Download Pintu App

10 Recommended Business & Financial Bookkeeping Applications

Jakarta, Pintu News – Running a business that does not have financial records will make it difficult to know if the business is profitable, if costs are leaking and when to put the brakes on spending.

This is where the role of bookkeeping applications as a tool to help overcome these problems. This application will become a business dashboard that can see business conditions in real time starting from incoming money, outgoing money and the current cash position.

With a digital system, processes that used to take time to record transactions, categorize expenses, and compile reports can be done faster. This system is suitable for MSMEs, retail stores, small, medium to large companies.

What is a Bookkeeping App?

Accounting bookkeeping is the process of recording financial transactions in a routine and structured manner.

From this data, businesses can form important reports such as income statements to see the profit & loss of the business being run, balance sheets to find out assets, debts, and capital, and cash flow to ensure the business has a healthy cash flow.

Bookkeeping apps are the modern version of that process. If you used to use a ledger and calculator, now you can record and summarize transactions through the same system.

Here is a recommended list of bookkeeping applications for businesses and enterprises.

Recommendations for Business Finance Bookkeeping Application Software

1. Jubelio Bookkeeping App

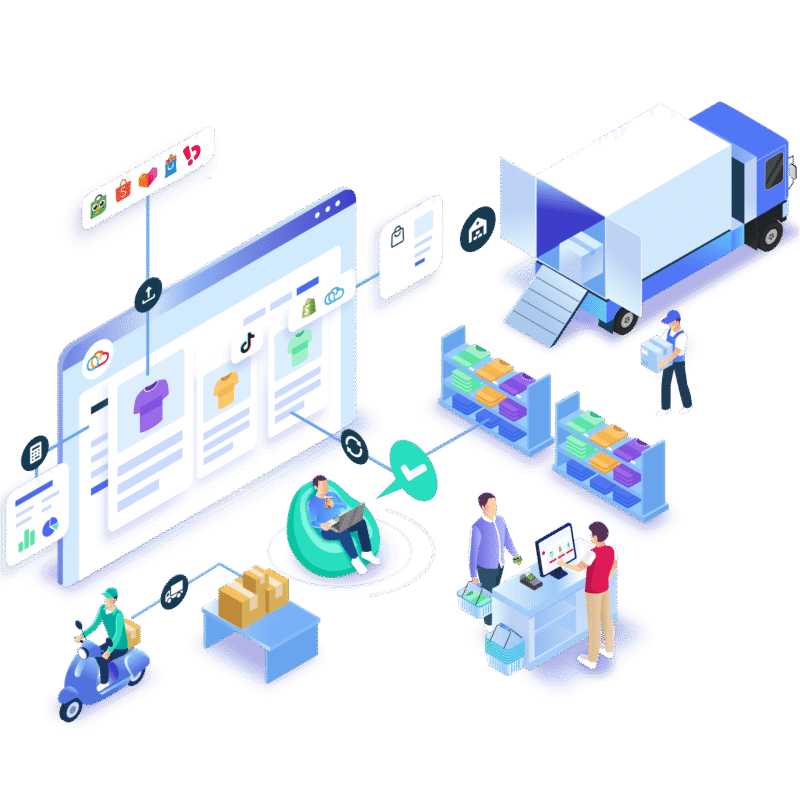

The most recommended business financial bookkeeping application is Jubelio. By using Jubelio, you can integrate with marketplaces, online and offline stores in your business.

Jubelio is a bookkeeping application that connects sales transactions, payments, and inventory into financial reports that are ready to be used anytime, Jubelio is arguably the best bookkeeping application because it is integrated with omnichannel systems.

Jubelio features:

1. Automatic transaction synchronization from multiple channels

All transactions from marketplaces (Shopee, Tokopedia, Lazada, TikTok Shop), POS, and online stores are automatically entered into accounting records. This reduces the risk of wrong input, speeds up report closing, and has consistent numbers between channels.

2. Real-time financial reports

Profit and loss, balance sheet, cash flow, and adjustment journal can be pulled at any time. Business decisions can be made faster in determining promos, stock purchases, or reducing costs without waiting for the month-end report.

3. Multi-branch and multi-warehouse centralized

Activities from various branches still go into one dashboard. You can compare branch performance, monitor operational costs and avoid duplicate data.

4. Automatic bank reconciliation

Incoming and outgoing transactions can be matched with cash and account balances, reducing bookkeeping and account discrepancies, speeding up payment checks, and making cash flow more controlled.

5. Full integration with Jubelio WMS & Omnichannel

One system from stock, orders, to bookkeeping including reporting needs. Financial reports are more appropriate because they are linked to stock and operations.

6. User access control

Control who can view, edit, or input data. Minimize the risk of internal errors, keep data secure, and make team workflows more streamlined.

2. Zahir

Zahir is often an option, mainly because it is locally developed and has been used by many businesses in Indonesia for a long time.

Zahir helps businesses tidy up their financial foundation from cash flow, customer receivables management, supplier payables recording, to easier-to-read reports.

Features of Zahir:

- Daily cash control: money in and out clearly recorded

- Receivables & payables: reduce leakage due to forgetting to bill / pay

Analysis is easier to monitor through a display that helps read business conditions.

3. SAP Business One

If the scale of the business is already large, the problem is usually controlling cross-divisional processes. Finance, purchasing, inventory, and HR all run individually, and often the data is not synchronized.

SAP Business as ERP is designed to unify business processes in one system, as the purchasing team makes purchases, inventory moves, and finance automatically records the impact.

SAP Business One is suitable for companies that need automation and standardization of processes to keep the company neat.

4. Xero Accounting

Xero makes it easy for business owners to keep track of their finances at any time and from any device. Its minimalist look and easy navigation help non-accounting users still understand the flow of records.

The added value of Xero is the digital invoice system, more automated report generation, and a lighter recording process.

Advantages of using Xero:

- Faster cashflow control without manual recap

- Invoices look professional

- Collaboration between owners and teams can access the same data in real-time

- Flexible scale for growing businesses

5. Wave

Many users utilize Wave for basic needs such as invoicing, recording income and expenses, and creating online receipts. For freelancers or service businesses, these features are usually helpful enough.

However, it is important to understand that Wave is not built for businesses that have complex operational processes, especially those that rely on stock and inventory. Because its main focus is on simple bookkeeping.

6. Moodah

Moodah helps you get your financial reports quickly because the recording and summarizing process is automated. In addition, the management of accounts payable and receivable is also made simple, so you no longer need to rely on separate records that are often scattered.

Interestingly, Moodah also brings added value to businesses that are just starting to sell online because it helps start the selling process more easily through the online shop feature.

Moodah Advantage:

- Suitable for businesses that want to start bookkeeping from scratch

- Helps reduce debt and credit chaos

- Perfect for online business beginners who want to have a selling + record-keeping flow in one place.

7. EQUIP

EQUIP (HashMicro) has a different approach, it is a modular platform that can be structured according to business needs.

You can start from the accounting module, then add other modules such as inventory, sales, purchasing, manufacturing, and so on without having to switch systems.

Advantages of using EQUIP:

- Modules can be selected according to priority

- Suitable for businesses that need synchronization between divisions

- More secure for medium to high scale as the system supports more complex processes

8. Monefy

Monefy has a simple interface that allows you to keep track of your daily expenses.

With a few taps, you can enter transactions such as shopping, bills, meals, or transportation, so you have a clearer picture of where your money goes every day.

Monefy supports multiple currencies, so it is practical for those of you who often transact across currencies (for example freelancers, travelers, or shopping from overseas platforms).

9. Spendee

Spendee stands out more as a tool to set spending limits and understand monthly financial patterns.

Spendee makes it easy for you to see the flow of money in and out and categorize it, so you can know your financial habits more objectively.

You can find out which parts are the most wasteful, which are stable and which are often overloaded.

The budgeting feature helps you create a smart budget, a kind of boundary alarm to keep you from overspending on certain categories.

10. Harvest

Harvest is different from the previous two apps. If Monefy and Spendee are closer to personal finance, Harvest is often used by freelancers, agencies, or project-based teams because it combines time tracking, expenses, invoices in one workflow.

The problem that often occurs is that working hours are not neatly recorded, billing is not accurate, and project profits are difficult to measure. Harvest helps tidy things up, so you can track work time per client/project, record costs, and then convert them into invoices.

Harvest can also stand alone or be connected to other accounting solutions as an add-on, making it suitable for workflows that want to remain flexible.

*This article is a collaboration between Jubelio and Pintu

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.