Download Pintu App

7 Bitcoin Facts Drop to 2-Month Low as Market Fails to Survive, Time for a Shake?

Jakarta, Pintu News – The price of Bitcoin (BTC) experienced a sharp decline this week, touching its lowest level in two months as cryptocurrency and traditional asset markets corrected together. The decline coincided with a drop in the prices of precious metals such as gold and tech stock indices after an earlier rally, as well as a large wave of liquidation in the crypto derivatives market that exceeded USD 800 million.

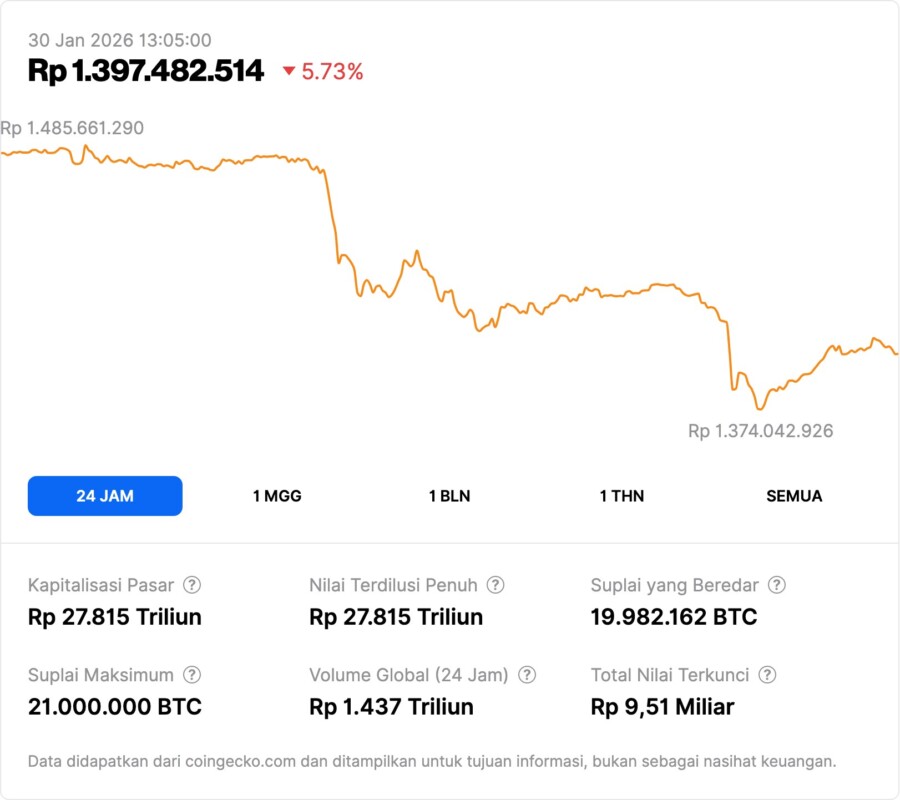

1. Bitcoin Drops to Around USD 84,400

Bitcoin recently traded at around USD 84,400, representing a drop of more than 5% in the last 24 hours. This decline represents the lowest point in the last two months due to broad market pressure. The price of BTC fell from the range of around USD 88,000-USD 90,000 that was seen earlier in the week. This pressure led to increased volatility in the crypto market in general.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. Crypto Market Liquidation Exceeds USD 800 Million

The crypto derivatives market saw over USD 800 million worth of positions liquidated in a short period of time. The majority of the liquidation came from long positions that were forcefully covered, adding to the selling pressure. These large liquidations reflect short-term bearish market sentiment.

3. Gold and Silver Decline Weighs on Sentiment

After setting a record peak above USD 5,600 per ounce, gold prices retreated around 0.6% to levels around USD 5,300. Silver also fell around 0.8% to around USD 112 per ounce, suggesting that the traditional safe-haven is not impervious to broader market momentum. The decline in precious metals prices also worsened the overall risk sentiment.

4. Tech Stocks Fall Following Global Pressure

Major tech stock indices such as the Nasdaq Composite fell more than 2%, erasing much of this year’s gains. Microsoft shares plunged more than 12% despite reporting better-than-expected earnings results, which fueled market concerns. This pressure extended the risk-off effect and pulled capital out of risky assets including crypto.

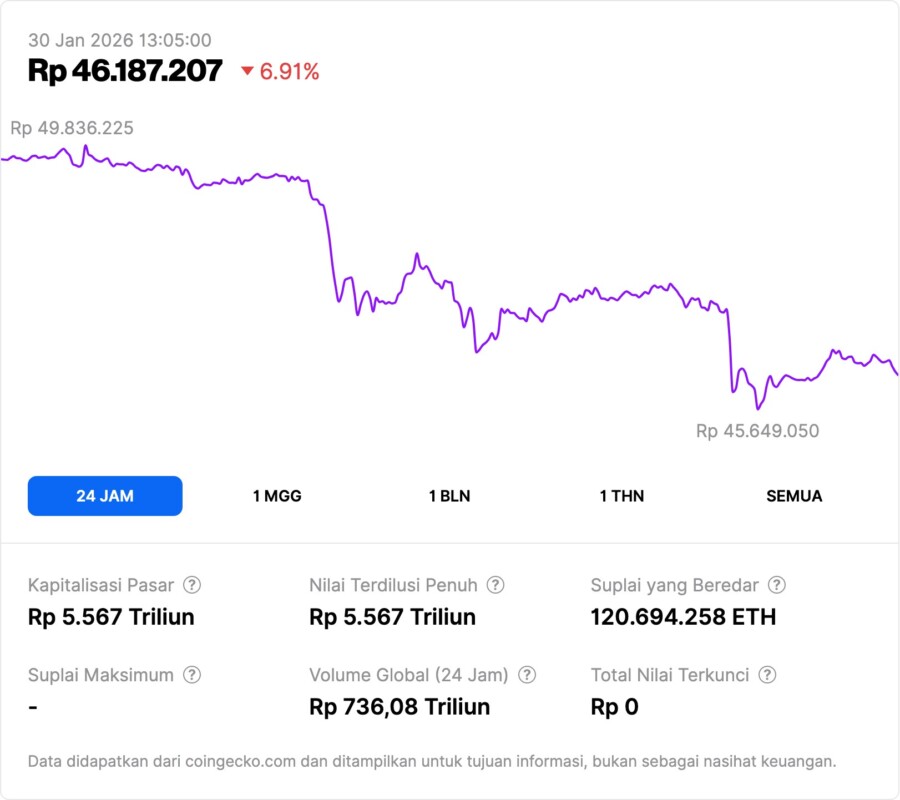

5. Altcoins also experience price pressure

Besides Bitcoin, other major altcoins such as Ethereum (ETH) and Solana (SOL) also experienced a sharp correction. ETH fell about 6.4% to around USD 2,800, while SOL fell about 6.8% to around USD 117. Other tokens such as XRP (XRP) also recorded similar declines, reflecting broad market pressure.

6. Market Downward Action Reflects Global Risk Sentiment

The decline in crypto and traditional assets reflects a broader change in market sentiment towards risk. Global investors appear to be reducing exposure to riskier assets due to a combination of weak economic data, tech stocks, and geopolitical pressures.

This sentiment led to risk-off moves that affected correlations between asset classes.

7. Implications for Crypto Investor Strategy

For investors, this price action highlights the importance of risk management in crypto portfolios, especially in the face of periods of high volatility. Large liquidations and traditional market pressures can accelerate short-term price movements that do not fully reflect long-term asset fundamentals. Understanding BTC’s price movements within the broader market context helps provide a perspective of crypto market risks and opportunities going forward.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– André Beganski/Decrypt. Bitcoin Hits 2-Month Low as Gold and Stocks Give Up Gains, Crypto Liquidations Top $800M. Accessed January 30, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.