Download Pintu App

7 Silver Price Opportunities & Predictions for the Next 5 Years

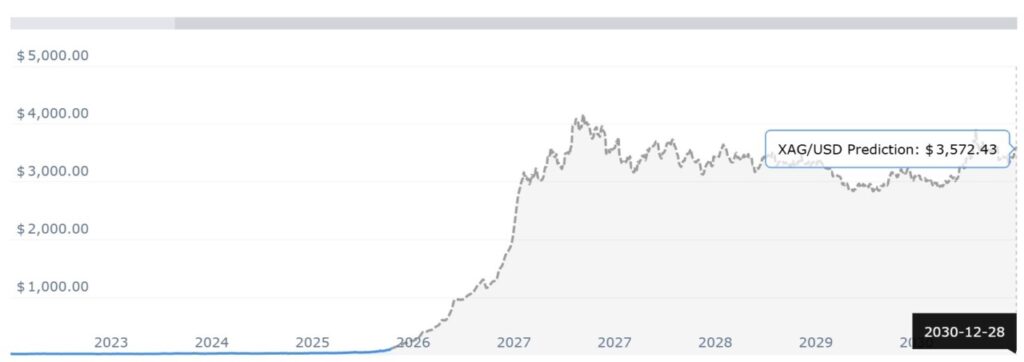

Jakarta, Pintu News – Five-year silver (XAG/USD) price forecasts show mixed views among analysts and market models, reflecting a combination of fundamental factors including strong industrial demand, supply deficits and global macro dynamics.

Some projections see moderate to significant appreciation potential, while the risk of correction also remains. Here is a summary of the key projections for the 2026-2030 period based on various market sources.

1. Rustification of Industry Supply and Needs

Silver demand is expected to remain strong amid growth in the industrial sector, especially in renewable energy such as solar panels and electronic applications, which could support a positive price trend over the next 5 years. Some analysts see a structural “industrial super-cycle” trend that could support silver price increases due to the metal’s role in clean technology and digitalization. This factor reinforces the expectation of higher prices than the historical average.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. CME Futures and Bank Projections

Data from silver futures prices shows that silver is expected to remain on an uptrend into the middle of the decade, with average prices expected to increase from early 2026 levels to late 2028. Several major banks and financial institutions present projection frameworks that reflect a continued rise for the commodity over time. Macro conditions such as inflation and interest rate policy also influence these predictions.

3. Target Price 2026-2030 According to Statistical Model

Some statistical models estimate that silver prices could average $155-$170 per ounce towards the end of 2026 or well past this level by the end of the decade, depending on global market demand and pressures. These estimates place silver at a much higher level than the historical average if bullish conditions persist. However, models like this are highly dependent on advanced assumptions about supply, volatility, and global capital flows.

4. Views of Large Institutions and Corporations

Some financial institutions’ projections see silver expected to experience moderate appreciation with average annual prices in the mid-range compared to long-term projections. Such outlooks often involve analysis of the long-term physical supply-demand balance as well as consistent industry needs. While moderate projections differ from extreme bullish scenarios, they reflect the likelihood of a steady uptrend.

5. Volatility Risk & Potential Correction

While there are many bullish predictions, there are also conservative views that point out the risk of price corrections related to commodity market volatility or unexpected macro events. A sharp rise in a specific period could trigger a profit-taking phase or mean reversion that stifles further upward momentum. Such views underline that silver remains vulnerable to the fast-changing global market dynamics.

6. Comparison with Previous Predictions

Some conservative predictions have previously placed silver prices in the lower perounce range as early as 2026, whereas a more optimistic long-term view sees a rise towards the end of the decade. This reflects the general consensus that the silver market is heavily influenced by non-lineal factors such as the technology industry and global monetary policy. The difference in scenarios suggests that investors need to combine different views to strategize.

7. Conclusion for 5 Year Investors

Overall, the 2026-2030 silver price forecast shows a wide range of opportunities, from moderate to significant depending on world market conditions. Investors assessing long-term projections should consider both the potential for price increases as an industrial asset and hedge as well as the risk of market volatility.

A diversification strategy as well as monitoring fundamental indicators such as industry demand, physical supply and macro policies will be key in managing exposure to silver.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Watcher Guru News. Silver Price Prediction for the Next 5 Years. Accessed January 30, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.