scoops Up $3.6 Billion in XRP as Bullish Signals Resurface

Jakarta, Pintu News – The price of XRP (XRP) fell about 1.1% on January 1, 2026 and still recorded a loss of 8.8% in the last 30 days. This makes it one of the worst-performing assets among the top ten cryptos, with only Dogecoin (DOGE) experiencing a larger monthly decline.

Even so, there has been a change in behavior from the whales and a resurgence of bullish signals that have occurred before. If both hold, this could be the first real attempt to reverse the downward trend.

Bullish Divergence Reappears; Trend Reversal Coming Soon?

The price movement of XRP showed weakness from November 4 to December 31. During this period, the XRP price printed lower lows, but the RSI (Relative Strength Index) indicator – which measures the strength of momentum – showed higher lows. This is known as a bullish divergence and indicates that selling pressure is starting to weaken. Patterns like this often signal the beginning of a downtrend reversal.

Read also: Bitcoin Holds Steady at $88,000 as Analysts Eye Potential Surge to $170,000

A similar pattern also emerged between November 4 and December 1, which triggered a 12% surge in prices. However, the rally failed to continue due to a lack of support fromwhale wallets.

This time, the divergence pattern was seen again, but with different market conditions.

Whale Adds $3.6 Billion Worth of XRP in 24 Hours – Unlike Before

The whale group played an important role when previous divergence attempts failed. In the early December rally (between December 1-3), the two large groups sold when prices started to rise.

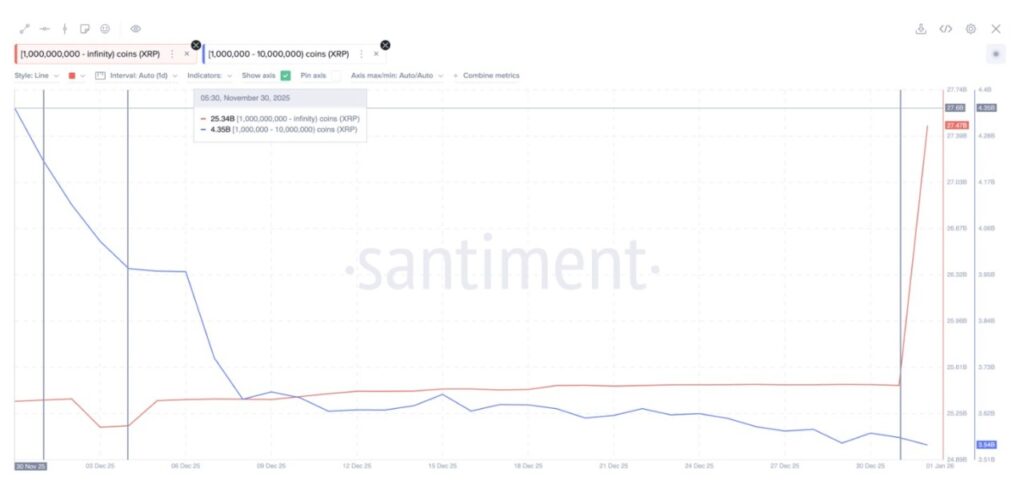

Wallets holding between 1 million to 10 million XRP reduced their holdings from 4.35 billion to 3.97 billion XRP between November 30 and December 4. Meanwhile, wallets with more than 1 billion XRP decreased their holdings from 25.34 billion to 25.16 billion XRP. It is this selling pressure that is likely hindering a potential trend reversal.

However, this time the situation was reversed.

In the last 24 hours (1/1/26), wallets with holdings of more than 1 billion XRP made massive purchases, from 25.47 billion to 27.47 billion XRP – an addition of about 2 billion XRP. At current prices, the value of these purchases equates to about $3.6 billion.

Although smaller whale groups (1 million to 10 million XRP) are still selling, the main power remains in the hands of the mega whales.

It is this change in behavior that distinguishes this situation from that of last November. Currently, the whales are buying when the RSI divergence forms. If this pattern holds, then XRP’s price structure will finally receive support from both momentum and supply.

Read also: Ethereum Struggles to Break $3,000 — Could a 20% Rally Be Ahead?

XRP Price Levels Determine Whether the Trend Reversal Lasts

XRP price still needs to confirm the positive signals shown by the technical indicators. The first sign that the trend reversal was successful would be if XRP is able to close the 12-hour candle convincingly above the $1.92 level.

This level was previously an area of resistance on December 22 and has resisted all upside attempts since then. If XRP manages to break $1.92 with strength, then the next challenge lies at $2.02. If the price is able to reclaim this level, the market’s attention will turn to the $2.17 to $2.21 zone – an area that was a barrier to the rally in early December.

Conversely, if XRP loses support at the $1.77 level, then the potential for a trend reversal will weaken. This could be a signal that the whales entered too early and that the divergence failed again. If this scenario occurs, the momentum structure will break down, and an outcome similar to early December could be repeated.

For now, the RSI divergence, $3.6 billion worth of whale buying, and the return of demand from big wallets provide a much stronger foundation than previous attempts. However, confirmation remains dependent on price action – and the $1.92 level is the deciding line whether the situation is really different this time.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Whales Add $3.6 Billion as Bullish Divergence Returns. Accessed on January 2, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.