Download Pintu App

Bitcoin Holds Steady at $89,000 — Is a Rebound on the Horizon for BTC?

Jakarta, Pintu News – Bitcoin (BTC) prices fell below $89,000 as global markets remained in a risk-off mode. With stock markets on the decline, cryptocurrencies are following the trend, and capital is turning to traditional safe assets – pushing the prices of precious metals like gold and silver up as investors seek refuge from uncertainty.

The decline was triggered by a complex combination of macro factors: renewed concerns about trade wars and tariffs, heightened geopolitical tensions, and tighter liquidity conditions as bond yields and the value of the dollar continue to be sensitive to news.

In this situation, the price of BTC is behaving more like a high-beta risk asset, rather than a hedge. The main question now is whether this drop is just a natural correction in a bullish market trend that will attract renewed buying interest, or if it is the beginning of a deeper drop that pushes the price to lower support levels before experiencing a significant rebound.

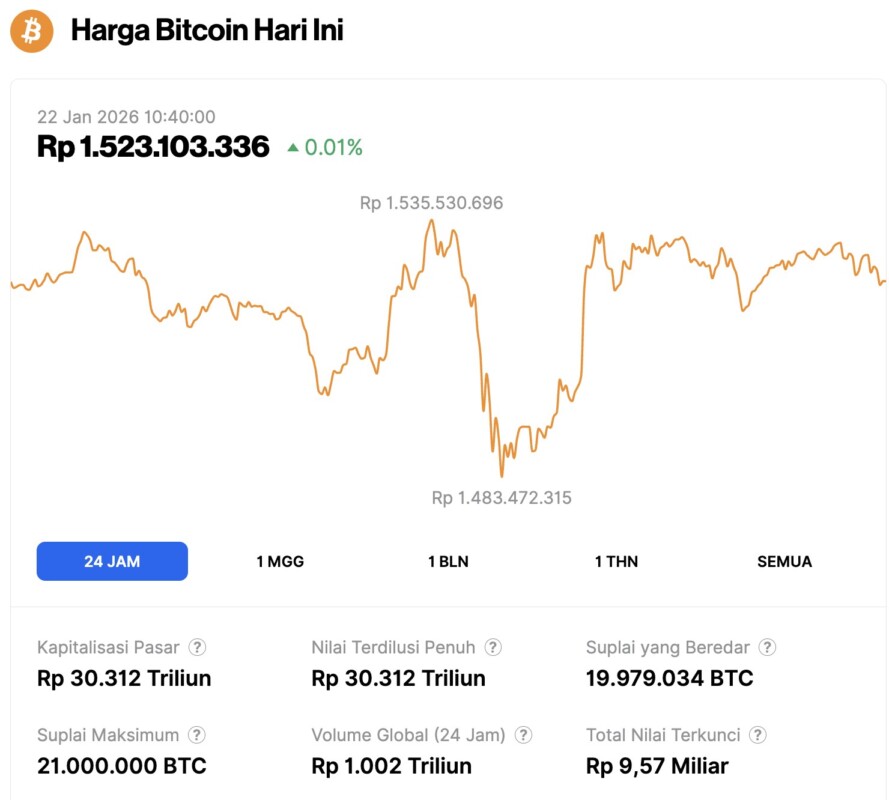

Bitcoin Price Up 0.01% in 24 Hours

Read also: Fear and Greed Index: Crypto Market Sentiment Plummets into Extreme Fear Zone!

On January 22, 2026, Bitcoin was trading at $89,748, equivalent to IDR 1,523,103,336, marking a modest 0.1% gain over the past 24 hours. Within that timeframe, BTC dipped to a daily low of IDR 1,483,472,315 before climbing to a high of IDR 1,535,530,696.

At the time of writing, Bitcoin’s market capitalization is estimated at approximately IDR 30,312 trillion, while its 24-hour trading volume declined by 6% to IDR 1,002 trillion, indicating slightly reduced market activity.

BTC Chart Watch: Volume Profile Shows Heavy Supply Wall Above $91,000

The 12-hour chart (1/21) shared by popular analyst, Altcoin Sherpa, shows that Bitcoin is on the decline after failing to maintain a position in the middle of the price range. The volume profile on the right side of the chart clearly shows the next decision area.

There is a thick band of trading volume (high-volume node) piling up in the $91,000-$92,000 range, which is usually an area of strong resistance when prices try to bounce back as many positions are opened there. As long as BTC is trading below this area, rallies tend to be quickly sold off again.

On the downside, prices are starting to move towards areas of thin liquidity, where price movements are usually faster as historically lower volumes are unable to “hold” prices. The current focus is on the $88,000-$87,000 area first, and then the broader support zone around $85,000-$84,000 if the selling pressure continues.

For the bullish side, the immediate task is simple but tough: reclaim the $91,000 level, then break $92,000 to turn the volume zone into support. Otherwise, the easiest path remains to the downside.

Read also: 3 Reasons Why January is a Crucial Consolidation Phase for Bitcoin!

What’s Next for BTC Price Rally?

Bitcoin’s drop below the $89,000 area keeps the short-term bias leaning towards the downside, and the volume profile reinforces that view. With a thick supply zone around $91,000-$92,000, any price bounce that fails to break and defend this area is likely to be sold off again.

If BTC price is unable to stabilize above the $88,000-$87,000 area, the next plausible downside target is towards $86,000, with a possible deeper drop to the $85,000-$84,000 range.

However, if buyers are able to make a sharp recovery and turn the $91,000-$92,000 area into support again, then the price correction could remain limited. Also, the market could potentially re-enter a consolidation phase rather than a longer decline.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Dips Below $89,000 as Bull Correction Deepens- What’s Next for BTC Price? Accessed on January 22, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.