Download Pintu App

Bitcoin vs Altcoins: Who will Win when the Breakout Happens?

Jakarta, Pintu News – Altcoins are slowly absorbing liquidity while Bitcoin (BTC) struggles to maintain its dominance. Smaller tokens are starting to take up a larger portion of trading volume, and this is not simply due to hype. Rather, it indicates real activity from users who are transacting and committing to the ecosystem.

Altcoin Trading Volume Increases Sharply by 55%

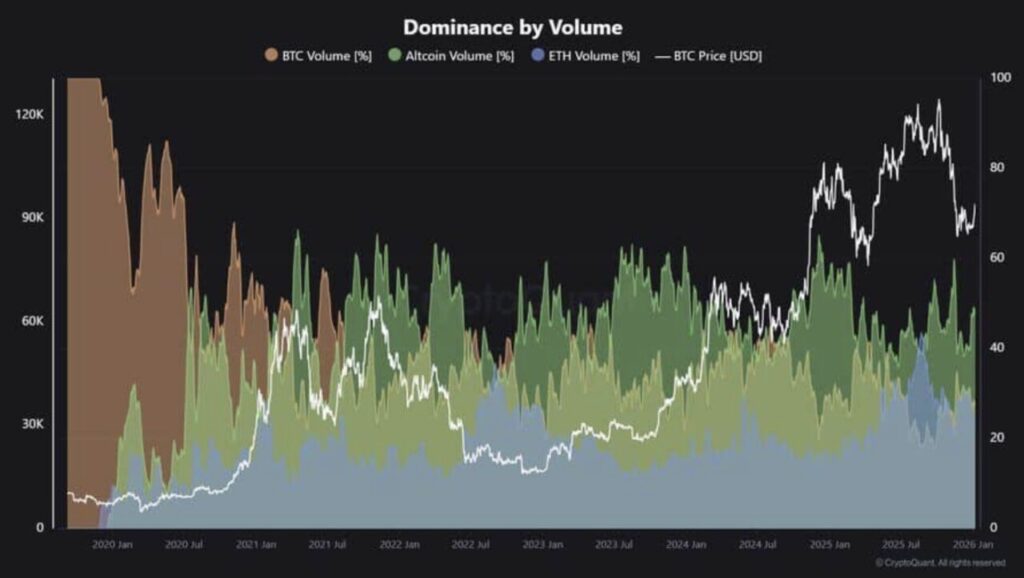

From 2025 to early 2026, there has been a significant shift in trading volume leadership. Bitcoin’s volume dominance, which had previously stabilized at around 45-50% in early 2025, gradually declined to the 30-35% level.

Read also: Pi Network Price Prediction: Developer SDK Release & $20 Million Token Unlock, What’s the Impact?

In contrast, altcoin trading volumes increased sharply, breaking the 55% mark and often reaching the 60-65% range. This became one of the most powerful and long-lasting periods of altcoin dominance in the market charts.

In the same period, Ethereum’s volume saw a modest increase, moving between 20% to 30%.

While Ethereum has benefited from ecosystem growth and adoption of scale solutions, it has not fully attracted speculative flows that have instead flowed to smaller altcoins. On the other hand, while Bitcoin’s price rose sharply in early 2025, its trading volume lagged behind. This discrepancy suggests a rotation of profits, rather than a renewed accumulation of Bitcoin.

High risk appetite, increased use of leverage, and narrative-driven trading have been the main drivers of altcoin dominance in recent times. However, for this trend to continue, it requires liquidity conditions and market sentiment to remain strong.

Macroeconomic shocks or volatility spikes in Bitcoin can quickly reverse the direction of this trend. Therefore, investors are advised to closely monitor relative volume shifts, the difference between BTC price and volume, and the strength of ETH participation.

Insights from On-Chain Data

Through the analysis of on-chain data, there is a clear gap between the growth in the number of wallets and actual usage. This gap has an important impact on transaction volumes.

The number of Ethereum (ETH) addresses has increased consistently, from around 300 million to 370 million. This growth has been smooth without any sharp spikes, suggesting organic adoption rather than momentary hype.

However, Ethereum appears to be lagging behind in terms of the number of daily active addresses. As a result, many wallets are inactive, which limits transaction volumes in the short term.

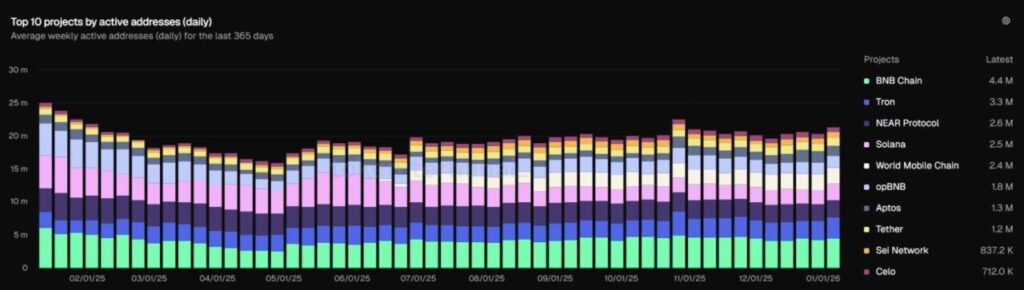

In contrast, BNB Chain showed a stronger usage rate. Its address count surpassed 730 million. More importantly, daily active users reached around 4.4 million. As users transact frequently, volumes remain high – and this contributes to the reduced transaction fees seen in this cycle.

Meanwhile, Tron (TRON), Near (NEAR), and Solana (SOL) also showed fairly stable activity patterns. There were no big spikes or sharp drops. Their activity persisted over time, so transaction volumes remained consistent.

In short, continuous activity generates continuous volume. Regular transactions deepen liquidity and increase asset turnover. This kind of activity reflects commitment, not mere speculation. FOMO creates wallets, but real usage creates volume.

Read also: 3 Best Performing Crypto Today, January 12, 2026

Technical Overview

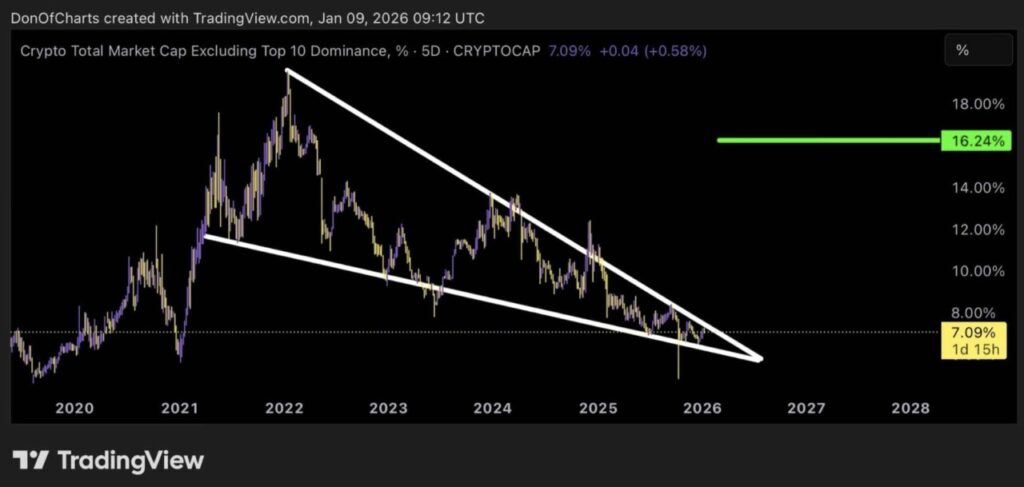

It should be noted that market dominance is currently being squeezed within a narrow falling wedge pattern on the chart. Although pressure from sellers continues to push for the formation of lower highs, buyers remain defensive along the continuously narrowing support line.

Tension is starting to build. With volatility decreasing, the price movements that occur are likely to be sharp. All the more so because the market energy is consolidating – and historically, Bitcoin dominance tends to experience strong moves after breaking out of patterns like this.

In the event of a decisive move through wedge resistance, market sentiment could change dramatically and accelerate asset rotation. Capital that has been “on the sidelines” could start chasing high-beta assets, driving a parabolic expansion in the market share of tokens outside the top 10 – from its current position of 7.09% towards the target level of 16.24%.

However, as long as there is no breakout, the compression phase still dominates. Even so, every little bounce adds to the pressure, indicating that a big breakout may be approaching – and when it does, the impact will be explosive.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMBCrypto. Bitcoin dominance, altcoins, and the odds of this breakout on the charts. Accessed on January 12, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.