Download Pintu App

7 Bitcoin Facts Drops to USD 83.4K Amid Gold Profit Taking & AI Stock Sell Off

Jakarta, Pintu News – Bitcoin (BTC) prices have shown selling pressure recently, plunging to around USD 83,400 (± Rp1.43 billion per BTC) – a low not seen in weeks – as the crypto market faces a correction alongside profit-taking in the gold market and sharp declines in artificial intelligence(AI)-related tech stocks.

1. BTC Price Falls to USD 83.4K

Bitcoin contracted drastically from the USD 88,000-USD 90,000 area, reaching levels below USD 84,000, marking a strong recovery earlier in the year that was completely eroded by market action.

This drop brought the price of BTC to the lows in the last 10-week consolidation range that has held the price since late 2025. This technical pressure reflects a market that is continuing a corrective phase rather than a full structural breakdown.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. Profit Taking in Gold Affects Capital Allocation

One of the factors that pushed BTC down was profit-taking activity by gold investors(goldbugs) after the rally in gold prices reached a record high. As investors lock in profits from previously booming precious metal positions, some capital flows out of riskier assets like cryptocurrencies. This shift in capital intensified the selling pressure in the BTC market in the short term.

3. AI Stock Sell-off Extends Market Pressure

In addition to the change in allocation from gold, pressure also came from the sell-off of AI technology stocks in traditional capital markets, which also reduced investors’ risk appetite. The decline in the tech stock sector is contributing to a more cautious market direction, which often negatively impacts risky assets including BTC. The short-term negative correlation between high-risk stocks and Bitcoin reinforces the current correction.

4. Futures liquidation puts pressure on Bitcoin price

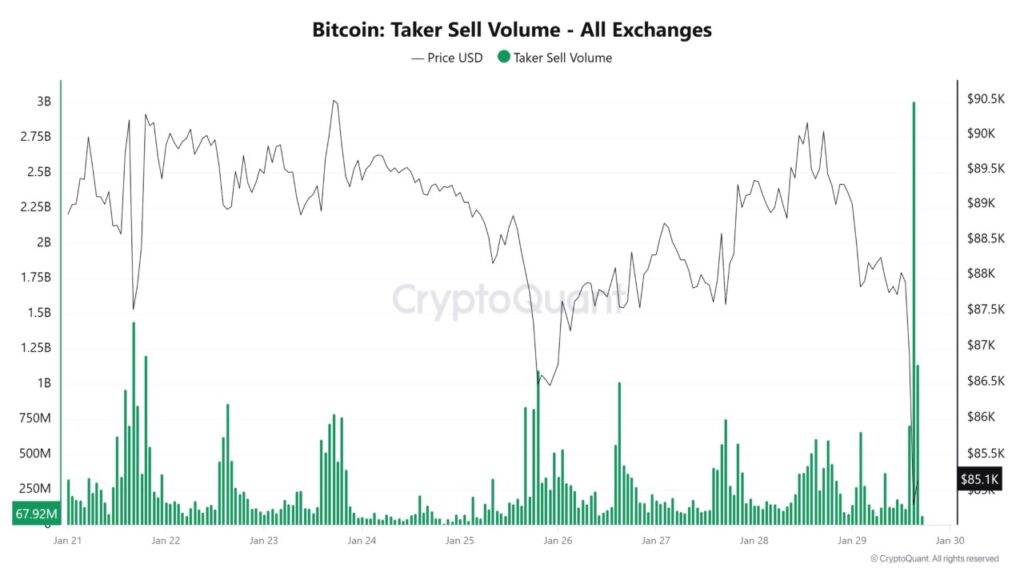

Market data shows that the downward pressure was triggered by aggressive futures market liquidation, meaning large long positions were forcibly closed. Taker sell volume on BTC reached billions of dollars in a short timeframe, indicating that most of the price pressure came from the derivatives market. This liquidation caused BTC to move lower even though spot demand was not as great as futures pressure.

5. Bitcoin Still in Consolidation Range

Technically, Bitcoin price is still trading within the price range that has been formed since the last few months, with the lower limit of consolidation around USD 83K-USD 84K. Failure to hold these levels could open up the potential for further declines to the next support area around USD 80K. This range signals a market that is waiting for a strong catalyst for the next trend direction.

6. Market Sentiment and Risk of Deep Correction

Market analysis suggests that this downtrend is more of a corrective phase than a sign that the Bitcoin market is undergoing a structural collapse. However, the downside potential remains if buyers are not effective in defending the short-term key support under the pressure of high volatility. Some analysts say the downside scenario towards the consolidation bottom area could persist if global risk sentiment does not improve.

7. Implications for Crypto Investors

For investors – especially those who are young or new to the crypto market – this price correction emphasizes the importance of risk management in portfolios. Liquidation actions in the derivatives market can cause sudden price volatility that does not fully reflect changes in the fundamentals of assets like Bitcoin. Understanding the link between traditional markets, commodity prices like gold, and the dynamics of tech stocks can help assess the short- and medium-term direction of the crypto market.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Cointelegraph. Bitcoin falls to $83.4K as gold bugs take profits and AI stocks sell off. Accessed January 30, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.