Download Pintu App

Gold and Silver Hype Overtake Crypto on Social Media, Signaling Retail Investor Interest Rotation?

Jakarta, Pintu News – Retail investor interest on social media showed a significant shift throughout January. Conversations about crypto and cryptocurrencies no longer always dominate, as rallying gold and silver prices captured the public’s attention. Social media data indicates that precious metals were the main topic on many trading days this month. The phenomenon signals a short-term sentiment rotation among retail investors.

Gold and Silver Dominate Investor Conversations

According to data from Santiment, discussions about gold spiked sharply in the second week of January, coinciding with gold prices setting new records. Between January 8-18, gold was the most talked about topic on social media. Interest in silver also emerged from the beginning of the month and picked up again when the price broke through an all-time high. This suggests that retail investors tend to follow assets with the strongest price momentum.

In the third week of January, interest in crypto briefly picked up again. This happened when market participants tried to take advantage of price corrections to buy at low levels. However, crypto’s dominance on social media did not last long. The public’s focus shifted again when silver recorded another price surge.

Also read: Ripple Officially Launches Ripple Treasury, Blockchain Goes to the Heart of Corporate Finance!

Surge in Retail Interest and FOMO Risk

The price of silver briefly surged above USD 117 or around Rp1.95 million per ounce, sparking euphoria among retail investors. Santiment notes that this kind of surge in interest is often accompanied by the fear of missing out on opportunities or FOMO. Within hours of reaching the peak, silver prices experienced a sharp correction. This pattern indicates that retail hype often coincides with short-term price peaks.

Analysts see the phenomenon as a signal of caution. When public discussion peaks, the risk of correction tends to increase. This is not only true in commodity markets, but is also often seen in crypto markets. Therefore, the surge in social media interest is an important sentiment indicator to watch.

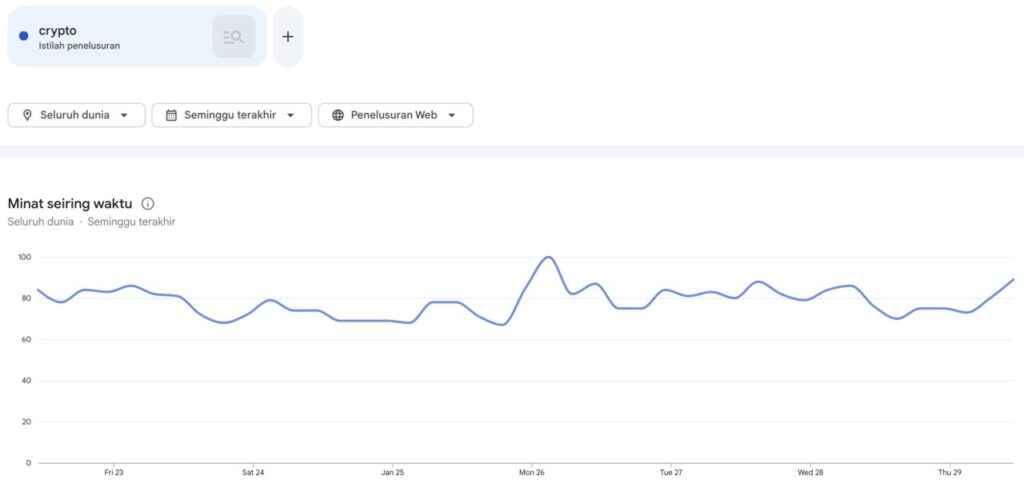

Crypto Still Strong in Search Engines

Despite being less dominant on social media, crypto still shows high traction in internet searches. Google Trends data shows that searches related to crypto and Bitcoin (BTC) have remained at high levels over the past seven days. Searches such as “crypto price” and “Bitcoin price” are still consistently in demand. This shows that interest in cryptocurrencies has not completely subsided.

This comparison indicates a difference between social conversation and search interest. Retail investors may follow the precious metals hype on social media, but keep a close eye on crypto movements. This dynamic reflects a rotation of attention, not a permanent shift. For crypto markets, this could potentially open up opportunities when sentiment shifts again.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Silver, gold hype overtaking crypto on social media: Santiment. Accessed January 29, 2026

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.