Download Pintu App

Retail Sentiment for XRP Shifts from Greed to Extreme Fear – Could This Signal a Bullish Turn?

Jakarta, Pintu News – The price of XRP (XRP) has dropped below $2, which translates to a drop of about 19% from its peak on January 5, 2026. This decline has many investors worried. However, analysts still see a number of positive signals that could support a price recovery.

This article discusses the main factors underlying this view. The analysis is based on social data, trading activity, and the latest developments from the exchanges.

Retail Sentiment Turns Bearish Amid Price Correction

XRP is experiencing a sharp change in sentiment. Positive/Negative Sentiment data from Santiment-a social media discussion-based market sentiment analytics platform-shows that XRP has entered into the “Extreme Fear” zone. Whereas, just a week earlier, the same metric still reflected greed.

Read also: Ripple President Reveals 4 Strong Predictions for 2026!

Santiment notes that historically, extreme sentiment conditions are often a sign of potential market reversals. Markets tend to move against the expectations of the majority.

“Historically, this high level of negative commentary has often triggered rallies. Prices often move against retail investors’ expectations,” Santiment reports.

Although these observations point to a possible positive scenario, such a rapid change in sentiment in such a short period of time reflects uncertainty and inconsistency among retail traders. This kind of instability usually does not favor a sustained upward trend.

Negative Funding Indicates a Potential Trend Reversal Pattern

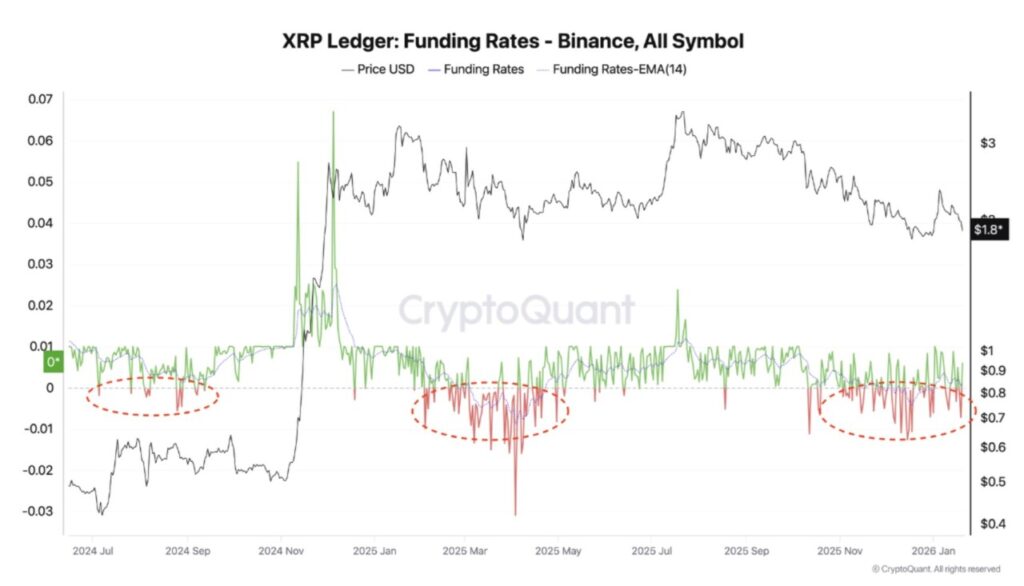

Market data is signaling another reversal. An analyst from CryptoQuant identified a negative funding rate in perpetual futures contracts, signaling an excessive buildup of short positions.

The funding rate is the periodic payment between parties holding long and short positions in the perpetual futures market. If the number is negative, it means that traders with short positions pay to those holding long positions. Historically, similar conditions have often preceded XRP price recoveries.

Data from CryptoQuant shows that this pattern has appeared twice since 2024 – in August-September 2024 and April 2025. In both periods, negative funding rates preceded significant price spikes.

Read also: GameFi Starts to Rise in 2026: These 3 Crypto Lead the Rally Trend!

“Historically, the market tends to move against the late consensus. The accumulation of short positions does create short-term selling pressure, but it also builds hidden buying pressure. If prices start to rise, these short positions can be liquidated and accelerate the price increase,” explained CryptoQuant analyst Darkfost.

Binance Listing XRP/RLUSD Pair, Increasing Trading Volume

Positive developments from the exchange side also strengthen XRP’s prospects. On January 21, 2026, Binance announced the listing of a new trading pair: XRP/RLUSD.

Ripple CEO, Brad Garlinghouse, welcomed the move. Trading RLUSD on Binance gives the stablecoin wider exposure. This expansion strengthens the XRP Ledger ecosystem and can indirectly support the XRP price.

The listing also opens up additional liquidity channels for both XRP and RLUSD. In the long run, if market conditions are favorable, increased liquidity could deepen the market, reduce price volatility, and attract new capital flows.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Retail Sentiment Shifts From Greed to Extreme Fear – A Bullish Signal? Accessed on January 22, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.