Download Pintu App

Ethereum Climbs to $3,200 — Here’s a Look at ETH’s Technical Outlook

Jakarta, Pintu News – Ethereum (ETH) has again caught the market’s attention due to price movements, derivatives data, and protocol upgrades in line at the start of 2026. The asset is still trading with a positive short-term structure, while traders continue to monitor leverage behavior and spot flow trends.

At the same time, recent technical milestones delivered by one of its founders, Vitalik Buterin, add a long-term narrative that goes beyond mere price charts. Taken together, these factors portray Ethereum as a market that is at a balance point between momentum, caution, and structural evolution.

Ethereum Price Up 0.96% in 24 Hours

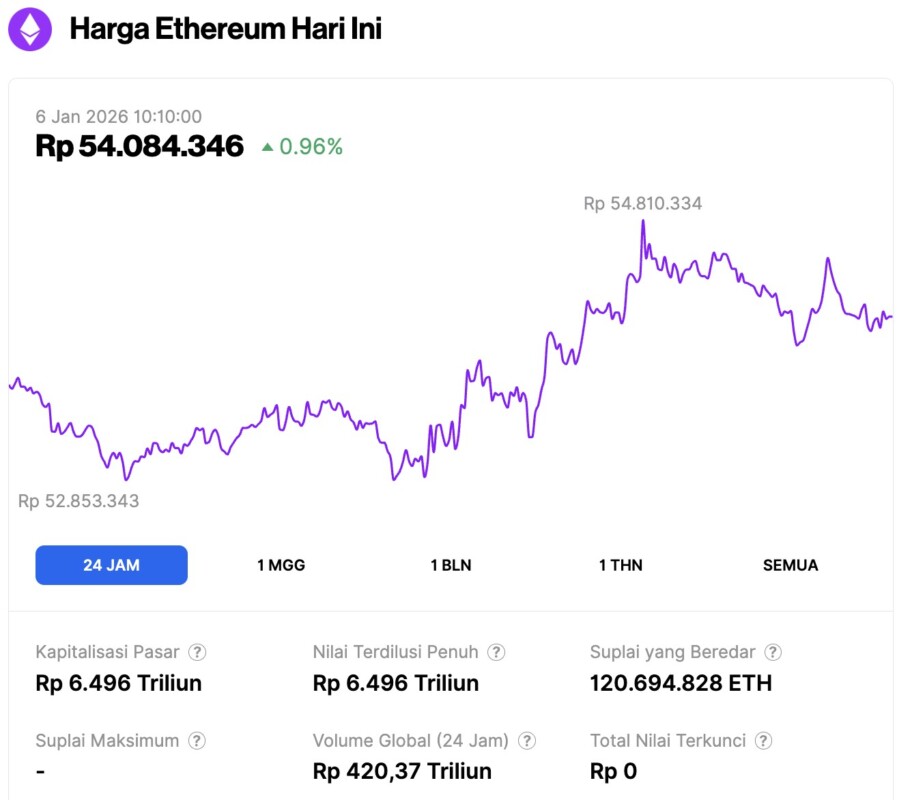

On January 6, 2026, Ethereum was trading at approximately $3,217, or around IDR 54,084,346 — marking a 0.96% increase over the past 24 hours. During this time, ETH fluctuated between a low of IDR 52,853,343 and a high of IDR 54,810,334.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 6,496 trillion, while its daily trading volume has surged by 55% to reach IDR 420.37 trillion over the last 24 hours.

Read also: Bitcoin Surges to $93,000 Today — A Look at BTC’s Technical Outlook

Price Structure Indicates Short-Term Strength

Ethereum’s 4-hour chart (5/1) shows a clear upward trend, characterized by the formation of higher highs and higher lows. The price remains above the rising short-term moving averages, signaling strong buyer dominance.

In addition to the trend structure, the widening of volatility occurred after a clean breakout above the $3,000 level. This movement indicates momentum participation, not just a thin surge in liquidity.

However, the resistance area above the current price still influences short-term expectations. The $3,220 to $3,250 zone becomes the first big test after the latest rise.

If the price is able to break consistently above this range, the next target is at $3,305 which is in line with an important Fibonacci retracement level. Beyond that, the $3,450 level becomes the next higher target if the momentum continues to strengthen.

On the downside, the reaction to support levels remains crucial. The $3,190 area is the initial defense and is close to the key Fibonacci level.

Moreover, the $3,110 to $3,070 zone incorporates support from the moving averages and the previous demand area. If the price breaks deeper towards $3,030, then the bullish structure will weaken and the market focus could shift to the consolidation area at $2,920.

Futures Data Shows Leverage Adjustment

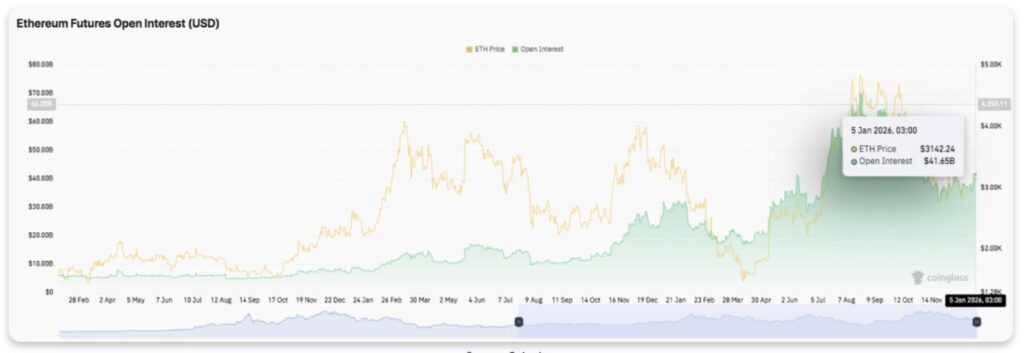

Open interest in the Ethereum futures contract increased sharply during the latest breakout, reflecting increased participation in the derivatives market. Open interest briefly peaked near the previous cycle high, as price momentum strengthened.

Importantly, the subsequent decline to the mid-$40 billion range indicates position trimming, not massive risk flight.

As such, traders seem to be reducing exposure after the expansion, but remain active in the market. Open interest is still high compared to previous cycles, signaling that interest in derivatives remains structurally elevated. This pattern often precedes a consolidation phase rather than a trend reversal.

Spot Current Indicates Active Rotation

Flows from spot exchanges reflect a more cautious story. In the past few sessions, outflows have dominated, indicating distribution action amid price strength.

Moreover, the surge in inflows was short-lived and unsustainable, reinforcing the view that current trading activity is more short-term than long-term accumulation. As prices continue to rise, supply rotation continues instead of supply tightening.

Network Updates Add Long-Term Context

Despite market dynamics, Ethereum’s development roadmap continues to evolve. Vitalik Buterin recently revealed progress regarding ZK-EVM readiness and increased dataavailability. These innovations aim to increase transaction capacity(throughput) while maintaining the principle of decentralization.

Read also: 3 Cryptos Highlighted by Analyst Ali Martinez at the Beginning of 2026, Potential to Rise or Fall?

Moreover, expectations of broader ZK-based validation by the end of the decade put Ethereum on a structural scaling path. This narrative has the potential to reinforce long-term conviction, even as the short-term price battle rages on.

Ethereum (ETH) Price Technical Outlook

Important levels remain clearly defined, while Ethereum is still trading within a short-term bullish structure on low time frames. ETH continues to hold above its rising moving averages, keeping the momentum positive despite facing resistance above it.

- Upper level (resistance): The immediate resistance is in the range of $3,220-$3,250, which is the area of the latest swing high. A confirmed breakout above this zone could open the way towards $3,305, which is in line with the 0.786 Fibonacci level. If the momentum continues, the next upside target could be $3,450.

- Lower level (support): Initial support is around $3,190, which is an important retracement area that buyers should defend. Below that, the $3,110-$3,070 zone becomes a confluence area between moving averages and intermediate Fibonacci support. If the correction deepens, the $3,030 level will be the next focus, with strong structural support in the $2,920-$2,950 range.

- Key resistance limit: The $3,250 region remains a key level that must be broken and defended to ensure a sustained continuation of the uptrend. A clean break and hold above this area will strengthen the intermediate bullish scenario.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Ethereum Price Prediction: ETH Maintains Bullish Structure While Network Vision Expands. Accessed on January 6, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.