Download Pintu App

5 Ways to Short Ethereum, Here’s What You Need to Know!

Jakarta, Pintu News – Shorting Ethereum (ETH) is one strategy that crypto traders often use when the market is down or moving uncertainly. Unlike spot trading, which generally only profits when the price goes up, shorting allows you to potentially profit when the price of Ethereum goes down. Here are five commonly used ways of shorting Ethereum, complete with important things to consider before trying it.

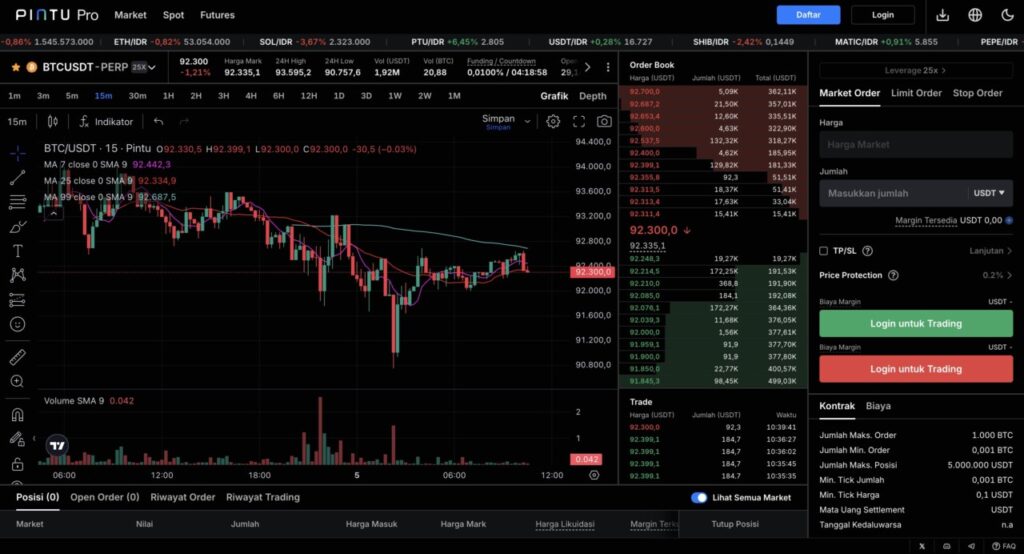

1. Choose a Platform that Provides Short Feature, One of them is Pintu Futures

The very first step before shorting Ethereum is to choose a platform that does provide the short position feature. Not all crypto apps support this feature, as shorting is usually available through derivative products such as futures. Therefore, it’s important to make sure the platform you choose has a clear and easy-to-understand system.

One option available in Indonesia is Pintu Futures, which allows users to open long or short positions on crypto assets like Ethereum. Through futures contracts, you can speculate on the price movements of ETH without having to own the asset directly.

Also Read: Ethereum (ETH) Keeps Going, Is 2026 the Right Time to Buy?

2. Use Futures Contract to Short Ethereum

The most common way to short Ethereum is using futures or perpetual futures contracts. In this mechanism, you open a short position assuming the price of ETH will drop from its current level. If the price actually drops, the price difference becomes a potential profit.

Futures provide flexibility as they can be utilized during both rising and falling markets. However, since futures contracts move quickly with market prices, you need to actively monitor your positions. Sharp price changes can have a direct impact on the margin used.

3. Pay attention to Leverage and Position Management

Shorting Ethereum almost always involves the use of leverage, which is the facility to open positions larger than the initial capital. Leverage can increase potential profits, but it can also accelerate losses if the price moves against you. The greater the leverage used, the less tolerance there is for price movements.

Since Ethereum is a highly volatile asset, using excessive leverage can lead to quick liquidation of positions. Therefore, it’s important to set position size and leverage according to your individual risk profile. A conservative approach is often safer for beginner traders.

4. Understand Volatility and Liquidation Risk

The main risk in shorting Ethereum is the high price volatility. ETH can move up or down by a large percentage in a short period of time, especially when there are macro data releases, network updates, or global market sentiment. If the price rises sharply while you’re in a short position, losses can happen quickly.

In addition, there is the risk of liquidation, which is the condition when a position is automatically closed by the system because the margin is no longer sufficient. Liquidation often occurs when the market moves quickly and in the opposite direction of the opened position. It’s important to understand the level of liquidation in advance before opening a short position.

5. Use a Disciplined Risk Management Strategy

Risk management is key when shorting Ethereum. The use of features such as stop-loss helps limit losses when the market moves against you. Without clear risk limits, losses can grow larger than planned.

In addition, traders also need to factor in additional costs such as the funding rate on futures contracts. These fees can have an impact on the final outcome, especially if the position is held for a long time. With a disciplined strategy and a good understanding of risk, shorting Ethereum can be done in a more measured manner.

Conclusion

Shorting Ethereum offers opportunities amidst a volatile crypto market, but it also comes with its fair share of risks. Choosing the right platform like Pintu Futures, understanding how futures contracts work, and practicing disciplined risk management are important factors before attempting this strategy. With proper preparation, traders can be better prepared for the fast-moving dynamics of the Ethereum market.

Also Read: New Strategy in the Crypto World: 680,000 BTC Acquisition by Strategy!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. How to Short Ethereum. Accessed on January 8, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.