Download Pintu App

Dogecoin Price Rises to $0.12 Today: Can DOGE Trigger a Strong Recovery?

Jakarta, Pintu News – Dogecoin (DOGE) has seen a decline of more than 20% in recent days, dropping sharply after hitting a monthly high. This correction pushed the price of DOGE down from the $0.15 range to a local low below $0.12-an area that bulls are currently trying to defend.

However, general market conditions and current trading flows suggest that the downward pressure may not be over yet, with the potential for a continued decline that could force late sellers to exit.

If this selling pressure occurs, the price of DOGE may try to bounce back, but the question is whether buyers will be able to turn the bounce into a sustainable uptrend towards $0.20. So, how will the Dogecoin price move today?

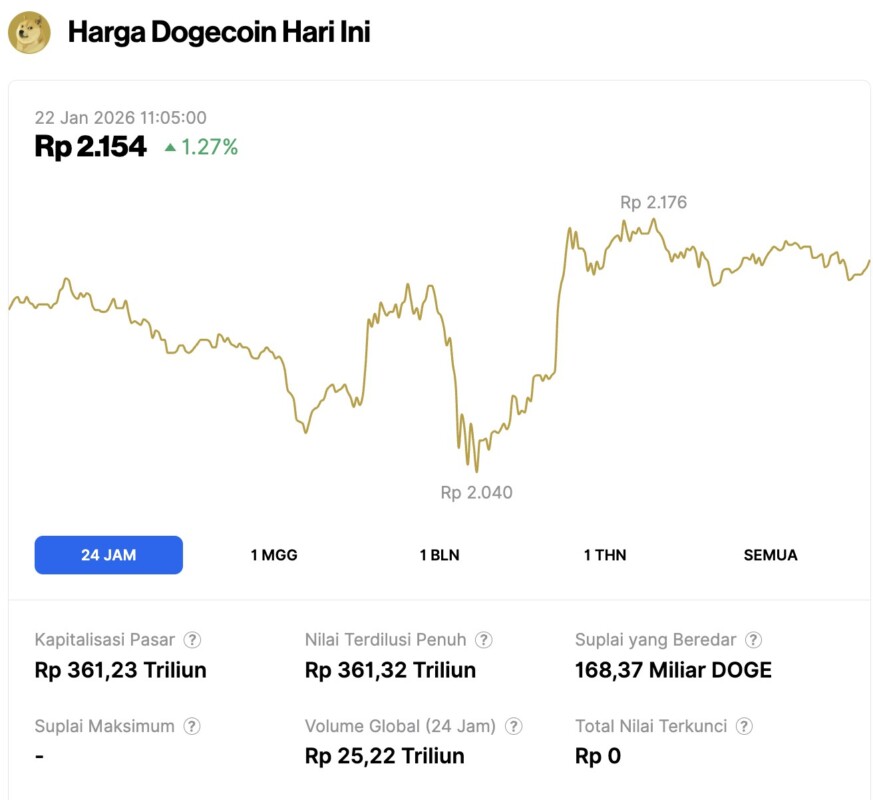

Dogecoin Price within 24 Hours

On January 22, 2026, Dogecoin saw a 1.27% gain over the past 24 hours, trading at $0.1269, or approximately IDR 2,154. During that time, DOGE fluctuated within a range of IDR 2,040 to IDR 2,176.

At the time of writing, Dogecoin’s market capitalization is around IDR 361.23 trillion, with a 24-hour trading volume of approximately IDR 25.22 trillion.

Read also: Ethereum Reclaims the $3,000 Level as Whales Scoop Up $360 Million Worth of ETH

DOGE Price Action: Clear Channel Down Pattern with Repeated Rejection

The price of DOGE is currently forming a descending channel pattern with progressively lower highs and lower lows, where every time the price bounces to the upper side of the channel, it faces selling pressure. The token has also experienced repeated rejection in the range of $0.15 to $0.153, signaling that these levels have changed from support to resistance.

Within this area, sellers have consistently maintained their dominance, keeping the trend bearish. Under these conditions, is a rebound towards $0.20 still possible?

The chart shows a tight consolidation zone near $0.12, where the price stabilized several times. This zone is important because it acts as a temporary pocket of demand amid a larger downtrend.

But here’s the thing: when the price keeps testing the same support level in a descending channel pattern, the strength of that support usually weakens. This suggests that despite the bulls’ efforts to defend the $0.12 level, they have not been able to push the price back up.

Read also: Bitcoin Price Held at $89,000 Today: Can BTC Rebound?

A daily close below this zone could open the way towards $0.115, then $0.11, and possibly even further down to $0.10.

Can DOGE Price Trigger a Strong Recovery?

DOGE’s price recovery attempts are clearly visible on the chart, but they tend to be shallow. This recovery risks failing if the price bounces but is unable to break the range between $0.13 to $0.14.

Another rejection from this area could see the price continue to move sideways below $0.15. This would signal a bounce in the bear market, but not yet strong enough to be considered a trend reversal.

Technically, the current price movement also still looks volatile, reinforcing the signal that bull strength is weakening. The OBV (On-Balance Volume) indicator shows a downward trend, indicating a distribution or at least a weakening demand in this downtrend.

Meanwhile, the CMF (Chaikin Money Flow) was slightly positive, suggesting that there is still buying interest, but not yet strong enough to change the overall market structure. This suggests that while there are buyers, dominance remains in the hands of sellers.

An increase towards $0.20 will only be possible if the DOGE price manages to break out of the current bearish structure by holding the $0.12 level and forming higher lows.

Conversely, if DOGE fails to reclaim the $0.15 level, the rally will likely only form a lower high, which is often followed by a price drop back towards the support level.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Dogecoin (DOGE) Price Plunges Below $0.13 After a Steady Sell-off, Is it Heading Back to $0.1? Accessed on January 22, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.