Download Pintu App

Bitcoin Faces Growing Pressure as 5 Bear Market Indicators Emerge This January

Jakarta, Pintu News – January has so far been a turbulent month for Bitcoin (BTC), as the asset faces renewed pressure due to rising geopolitical tensions between the US and the European Union following President Trump’s latest tariff announcement.

By January 19, the largest cryptocurrency had fallen nearly 2.5% to $92,663. Meanwhile, analysts indicated the emergence of important bear market signals in 2026.

1. Emergence of Bearish Kumo Twist on Bitcoin Chart

In a recent post on X (formerly Twitter), Titan of Crypto analysts highlighted a “Kumo twist” appearing on Bitcoin’s weekly chart. For context, a Kumo twist is a formation that occurs when two major lines in the Ichimoku Cloud indicator (Senkou Span A and Senkou Span B) cross each other, changing the future direction of the cloud.

Read also: Bitcoin Holds Steady at $92,000 — Will the Bulls Break Through the Bearish Wall?

The direction of this cross can signal a potential switch from bullish to bearish market conditions, or vice versa from bearish to bullish. In the case of Bitcoin right now, the twist is bearish.

Looking at previous market cycles, Titan of Crypto notes that weekly Kumo swings like this usually precede a significant corrective phase, where Bitcoin experiences declines of around 67% to 70%.

“Historically, when the weekly Kumo turns bearish, BTC enters a bearish market phase. This doesn’t mean the price will drop immediately. It just means that the market structure and overall trend dynamics have changed. This is a context, not a prediction. Based on the last three cycles,” he wrote.

2. Bitcoin Struggles to Break the Lock Limit

Currently, Bitcoin is trading below its 365-day moving average, which stands at around $101,000. This level is considered important because during the bear market of 2022, it successfully halted the price’s recovery attempts.

According to analysis from Coin Bureau, Bitcoin’s position still below the MA shows that the market is still in a bearish condition.

Additional technical analysis using the Gaussian Channel on the five-day chart also reinforces these concerns. Raven crypto analysts note that Bitcoin has lost the center (median) level of the channel.

In his post, he added that losing the median level and failing to retest it successfully historically often marks the beginning of a more aggressive bearish phase.

“I believe we are heading towards the $103,000 zone for a retest, or perhaps a little higher for the sake of liquidity hunting. If we manage to establish and maintain support above the median level, I’ll let you know. Until then, this should all be considered a ‘dead cat bounce’,” the analyst added.

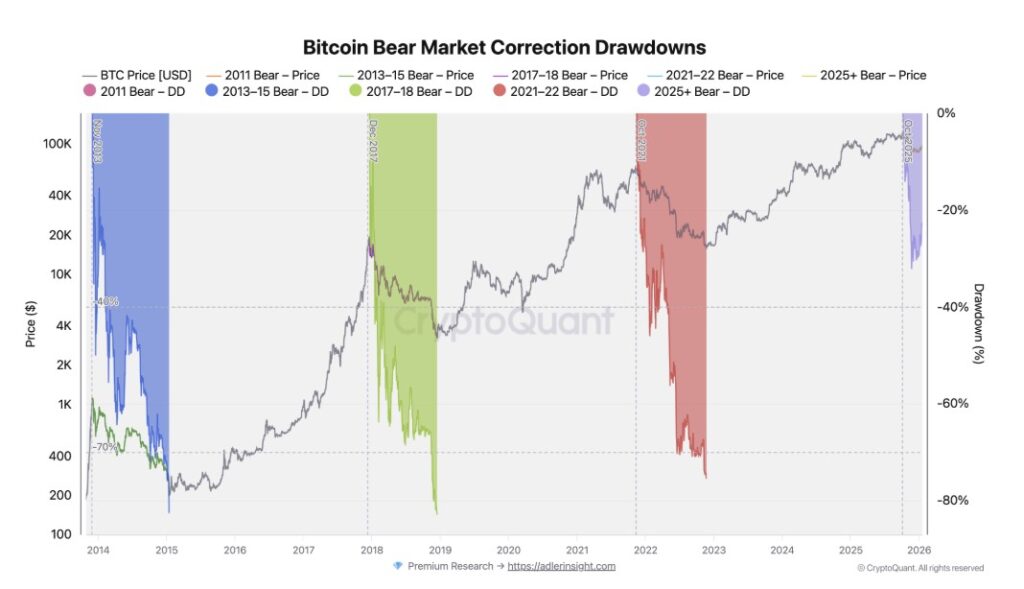

3. Historical Decline Pattern Indicates Potential for Further Decline

Bitcoin’s price history shows a recurring pattern of a sharp decline after reaching a cyclical peak. After reaching its peak in 2013, Bitcoin price fell by about 75.9%.

Read also: Dogecoin Price Rises to $,012 Today: What Will Happen Next?

After the 2017 peak, there was a decline of 81.2%, and after the 2021 peak, Bitcoin corrected by about 74%.

But in the current cycle, the decline has been mild, only about 30% less – a relatively small correction by historical standards. This indicates that the downward phase may still be at an early stage, and further declines are still possible as the cycle progresses.

4. Market Cycle Indicators Show Bitcoin Bearish Phase Still Developing

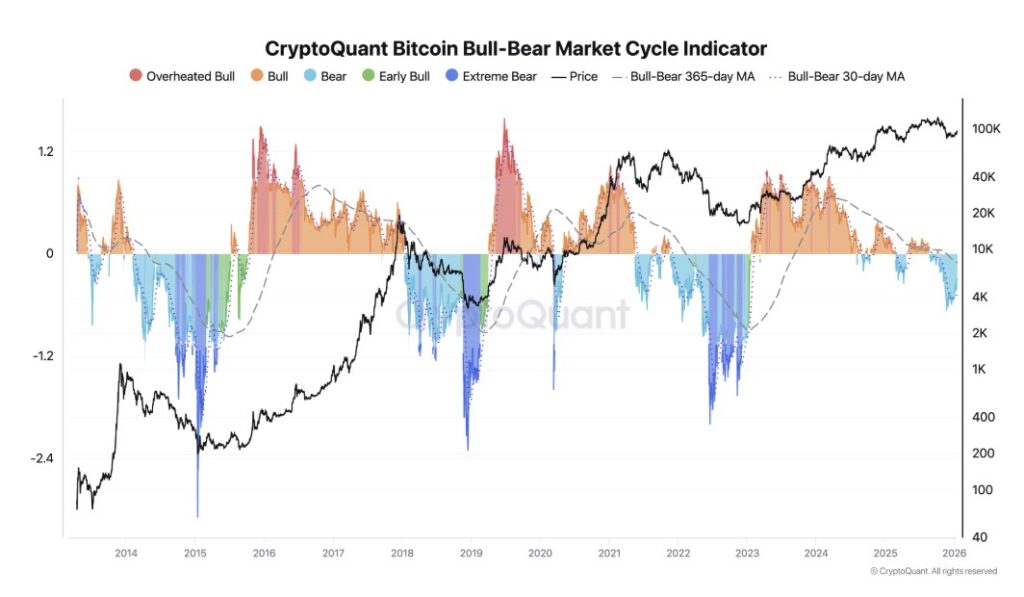

While historical dips focus on price behavior after market peaks, broader cyclical indicators can help understand current market conditions.

The Bull-Bear Market Cycle indicator, which monitors the overall market phase, shows that bearish conditions began in October 2025. However, this indicator does not yet indicate that the market has entered an extreme bearish phase.

“Based on this indicator, BTC is in bear market territory, and in every previous cycle, we have always gone into the dark blue zone, which indicates lower price levels are still possible. But go ahead and be optimistic, there’s always a need for ‘exit liquidity’ eventually,” said an analyst.

5. Inflow to the Exchange Indicates Distribution by Large Holders

Finally, on-chain data shows an increase in Bitcoin inflows to exchanges. These flows are dominated by medium to large holders, specifically in the groups holding 10-100 BTC and 100-1,000 BTC.

An increase in Bitcoin transfers to exchanges generally signals increased distribution (selling) activity, rather than long-term accumulation, as market participants move assets in preparation for a possible sale.

“Their activity tends to be more informationally significant than fragmented retail flows, as it reflects strategic decisions, not just market noise. From a macro on-chain perspective, the combination of high exchange inflows and distribution from large holder groups suggests that the market is entering a more fragile phase,” explained an analyst.

In conclusion, Bitcoin is showing various bearish market signals from technical, historical, and on-chain indicators. However, whether the next move will follow the historical downward pattern or surprise the market with new strength is still uncertain.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Bear Market Indicators. Accessed on January 20, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.